Some U.S. Retailers May Be ‘Tariff Proof’

U.S. retailers that offer value and convenience continue to outperform — and gain market share. Additionally, they have the wherewithal to do better during a trade war. Walmart and Target smashed Q2 earnings expectations and are showing strong defensive qualities. Given their wide range of brand categories and robust supply/vendor relationship, they are less vulnerable to a trade war. These discounters have the resources and flexibility to make the necessary adjustments to their supply chain more rapidly than their peers do.

Exhibit 1: Q2 2019 Same-Store Sales Actuals and Estimates for Tariff-Proof Retailers

Source: I/B/E/S data from Refinitiv

Omnichannel is the future of retail

Walmart and Target both beat Q2 same-store sales and earnings estimates and posted e-commerce growth above 30%. These remarkable results are telling us that the retailers’ big investments in digital innovation are paying off. They are using their real estate and proximity to the consumer to their advantage by using their stores as fulfillment centers. This, in return, allows them to reduce their shipping cost during a time when other retailers like Macy’s are seeing a spike in delivery charges. Above all, these discounters have succeeded in making the shopping experience seamless by combining their brick-and-mortar stores with digital options.

This puts the discounters in a better position to fend off the impact of a trade war. Still, a possible threat to Walmart’s international revenue could be if the Chinese government decides to tighten controls on companies generating revenue in China. Significantly, Walmart said during its Q2 earnings call that the Chinese consumer loves the Sam’s Club format and posted double-digit comps growth, led by groceries.

Trading down

Walmart and Target still have room to grow. If tariffs are imposed later in the year, consumers will have to pay higher prices and are very likely to trade down on spending. This could definitely benefit the discounters as they lure in new potential consumers hit by rising prices elsewhere. Similarly, shoppers wanting designer clothing for less could trade down and start shopping at TJX Companies and Ross Stores – a phenomenon that attracted new shoppers during the last U.S. recession. Since then the consumer has been conditioned to open up their wallets when offered a discount. The value proposition has become critical, and therefore off-price retailers as TJX and Ross Stores continue to grow and open stores.

Manufacturing in China

We looked at the list of most vulnerable retailers to tariffs, given that they source and manufacture their products in China. Below is a table of the retailers from that list that are in a stronger financial position. The three retailers rank in the top decile of the StarMine Combined Credit Risk and Earnings Quality model scores. These scores correspond to implied credit ratings of AA- or better, suggesting these stores are financially stable, earnings are coming from sustainable sources and as a result can weather the trade war better. It also means that they have the financial strength and power to execute properly during a trade war.

Exhibit 2: High StarMine Scores for Retailers with Products Sourced/Manufactured in China

Source: StarMine by Refinitiv

Unique business models

Some retailers have unique business models that are very difficult to replicate online, including cosmetic and off-price retailers. Moreover, these successful retailers appeal to Gen Z and millennials, which is key because they make up the biggest portion of the U.S. consumer population. Ulta Beauty and Sephora offer a unique shopping experience, where consumers can play and try on the merchandise. Although customers can book a beauty treatment online, they still have to go into the store to get the treatment. Meanwhile, off-price retailers TJX and Ross Stores lure shoppers into their stores with the treasure hunt experience.

Earnings this week

Here are the Same Store Sales and Earnings estimates for retailers reporting earnings this week:

Exhibit 3: Same-Store Sales And Earnings Expectations/Results – Week Of August 19, 2019

Source: I/B/E/S data from Refinitiv

Earnings on deck

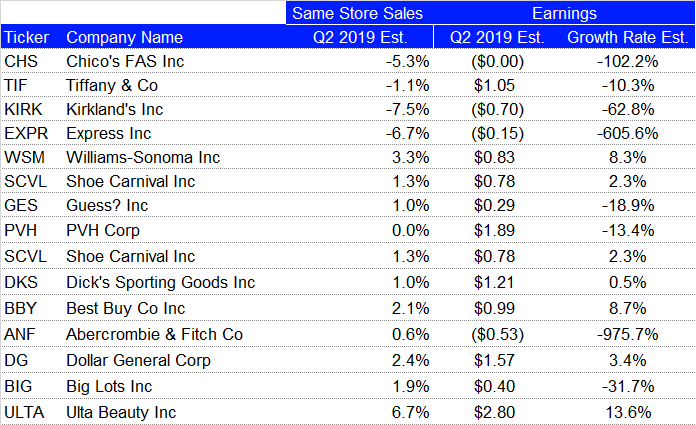

Here are the Same Store Sales and Earnings estimates for retailers reporting earnings next week:

Exhibit 4: Same-Store Sales And Earnings Expectations/Results – Week Of August 26, 2019

Source: I/B/E/S data from Refinitiv

Q2 2019 earnings dashboard

Seventy-eight percent of companies in our Retail/Restaurant Index have reported Q2 2019 EPS. Of the 164 companies in the index that have reported earnings to date, 69% have reported earnings above analyst expectations, 10% reported earnings in line with analyst expectations and 21% reported earnings below analyst expectations. The Q2 2019 blended earnings growth estimate is 3.1%.

Exhibit 5: Refinitiv Earnings Dashboard – Q2 2019

All names and marks owned by Thomson Reuters, including "Thomson", "Reuters" and the Kinesis logo are used under license from Thomson Reuters and its affiliated companies.