S&P 500 And DXY Performance In US Election, What To Expect This Year?

Every four years the elections arrive in the United States and the performance of the most important health indicator of the financial markets, the S&P 500, is reviewed again. In recent years, the S&P 500 has been well above other indices worldwide, such as the DAX or the FTSE.

That leads us to think about the importance of the S&P 500, as this index drags the world economy towards a better financial health because if it weren’t for the economy of the United States, other countries would be well below their current levels. In addition, we will see the behavior of the DXY after the elections, which is another important index as it affects international trade.

S&P 500 and its performance in election years

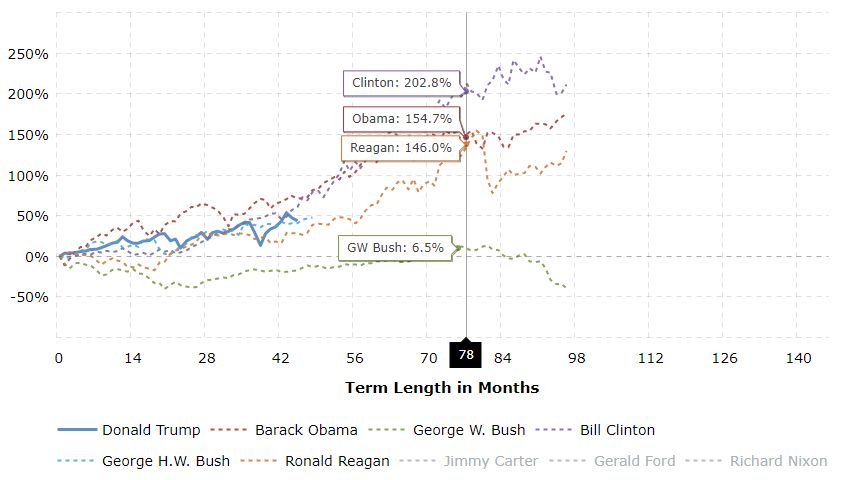

In the following chart we can see how the S&P 500 has generally maintained a positive outlook since President Ronald Reagan. However, that does not mean that the President in office does not affect the performance of the S&P 500, as we can see that under President G. W. Bush, the performance was well below average. A President with unfavorable policies can push the S&P 500 underwater. Politics matter.

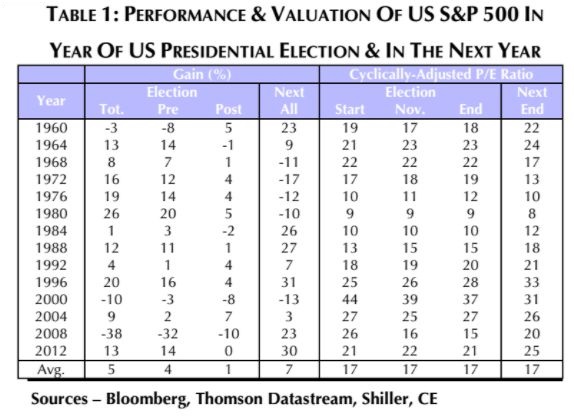

In table 1, we have the percentage of profit of the S&P 500 in the election year and the following election year. We can see in the S&P 500, that 71% of the time its performance drops between the pre-election and the post-election. We can see this in the year 1988, for example, where the pre-election return was 11% and the post-election return was only 1%.

Though, we did see a rebound in a some years, such as 1960, 1992, 2004, and 2008. For example, in 2008 after emerging from a recession of -32% post-elections, the yield was -10%, thus improving the yield of the pre-elections.

What about the DXY?

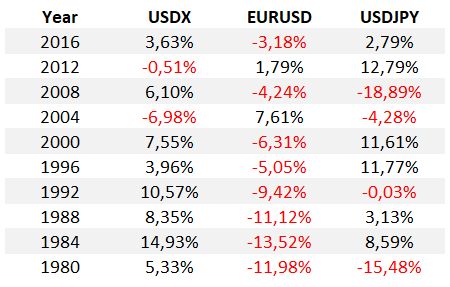

In the following table, we see the DXY has a generally favorable performance in election years, except for two years since 1980. The inverse correlation with the EURUSD remains, but it is a different story with USDJPY.

In years like 1980, 1992, and 2008, the USDJPY performance is negative compared with the DXY, and this is most likely due to a poor performance of the stock markets that year. While in the year 2012, the USDJPY looks much better than the DXY due to a rebound in the stock market worldwide.

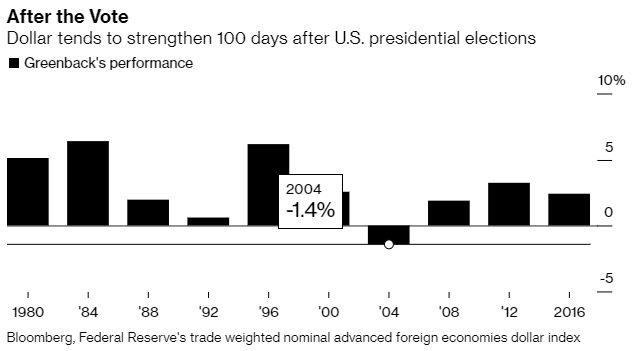

Now what about the first 100 days after electing a President in the United States? The DXY generally has a favorable performance. Although, in 2004 it registered a negative balance of -1.4%.

Conclusion

Therefore, we can conclude that economic policies influence the performance of the S&P 500, and in the year after the elections it is most probable that its performance will decline. The DXY reports a favorable performance in the first 100 days after an election. Will that performance be repeated this year?

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more