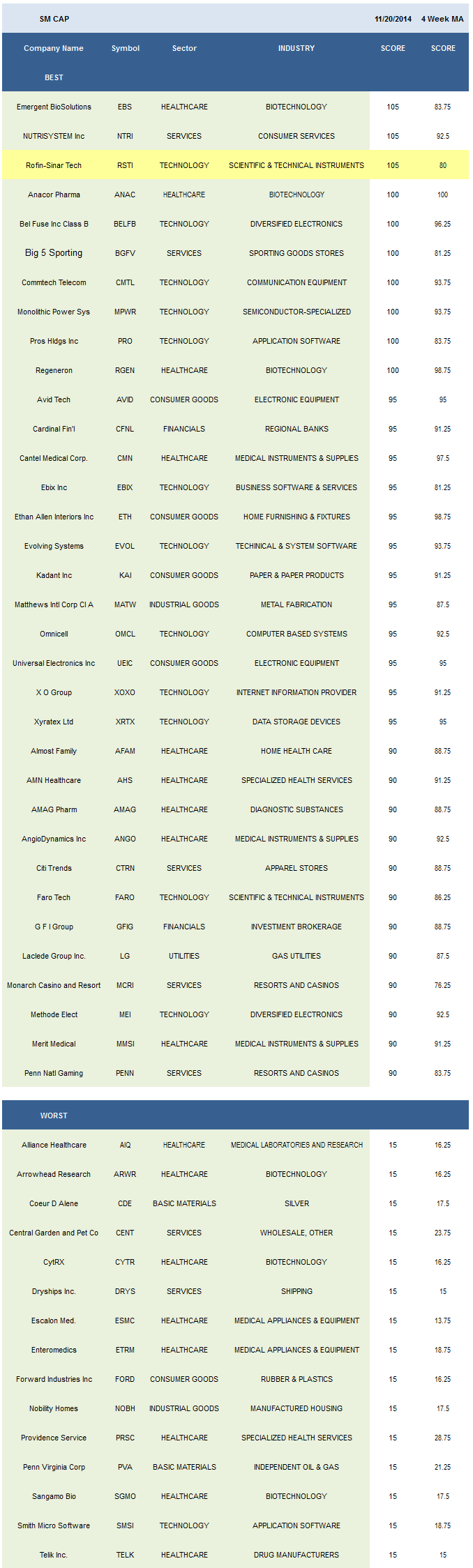

Small Cap Best & Worst Report - November 20, 2014

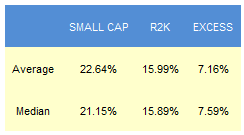

Since 2010, the average return for our weekly best scoring small caps has outpaced the R2K by a median 759 bps over the following year. The best performers from one year ago are HA up 119%, ARII up 64%, and UEIC up 58%.

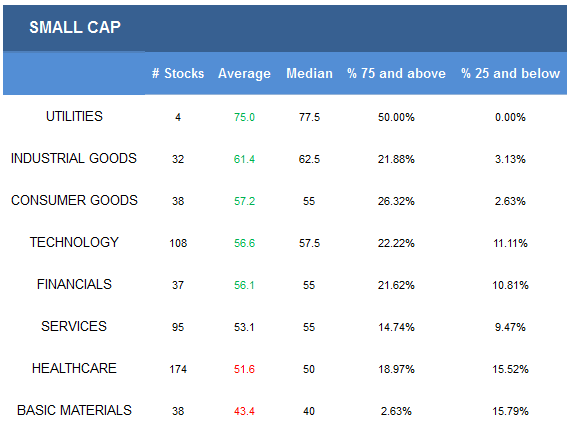

- The best scoring small cap sector is utilities.

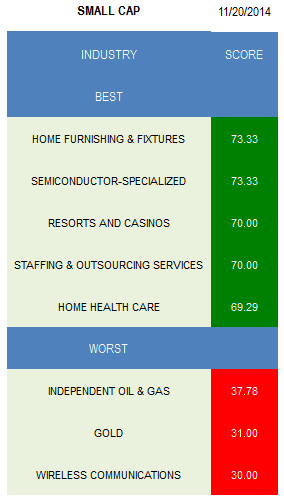

- The top small cap industry is home furnishings and fixtures.

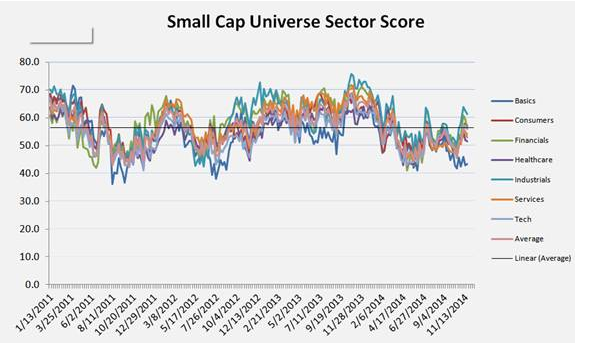

The average small cap score is 53.77, below the four week moving average score of 53.89. The average small cap stock is trading -27.83% below its 52 week high, -1.57% below its 200 dma, and has 8.05 days to cover held short. Short interest is now nicely off the early October peak that prompted our bullish note and no longer offers the same catalyst it did six weeks ago.

