Solving The Alpha For O

There are just a handful of stocks with one-letter ticker symbols. Some are quite large, such as Citigroup Inc. (NYSE:C), Ford Motor Company(NYSE:F), Kellogg (NYSE:K), AT&T (NYSE:T), and Visa (NYSE:V). Then there are some smaller relatively unknown companies like Dominion Resources(NYSE:D) and Barnes Group (NYSE:B).

Outside of simplicity, I'm not sure that a company with a one-letter ticker symbol has a competitive advantage, but it's certainly easier to remember the stock when you know its ticker symbol.

One symbol that I know quite well is "O", the ticker for Realty Income Corporation (NYSE:O).

Just like the other stocks I just cited, I'm not sure there's a real competitive advantage for "O" based solely on the clever one-letter ticker symbol. However, there is a reason that Realty Income has become a force in the REIT sector and also as a valuable member of the S&P 500.

Remembering a clever ticker symbol doesn't mean a lot if there's no reason to invest in the company. The stock market affords virtually unlimited opportunities to invest in practically any business in the world, and if the company does not earn profits, it's simply a waste of time and resources to invest in a one-, two-, three-, or four-letter ticker symbol.

So, what's this big deal with "O"?

Well, this is the purpose of my article today, and by the time you finish reading, you should be able to memorize the ticker symbol in your sleep (at least that's what I hope you will do).

Are All Net Lease REITs The Same?

I'm sure most of you have read some of my previous articles on Realty Income, and specifically, the over-used term "economic moat". In this article, I will not bore you with the Buffett-enhanced term, but I will provide you with the "true secret" that differentiates Realty Income from most other companies.

If you think about it, most great companies offer some unique advantage that protects them from their competitors. As I alluded to above, a one-letter ticker symbol does not provide any source of competitive advantage that allows the company to earn high returns on capital for many years into the future.

Instead, a true champion is a company or organization that not only sustains earnings, but increases them, while returning cash to shareholders and compounding intrinsic value. In 1999 (Fortune Magazine), Warren Buffett said:

The key to investing is... determining the competitive advantage of any given company and, above all, the durability of that advantage. The products or services that have wide, sustainable moats around them ate the ones that deliver rewards to investors.

But how can a REIT, especially a Net Lease REIT, be competitive in the crowded playing field that consists of a growing universe of equity REITs. Even more recently, the Net Lease space is adding a few new players like Four Corners Property Trust, a split-off from Darden Restaurants' (NYSE:DRI) real estate portfolio, and STORE Capital (NYSE:STOR), a Scottsdale-based REIT that listed shares back in November 2014.

It seems difficult to assign a true competitive advantage to a Net Lease REIT when most of them do essentially the same thing: they buy free-standing properties (no proprietary pipeline for sourcing acquisitions), there is no skilled asset management requirement, and there are no laborious operational requirements (or what I call the 3Ts: toilets, trash, or taxes).

If you think about it, a Net Lease REIT is like a bank. It simply pockets cash flow to fund external growth.

So, outside of the clever "O" ticker, what makes Realty Income a truly unique business model?

What Is O's Competitive Advantage?

It may surprise you, but there is a "secret sauce" for Realty Income, and I'm going to show you the formula. It's no secret code or high-level algorithm that is locked up in a safety deposit vault. It's simply the following:

Cap Rate - WACC = Spread

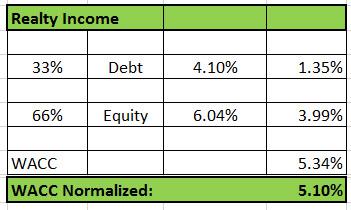

The weighted average cost of capital (or WACC) is the "secret sauce" to net lease investing, and to calculate it, you simply multiply the cost of each capital component by its proportional weight and take the sum of the results. In the case of Realty Income, I have prepared the following model for the company's WACC:

I'll explain: Realty Income capital stack consists of ~33% debt and 67% equity, and beginning with the debt calculation, I used 10-year unsecured rate of 4.1%. On the equity portion, I took the 2015 AFFO per share run rate of $2.72 and divided that by the closing share price of $47.33 ($2.72/$47.33 = 5.75%).

I then reduced the equity cost by 5%, since Wall Street charges to raise equity - so the actual "all-in" cost of equity is 6.04%. Then, by blending the cost of equity and debt, I arrived at a WACC for Realty Income of 5.34%.

To be fair, Realty Income generates around $90 million in free cash flow (after dividends), so a more realistic WACC would be around 5.0%. I'll also point out that this is what I would consider to be a normalized Nominal Year One WAAC, since its long-term cost of capital likely ebbs and flows based on the interest rate and stock market conditions.

In the first six months of 2015, Realty Income acquired assets at an average cap rate of 6.4%, and the company has issued guidance that it will acquire properties at a range of 6.5-7% in Q3 and Q4. That tells me that Realty Income generates highly accretive spreads of around 150 bps, or what I refer to as "dividend power".

Now that I've established the proxy, let's take a look at a few peers.

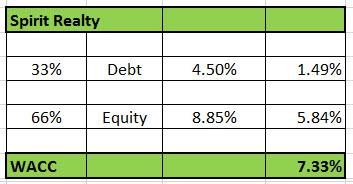

Earlier this week, I wrote an article on Spirit Realty (NYSE:SRC), and specifically, I explained my dissatisfaction with its acquisition of Haggen properties and the company's more recent bankruptcy filing. Before I get on my high horse, though, let's examine SRC's WACC using the same target leverage ratio as Realty Income:

I'll explain. Spirit does not have unsecured debt, so I used a comparable CMBS rate of 4.5% (that's overly generous), and while SRC has higher leverage than Realty Income, I used 1/3rd debt to make an "apples to apples" comparison. In regard to SRC's equity, I used the AFFO run rate of $.84 per share divided by the closing price ($.84/$9.49 = 8.9%).

Back to my high horse. SRC purchased 20 Haggen grocery stores at a cost of $224.4 million, at a cap rate of 7.5%. As you can see here, based upon the company's WACC model, the deal was essentially a breakeven. The deal was dilutive on a lever-neutral basis, and based upon the higher-risk WACC, it's clear that SRC must reach up the flag pole for higher-yielding assets. That's what spooks me about Spirit!

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more