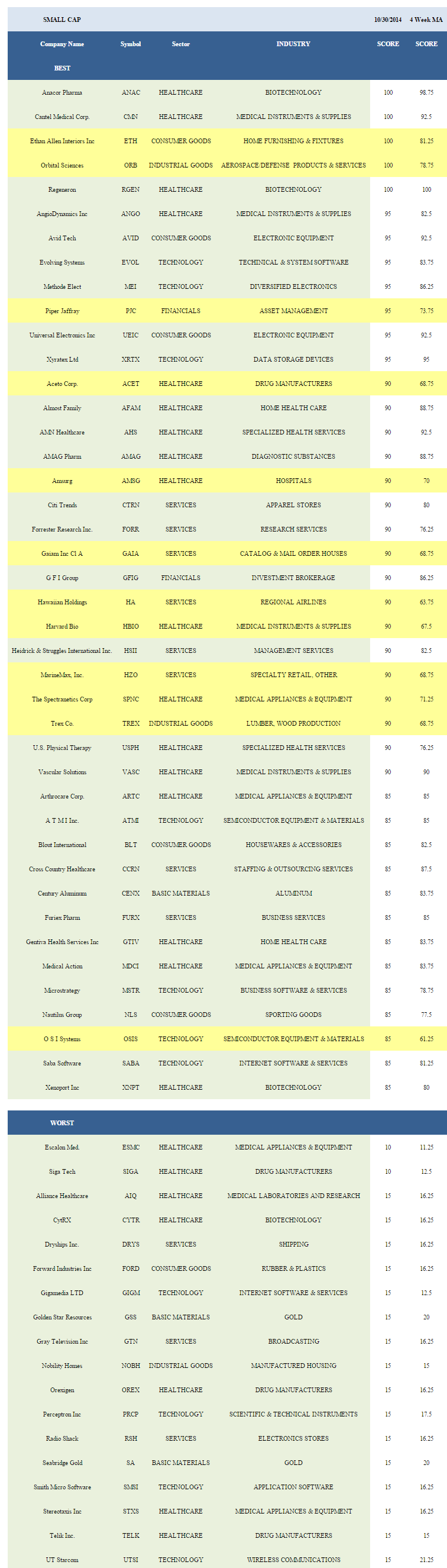

Small Cap Best And Worst Report - October 30, 2014

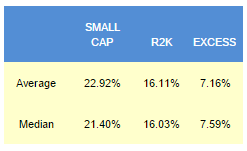

Since 2010, the average return for our weekly best scoring small caps has outpaced the R2K by a median 759 bps over the following year. The best performers from one year ago are CENX up 224%, ARII up 70%, ODFL up 50%, and PJC up 49%.

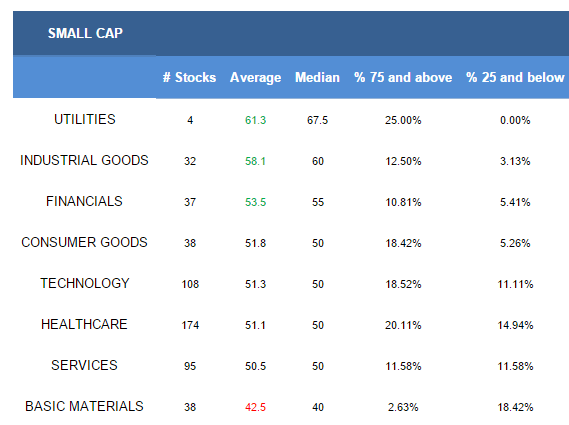

- The top small cap sector is utilities.

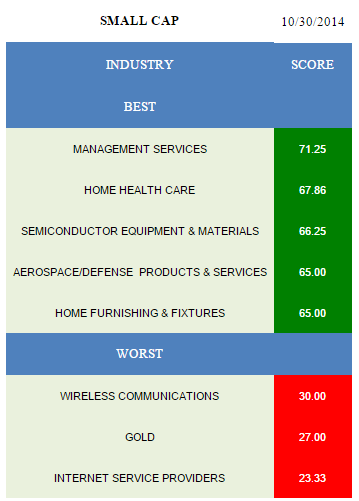

- The best small cap industry is management services.

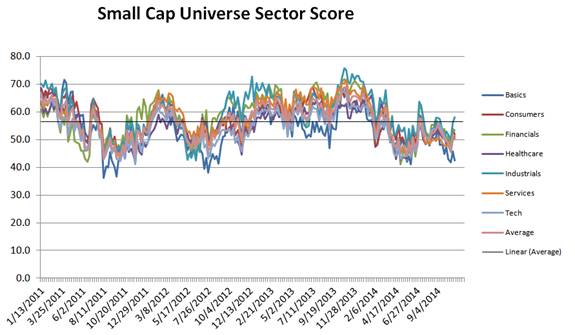

The average small cap score is 51.03, above the four week moving average score of 49.21. The average small cap stock is trading -30% below its 52 week high, -5.52% below its 200 dma, and has 9.05 days to cover held short.