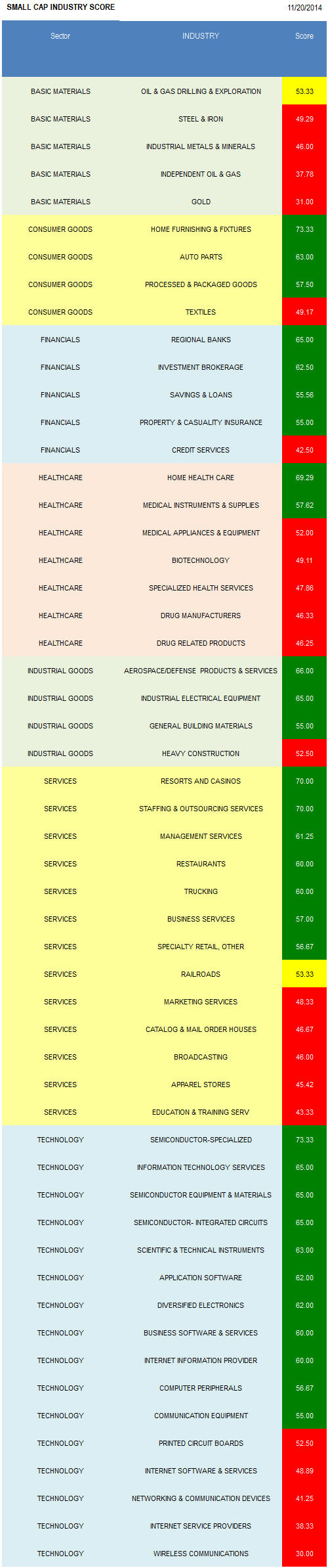

Utilities are the top scoring small cap sector. Industrial goods, consumer goods, technology, and financials also score above average. Services score in line. Healthcare (trade up in market cap) and basics score below average.

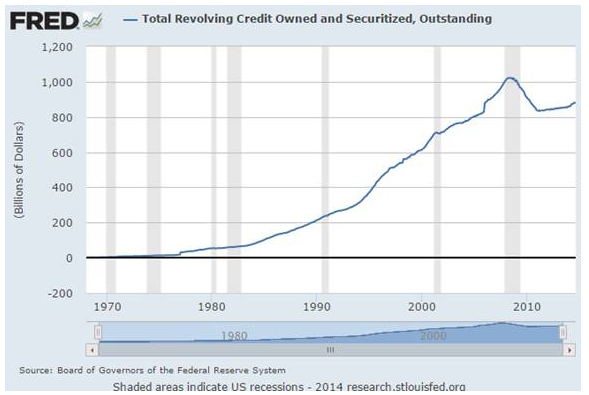

The top scoring industry across our small cap universe is home furnishing and fixtures (ETH, STLY). Consumer spending is showing signs of growth. Revolving credit reached $881.7 billion in September, up from $873.3 billion in May. Private single family homes started in September hit 1.07 million, up from 863k last year. Specialized semi (MPWR, QLGC) revenue benefits from rising electrification across industrials/machinery. Resorts and casinos (PENN, MCRI, BYD) have tailwinds tied to improving RevPAR. Despite capacity additions, occupancy rates continue to grow. Staffing (KFRC, CCRN) demand historically peaks into year end. Home healthcare (AFAM, AMED, CHE) enjoys multi decade demographic tailwinds which support consolidation and offset reimbursement risk.

No small cap basics baskets score above average. In consumer goods, buy home furnishings, auto parts (MTOR, SMP), and processed & packaged goods (DMND). In financials, focus on regional banks (CFNL, TCBK, LKFN), investment brokers (GFIG, CLMS), and savings & loans (BRKL, BANR, NWBI, COLB). Home healthcare and medical instruments (CMN, MMSI, ANGO, HBIO, ICUI) score best in healthcare. Look for potential legislative support for instruments to come from Capitol Hill in the form of a repeal of the medical device tax. In industrials, concentrate on aerospace/defense (TASR, ORB) and industrial electrical equipment (SNHY, CIR). The top services groups include resorts & casinos, staffing, and management services (CRAI). In technology, buy specialized semiconductor, information technology services (SYKE, MNDO, RDWR), and semi equipment & materials (ATMI, OSIS).

Disclosure: None.