Silver: Is This Short Squeeze For Real?

Fundamental

The fundamentals for precious metals are highly favorable. Yesterday Fed Reserve Governor Powell said they are going to leave interest rates as is and that they have no intention of raising rates any time soon. They can’t afford to raise rates. We are going to see low rates for a long time. It's creating the economic boom in real estate, with rates so low. The cost of money is the cheapest we have ever seen. If you qualify, this is a great time to buy a home in terms of the cost of borrowing money. There's a risk, of course. The economic stimulus will have an inflationary effect on the economy. We already are seeing inflation in food prices. Wholesale food prices have increased more than 54%. The supply issues caused by lockdowns will only increase costs for food and other commodities.

We are likely to see massive amounts of stimulus coming into the market. Last March the Feds and the Treasury looked at putting 10% of GDP or $24 trillion into stimulus spending. We appear to be heading that way toward that staggering amount of money. We are still far from recovered from the pandemic.

Massive stimulus is like a put for the market, guaranteeing that the Fed will be there if any systemic risk arises. However, the stimulus is not bullish for the US dollar. It decreases the value of the dollar and its clout as the world’s reserve currency. We are basically exporting our inflation to the world via the US dollar. The Fed wants to ensure we don’t run low on dollars, as we did in 2008. Now cheap money is fueling the stock market. We are not likely to see the kind of implosion we saw in March. There's tremendous cheap money available and the markets appear to have taken a bullish view of the future. The free money appears to be going to the stock market and safe havens, such as the dollar, short term.

