Sleepy Stocks Drift As Fed Minutes Fail To Ignite Buying Boost

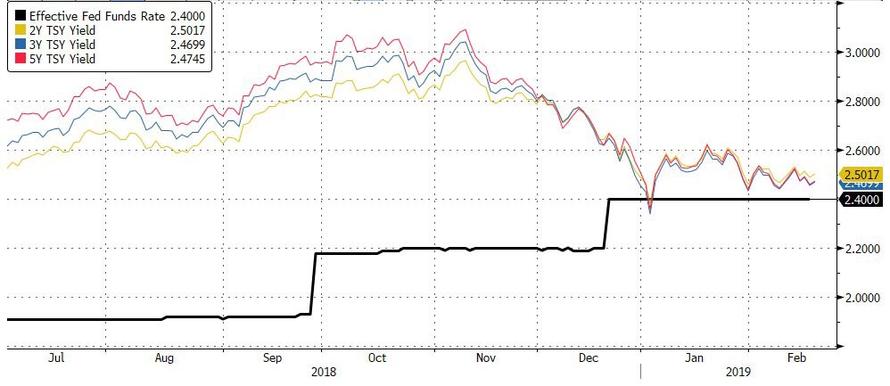

The market's hopes that today's snow-delayed Fed minutes would resolve the debate over the fate of the balance sheet unwind, were dashed with the Fed confirming what traders already knew: the Fed would remain patient, data dependent, focused on the fading inflation impulse, and would seek a plan for when the Fed's balance sheet unwind would end by the end of 2019 suggesting that the QT may continue well into 2020 if not later, dependent on what the Fed concludes is a sufficient amount of required bank reserves.

As Bloomberg notes, "small moves in stocks, bonds, and FX as the Fed minutes portray a central bank that still sees a decent economy, slow-growing inflation, a tight labor market and an uncertain path for interest rates." The Minutes punctuated another rather quiet session that saw economically-sensitive stocks such as steelmakers, chemical and industrial companies outperform against a flat tape.

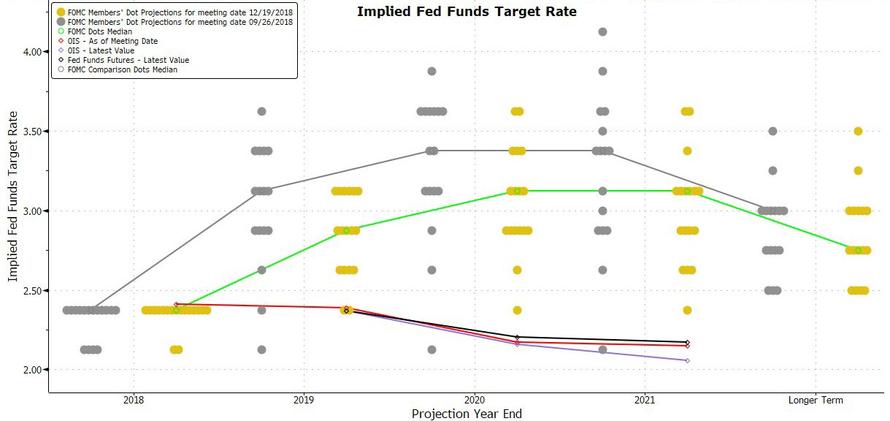

Following the ambivalent minutes, rate hike expectations were broadly unchanged, with the Fed Funds still pricing in a rate cut in 2020 as the divergence with the Fed's hawkish dots continues.

(Click on image to enlarge)

