Sloppy 10Y Auction Tails, Bid To Cover Tumbles

One day after a surprisingly strong 3Y auction priced, stopping through the When Issued for the first time after 10 consecutive tails, moments ago the US Treasury sold $27BN in 10Y paper in what can only be described as a poor, sloppy auction, which stopped at 2.689%, which while the lowest yield for a 10Y issue since January 2018, tailed the When Issued 2.681% by 0.8bps.

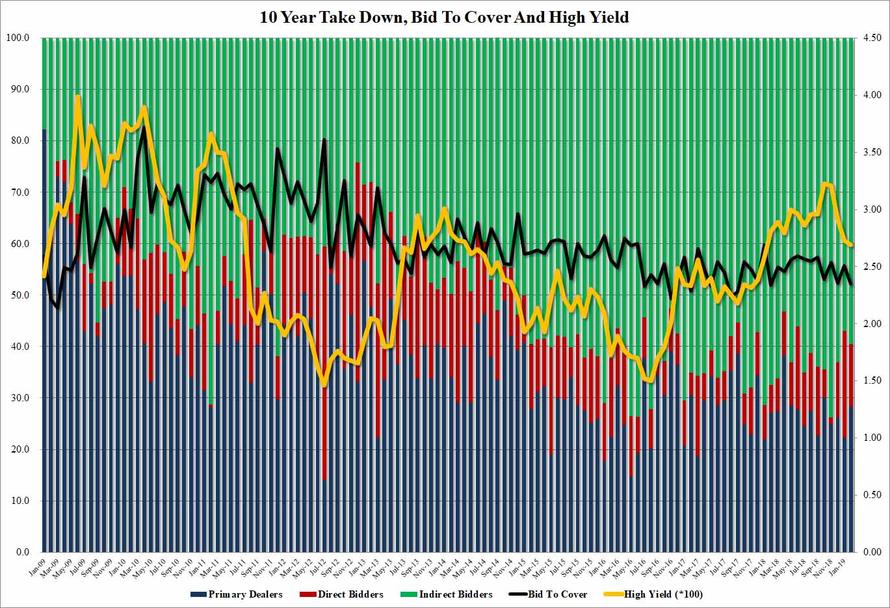

The internals confirmed the weak nature of today's auction, with the Bid to Cover sliding from 2.51 in January to only 2.35, which was tied with the lowest since February 2018; it was also well below the 6 month average of 2.49.

Finally, looking at the buyside, there was a distinct lack of enthusiasm by foreign buyers, with the Indirects taking down just 59.5, which while above last month's weak 56.9%, was below the recent average of 63.9%. At the same time, the Direct bid tumbled from 20.8% to 12.2%, the lowest since December if above the 10.5% average, which however was dragged down by November's surprisingly low 1.2% takedown. Dealers were left with 28.4% of the final allotment, the highest since October.

Overall, a poor auction - one which dragged the bond market modestly lower - and which may reflect the recent sharp drop in yields, and while investor demand is certainly there it just may not be as strong when the 10Y yield is below 2.70%, which as various strategists have noted is a concerning sign as it disproves any speculation that the economy is on a growing trajectory and merely sets the stage for further yield curve flattening.

(Click on image to enlarge)