S&P 500 Dropped With Oil; Slow Stimulus Talks And Demand Concerns

The S&P 500 cash index dropped about 1.4% in yesterday’s New York trading session by seemingly slow development in stimulus talks. The weekly perspective is balanced, heading towards the lower extreme while the daily periodicity found buyers off the EMA50 which was confluent with the upper distribution from early October on the hourly chart perspective. The market might retest the lows for new possible buyers by testing the previous microbalance extreme for sellers.

(Click on image to enlarge)

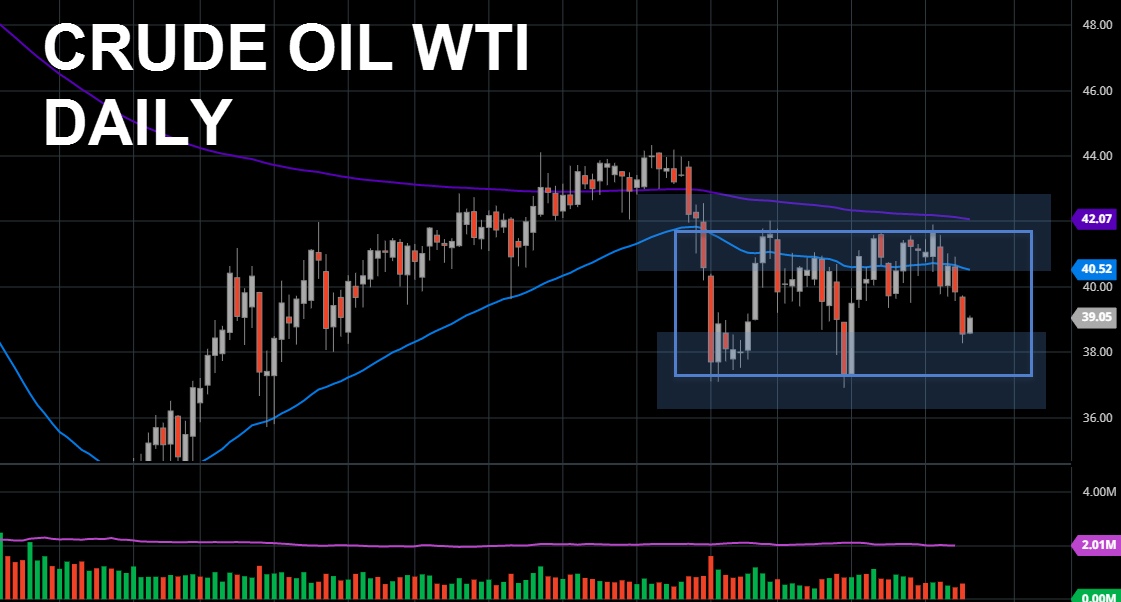

Crude Oil WTI December declined around 3.2% by demand concerns and Lybian oil production. The weekly periodicity is balanced and heading towards the lower price range to find new buyers while the daily testing areas from September and early October which brought the market higher. The current market is up about 1.3%, testing the lower EMA structure for selling on the hourly periodicity. The test of the lows and microbalance from the 2nd of this month for the possible buying scenario is probable.

(Click on image to enlarge)

Visit our trading community to read more market insights and to learn the more indepth analysis process with various tools such ...

more