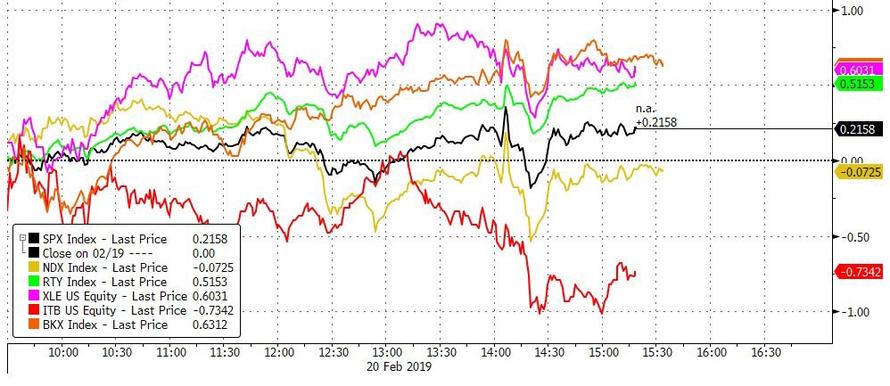

As a result, stocks initially slumped, then rebounded, and traded modestly in the green, with the Nasdaq hugging the flatline, as banks, small caps, and energy stocks outperforming, offset by losses in homebuilders.

(Click on image to enlarge)

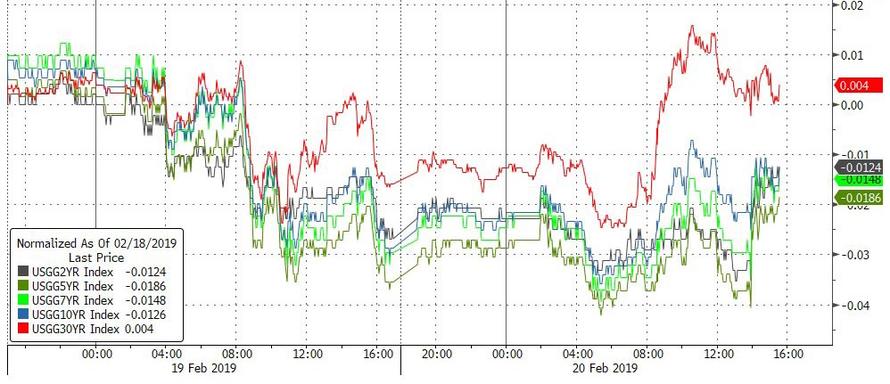

Treasurys were mixed, with the long end taking on water and the curve initially steepening led by 30Y yields higher, even as the short end and 10Ys were more or less flat for the day...

(Click on image to enlarge)

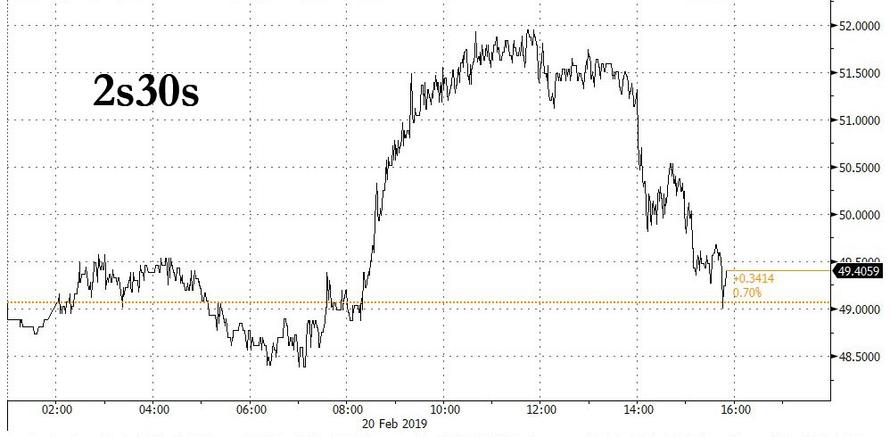

... however by the close of trading, today's steepening had faded most of the intraday move.

(Click on image to enlarge)

Despite today's modest appetite, the scramble into safe havens observed in late December remains a distant memory, and the short end continued to trade about 10bps higher than Fed Funds.

(Click on image to enlarge)