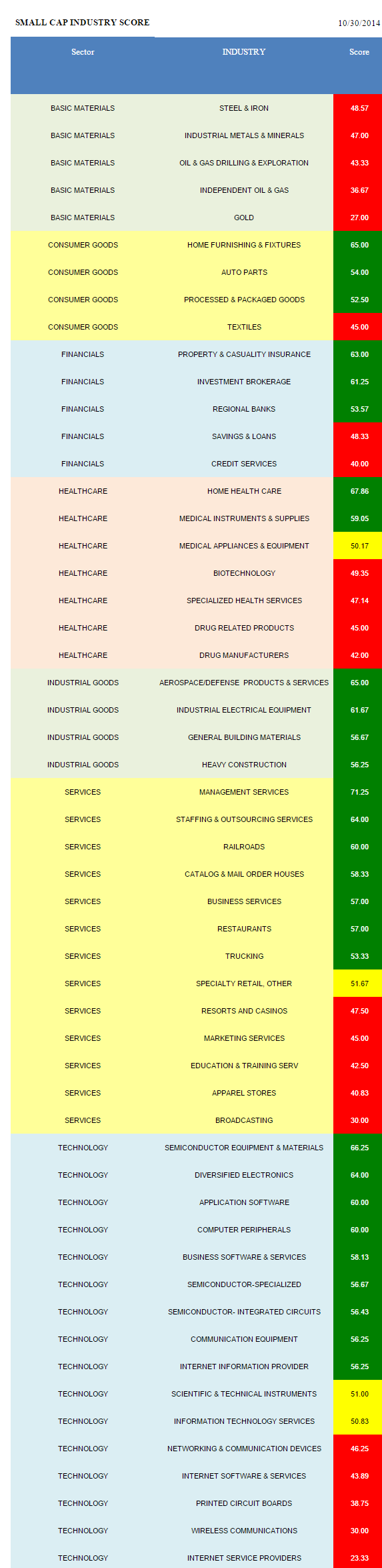

Utilities, industrials, and financials score above average. Consumer, technology, healthcare, and services score in line. Basics score below average.

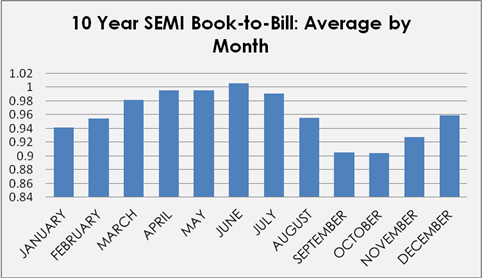

Management services (HSII, CRAI, NCI) are the top scoring small cap industry. Home healthcare (AFAM, CHE) consolidation offsets reimbursement risk as demographics continue to support growth. Semi equipment & materials (OSIS, ATMI) are high scoring. Although we are in the seasonally weakest period for semi book to bill, the measure typically bottoms in October and heads higher into spring. Aerospace (ORB) build rates continue to provide tailwinds for suppliers. Improving housing trends support pent up furnishings (ETH) demand.

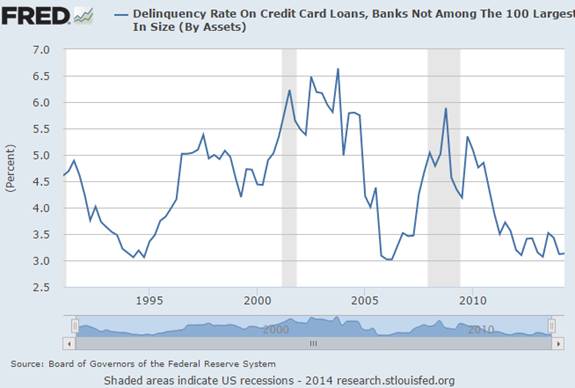

No small cap basics baskets score above average. In consumer goods, concentrate on home furnishings and auto parts (SMP, SRI). The best financials groups are P&C insurers (STFC, MIG, GLRE), investment brokers (GFIG, KCG), and regional banks (CFNL, TCBK). Delinquency rates at banks not among the 100 largest remain near their lowest levels at just 3.13%.

Home healthcare and medical instruments (CMN, ANGO, VASC, HBIO, OSUR, MMSI) are top scoring in healthcare. In industrial goods buy aerospace/defense, industrial electrical equipment (DAKT, BGC), and general building materials (NCS). Private non-residential construction spending totaled $333,327 million in August, up from $328,180 million in April and $305,215 the year before. The top services industries are management services, staffing (CCRN, KFRC), and rails (RAIL, ARII). Staffing demand typically accelerates into year end. In technology, focus on semi equipment, diversified electronics (MEI, BELFB), and application software (PRO, EPAY).

Disclosure: None.