Small Cap Best & Worst Report - August 29, 2014

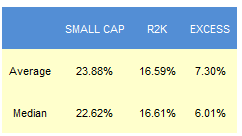

Since 2010, the average return for our weekly best scoring small caps has outpaced the R2K by an average 730 bps in the following year. The top performers from our report one year ago include DYAX up 124%, JAZZ up 85%, and UEIC up 73%.

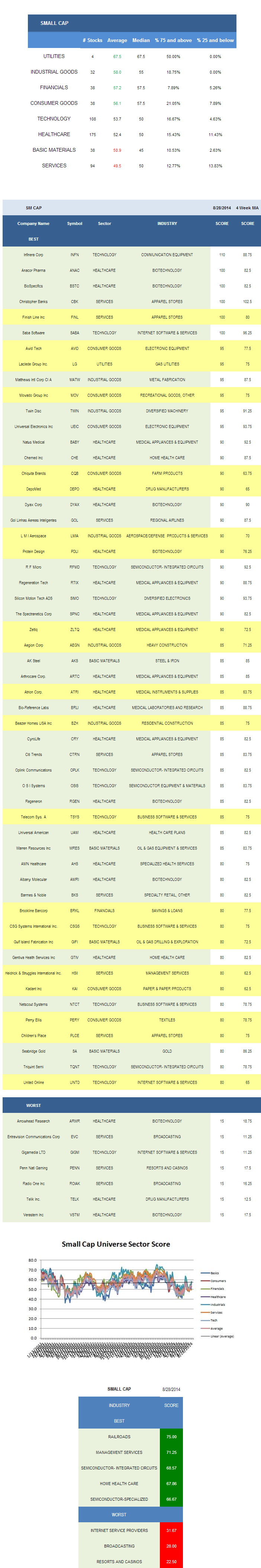

- The top scoring small cap sector is utilities.

- The best small cap industry is railroads.

The average small cap score is 53.1, above the 51.71 four week moving average score. The average small cap stock is trading -25.14% below its 52 week high, -1.37% below its 200 dma, and has 8.37 days to cover held short.

The top scoring small cap sector is utilities. Industrial goods, financials, and consumer goods also score above average. Technology and healthcare score in line with the average universe score. Basic materials and services score below average.

Railroad (RAIL, GBX, ARII) carload volume continues to support demand for railcars, supporting supplier revenue and profit. Management services (HSII, CRAI) are high scoring. Semi ICs (RFMD, OPLK, TQNT) and specialized semi (MPWR) remain strong scoring and benefit from the Internet of Things. Ageing baby boomers make home healthcare (CHE, GTIV, BIOS, AMED) one of the fastest growing industries, creating opportunities for larger players to roll-up smaller competitors for scale advantages amid tight payer purse strings.

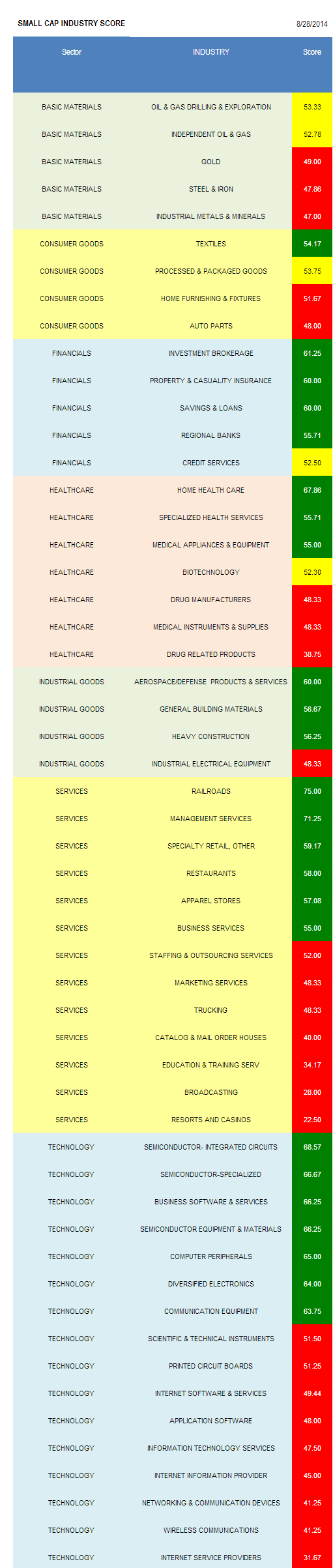

No small cap basic materials score above average; however drillers (GIFI) and independent oil & gas (PQ, SFY, GDP) score in line. In consumer, buy textiles (PERY, BEBE, OXY), which benefit from back-to-school and holiday shopping season. Investment brokers (GFIG, KCG), P&C insurers (HMN, UFCS), and S&Ls (BRKL, PROV, COLB, BANR) are the best scoring baskets across financials. In healthcare, concentrate on home healthcare, specialized health services (AHS, PRSC, HWAY), and medical appliances (ZLTQ, SPNC, RTIX, BABY). Aerospace/defense (LMIA) and general building materials (NCS) are best in industrial goods. Concentrate on railroads, management services, and specialty retail in services. Retail headwinds are typical through Q3, but tailwinds return in Q4 and last through Q1 -- position accordingly. The best scoring technology groups include semi ICs, specialized semi, and business software.

Disclosure: None.