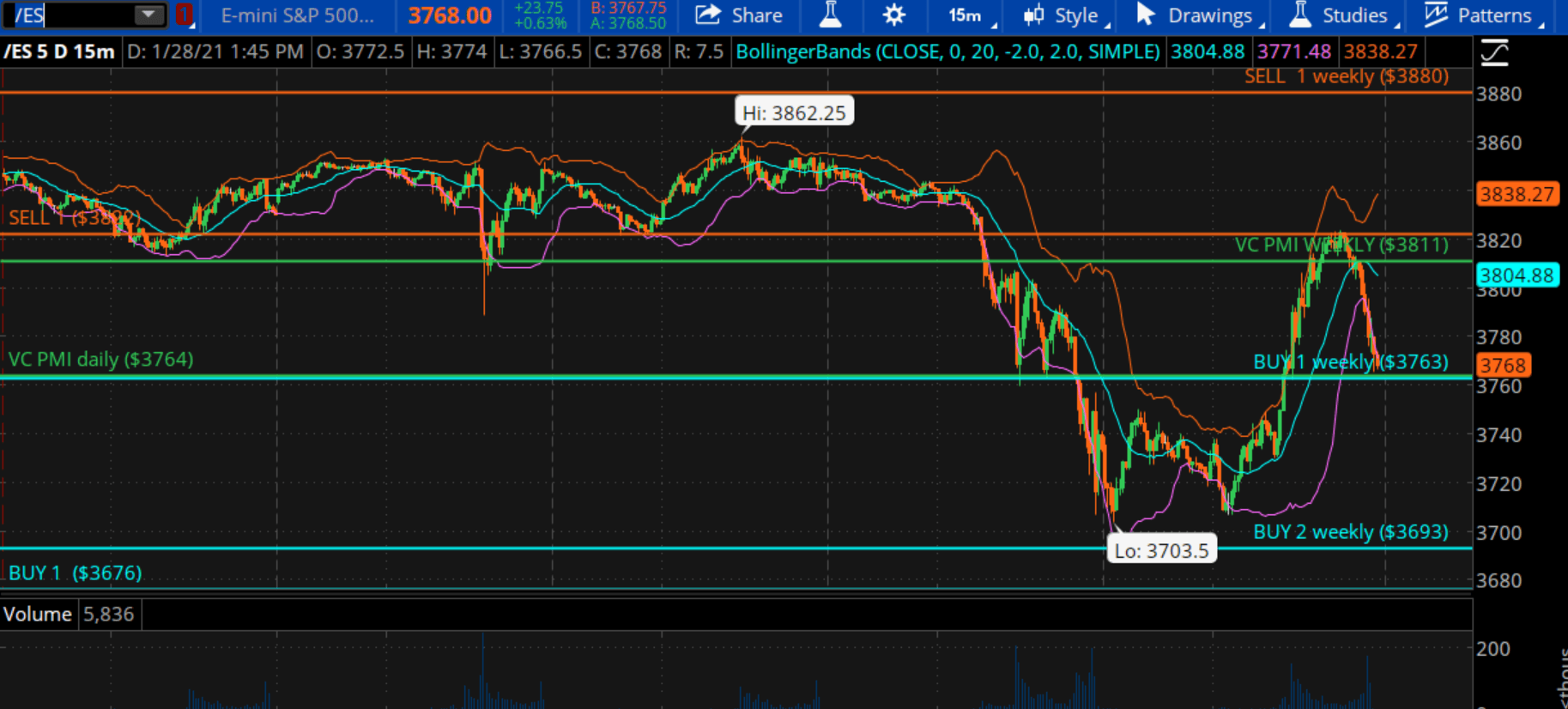

The E-mini S&P reversion appears to have been completed yesterday. 3703 was the low and the weekly Buy 1 and daily bullish trend momentum were activated. Free money continues to pour into the stock market. It will find its way into precious metals soon.

(Click on image to enlarge)

