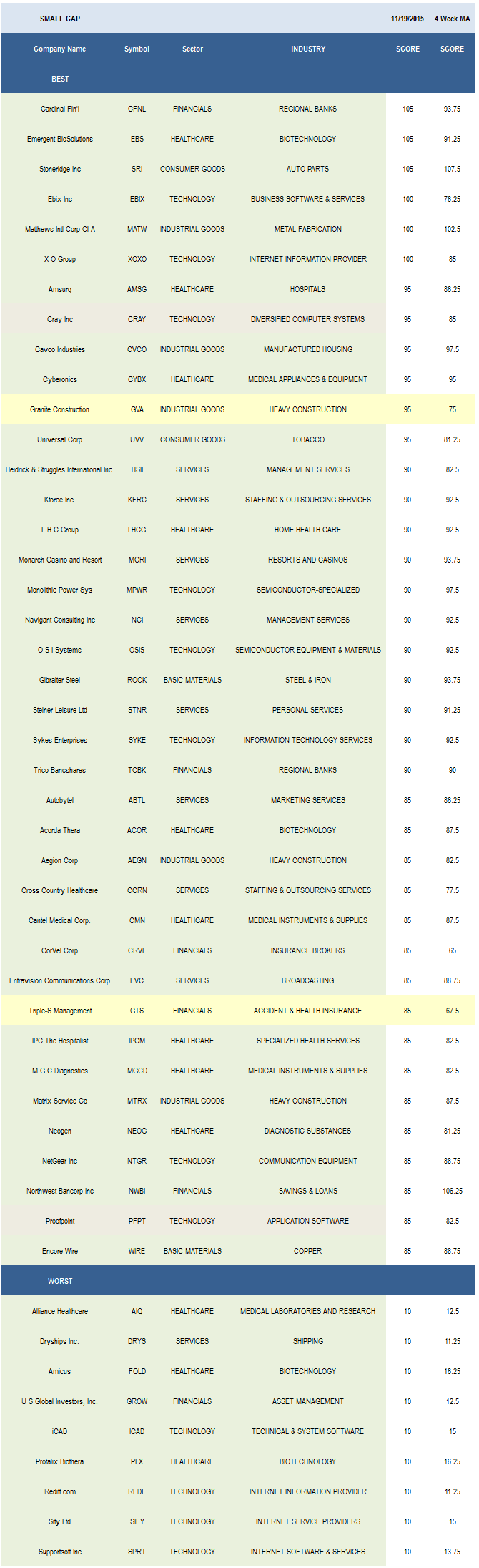

Small Cap Best & Worst Report - November 19, 2015

- The top small cap sector is financials.

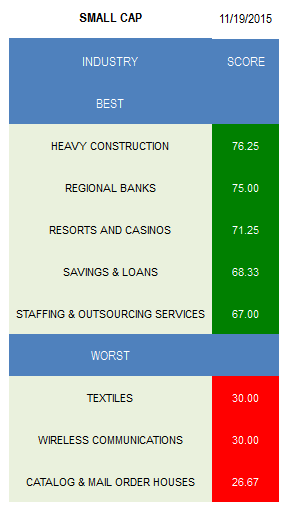

- The best small cap industry is heavy construction.

The average small cap score is 49.76 and that's below the four week moving average score of 51.79. The average small cap stock is trading -33.2% below its 52 week high, -9.57% below its 200 dma, and has 8.27 days to cover held short.

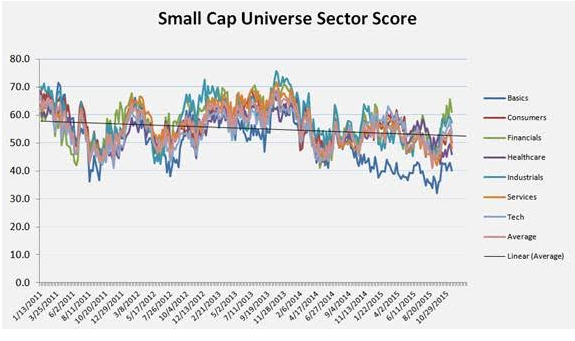

Financials, industrial goods, technology, and utilities score best. Consumer goods scores in line. Services, healthcare, and basic materials score below average.

(Click on image to enlarge)

The top scoring small cap industry is heavy construction (GVA, MTRX, AEGN). Regional banks (CFNL, TCBK, MBWM, LKFN, BBCN), resorts & casinos (MCRI, BYD), S&Ls (NWBI, BANR, PROV, DCOM, COLB), and staffing (KFRC, CCRN) stocks also score strong.

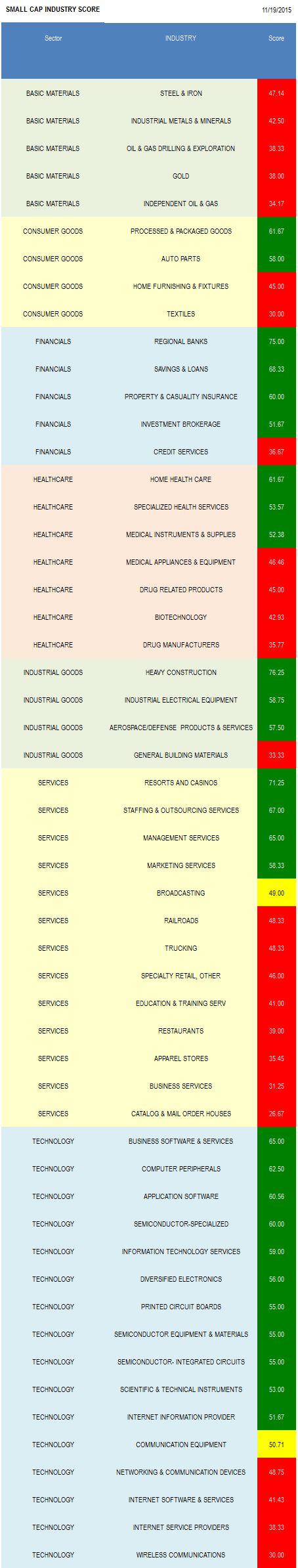

No small basics baskets score above average. Focus on processed & packaged goods (DMND) and auto parts (SRI, SMP) in consumer goods. The top financials groups are regional banks, S&Ls, and P&C insurers (MIG, STFC). Concentrate on home healthcare (LHCG, CHE, AFAM), specialized health (IPCM, AHS), and medical instruments (MGCD, CMN, LMNX, ICUI) in healthcare. The strongest industrials baskets are heavy construction and industrial electrical (ULBI). In services, buy resorts/casinos, staffing, and management services (NCI, HSII). Business software (EBIX, PRFT, CSGS, TSYS), computer peripherals (ALOT), and application software (PFPT, LOGM, QLYS, EPAY) are the best industries in technology.

Disclosure: None.