S&P 500 Continues Setting New Record Highs

The S&P 500 (Index: SPX) continued setting new highs in the first full week of November 2019, buoyed by positive changes in the outlook for dividends and earnings for the component companies that make up the index, which ended the week at an all-time-high closing value of 3,093.08.

We're nearing the end of the period to which our impromptu redzone forecast applies, where the trajectory of the S&P 500 appears to be converging with the expectations associated with the alternate trajectory for 2020-Q3, indicating that investors are focusing their attention on that distant future quarter.

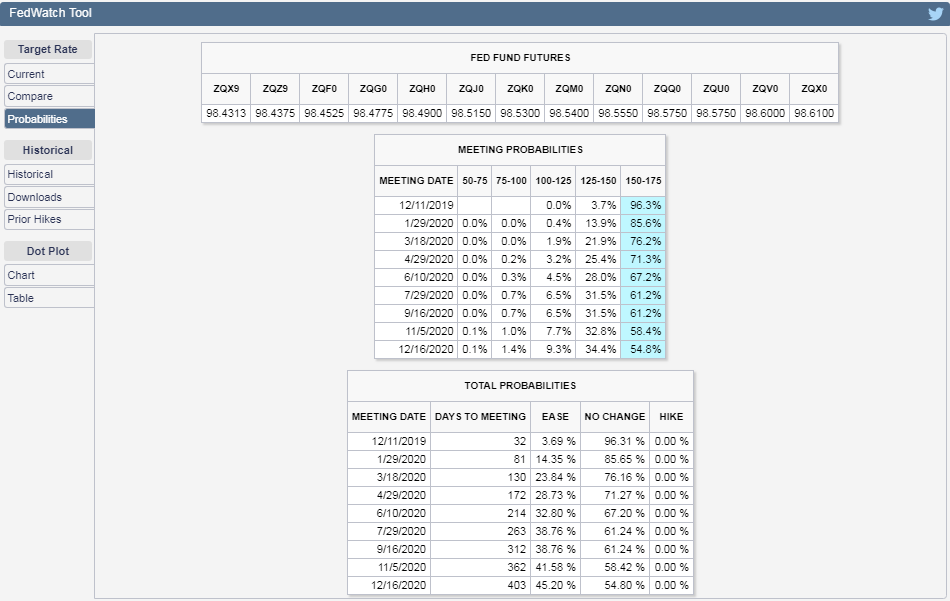

That makes sense because this future quarter has seen the greatest change in the outlook for its dividends during the last three weeks. Meanwhile, the prospects for the Fed taking action in this quarter to cut the Federal Funds Rate dropped back below the 50% mark in the last week, with the latest probabilities of rate changes at various upcoming Fed meeting dates from the CME Group's FedWatch Tool suggesting that investors are leaning against any rate changes in 2020.

Investor expectations have changed by quite a wide margin during the past several weeks. Here is some of the new information that investors absorbed into their expectations from the past week:

Monday, 4 November 2019

- Oil rises more than 1% on U.S.-China hopes and improved outlook

- Bigger trouble developing in the Eurozone:

- Bigger stimulus developing in emerging markets:

- Wall St. extends recent gains on trade deal optimism

Tuesday, 5 November 2019

- Oil gains 1% as China pushes Trump for more tariff rollbacks

- Bigger trouble developing in China:

- Bigger stimulus developing in China and Japan:

- Fed minion admits both uncertainty and confidence:

- S&P 500 index retreats slightly after recent record

Wednesday, 6 November 2019

- Fed is data-dependent from here, NY Fed's Williams says

- Fed's Evans: U.S. economy in 'good place', but watching inflation

- Bigger trouble developing in China:

- Bigger trouble developing in the Eurozone:

- Wall St. ends near flat; healthcare shares gain but trade deal delay weighs

Thursday, 7 November 2019

- Oil rises above $62/bbl on hopes for U.S.-China trade deal

- Fed minion speaks out against last rate cut:

- Bigger stimulus developing in Japan:

- Dow, S&P 500 hit record closes as investors digest trade news

Friday, 8 November 2019

- Oil rises after falling on Trump comments on U.S.-China trade

- Trump says has not agreed to roll back tariffs on Chinese goods

- Denial runs through the Eurozone:

- Bigger stimulus developing in Asia and the Pacific:

- Indexes trade near flat, pause as trade deal doubts resurface

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more