Small Caps And Tech Feel The Pressure

More damaging action in the indices today as sellers found little in the way of blockers to push both the Russell 2000 and Nasdaq lower. We haven't seen much from sellers since February, particularly in the Russell 2000.

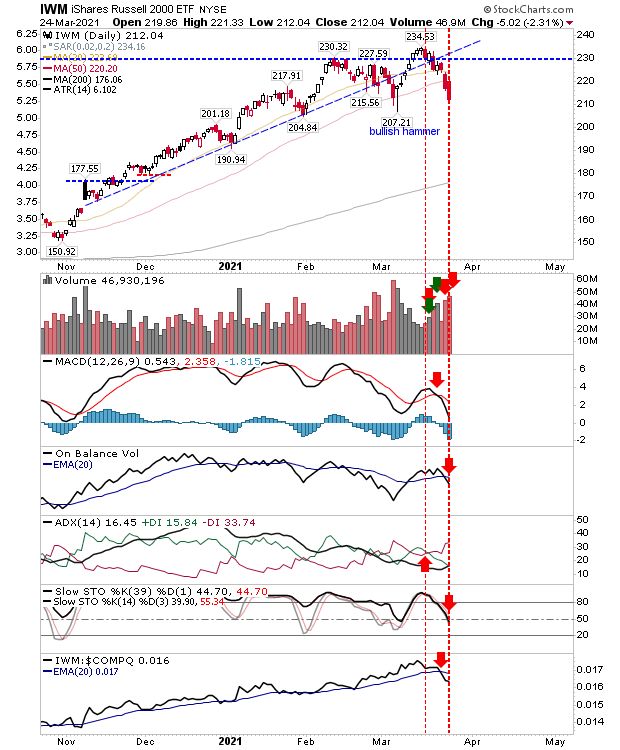

The Russell 2000 didn't pause at its 50-day MA as it makes its way toward the spike low from early March.Given the rate of decline I would expect this to surpass the low and start a longer move down towards its 200-day MA. Volume climbed to register as distribution. j Certainly, there are the makings of a trading range wit the 200 level looking nnlike the low end of the range

The Nasdaq was another hard hit index as it shapes a mini-"z" measured move lower. This index has struggled since an attempted swing low in early March and now finds itself staring at a possible move to its 200-day MA. There were 'sell' triggers in the MACD and Stochastic, but relative performance against the Russell 2000 has been gaining sharply, so while this index suffers - it's not the worst.

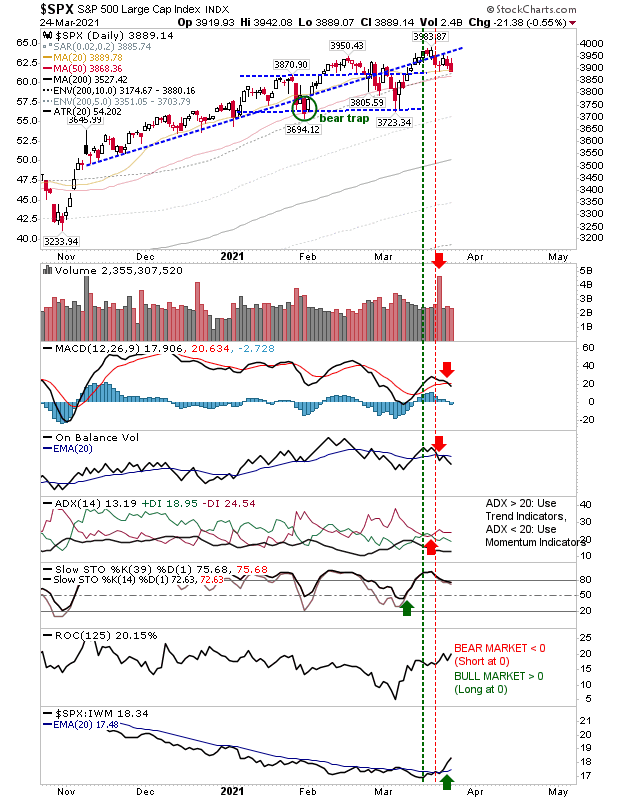

The S&P was least impacted by the selling. It still has a number of support levels it can call on, next of which is the converged 20-day and 50-day MAs. Technicals for this index are rough with weakness across the board except for stochatics and relative strength to the Russell 2000 - which is now moving markedly higher in the S&P's favor.

While it was a bad day all around it does feel like the S&P is proving to the most resilient and the index likely to outperform its peers in the coming weeks. The rotation appears to be on...

Disclaimer: Investors should not act on any information in this article without obtaining specific advice from their financial advisors and should not rely on information herein as the primary basis ...

more