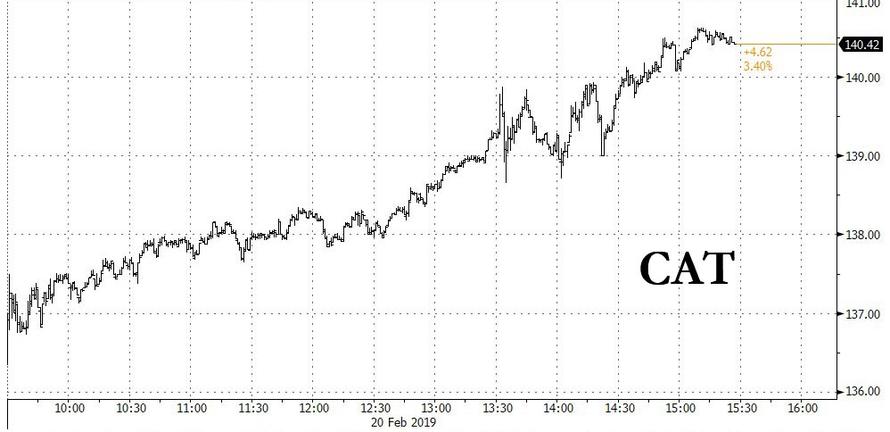

In single names gainers, Caterpillar stood out, with its rally accelerating after it said Chinese demand is “very strong.”

(Click on image to enlarge)

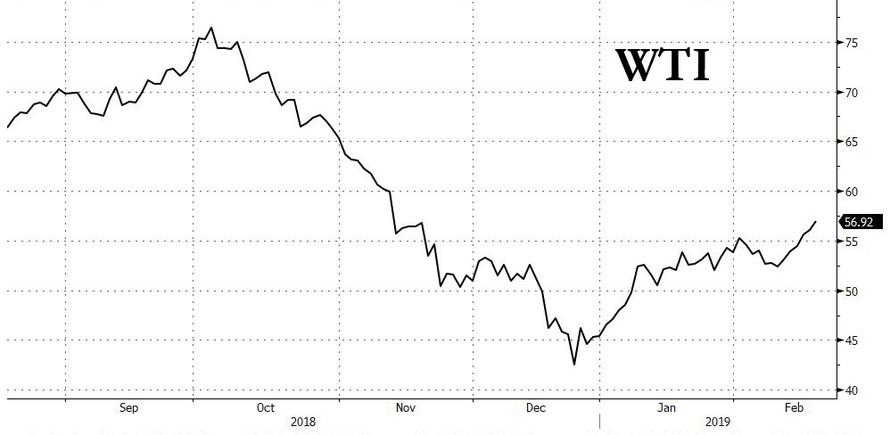

In commodities, WTI crude rose to 2019 highs, up roughly a dollar on the day...

(Click on image to enlarge)

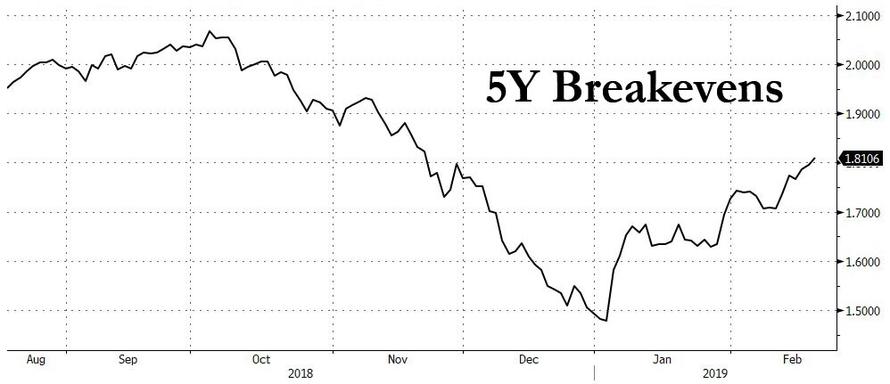

... helping to push 5Y breakevens similarly to 2019 highs...

(Click on image to enlarge)

... while nickel and copper were among the biggest commodity gainers, with some traders citing China’s latest easing steps overnight as a catalyst.

After swinging higher, then lower, the dollar ended mostly unchanged, even as the recent surge in the offshore yuan extended its advance toward the 6.70 level in the New York session despite analyst expectations that gains will be short-lived as China’s weak economy eventually outweighs optimism from a potential trade deal.

(Click on image to enlarge)

And so, with the Minutes coming and going, the critical 2,800 level in the S&P remains untouched, with the broader index trading about 15 points away, and facing massive resistance to break out above what has now been called a "quadruple top."

(Click on image to enlarge)

When and how the S&P can breach this level remains a question for another day after today's subdued trading day.