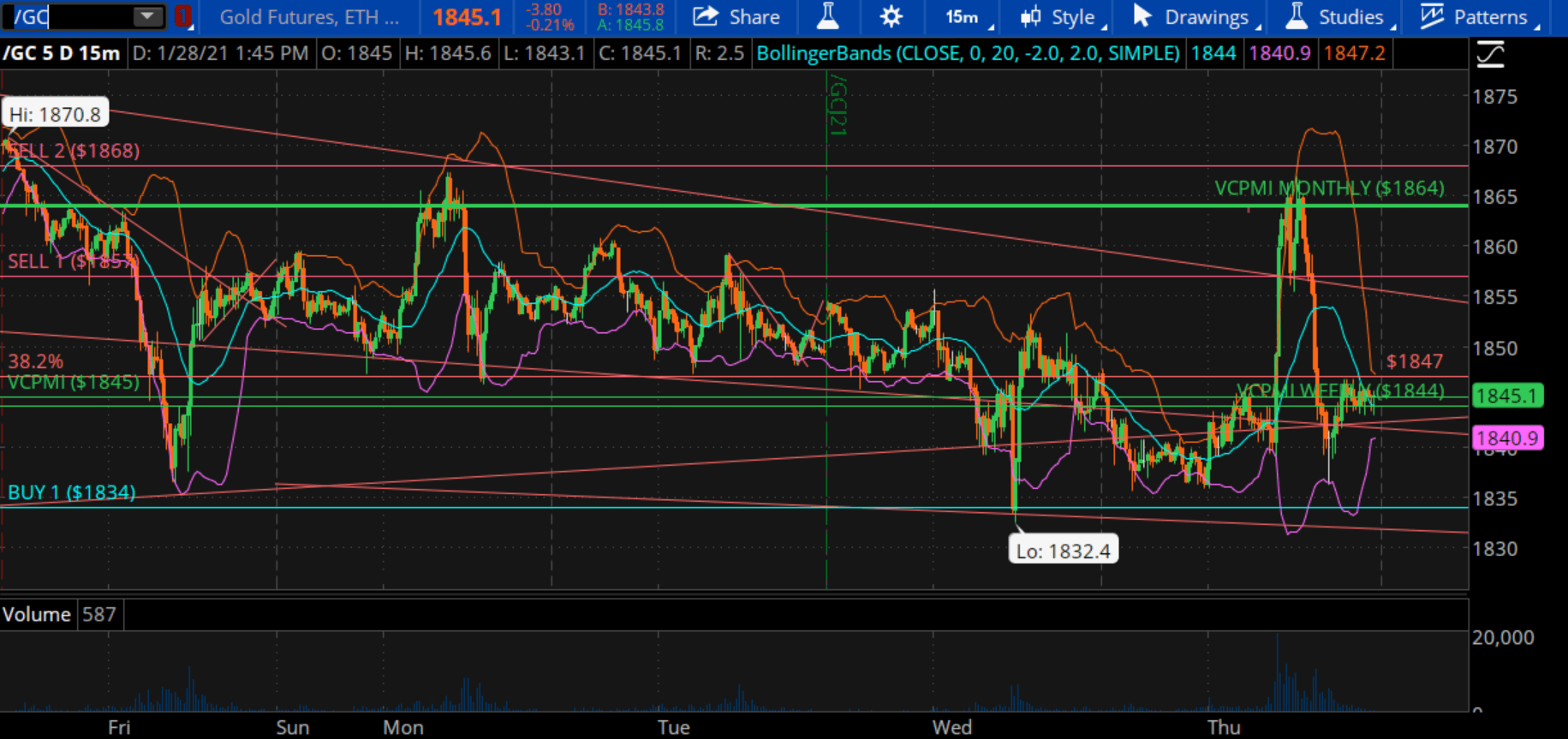

Gold

January 28, 2021 at 7 am PST. Gold is in a fast market. It made a low of $1838.60. It did not quite reach the Variable Changing Price Momentum Indicator (VC PMI) Buy 1 level of $1834. Once it traded above the daily and weekly average prices, it completed the daily Sell 1 target of $1857 and $1868 is the Sell 2 target. It also completed the weekly Sell 1 target of $1864. The market on the monthly then reverted and is trading under the average price, so it’s neutral to bearish. The daily signal is neutral. A close below $1857 could trigger a short signal.

(Click on image to enlarge)

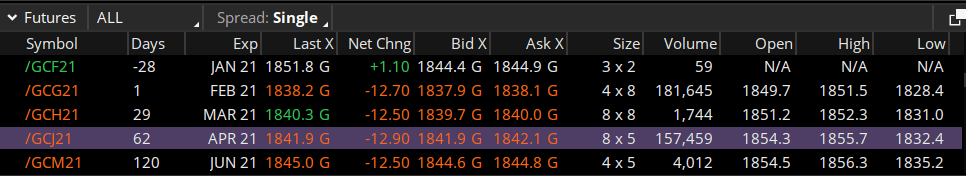

The February contract is inverted to the back months. We still had 59 gold contracts to take delivery. An inversion represents the possibility of a shortage of supply, which we also saw back in March. It's caused by the lockdown disrupting the supply chains. We are looking at the effect that this will have, just as it did in March. The spot month went up $80 against the physical future in March because you could not get gold. The premiums in the cash market are exploding, as they are in the silver market, too.

It's an indication of the demand that appears to be in the metals markets right now for taking physical delivery. Whenever you see this inversion in the spot month, it usually represents a shortage of supply. We may be looking at a short squeeze of the short positions that central banks are carrying to the tune of about $35 billion. If interest begins to develop on the long side of the market, we could see an explosive move up in gold.

(Click on image to enlarge)

The momentum of the market has turned bullish. The VC PMI expected a reversion from these levels, which seems to be occurring. We also are breaking out of a little wedge that has been formed, which is a descending wedge - a bullish formation. If we trade above $1864, which is the monthly mean, then we are going to activate $1887 to $1917 as targets. The daily target is $1868. Gold went above $1864, which means you should buy at the market.

The targets are then $1868 and the weekly $1887 and $1917 levels. The monthly targets are also around $1900. For the monthly, the close at $1864 is bullish with targets of $1950 and $1998 for the remainder of this month. For the annual numbers, for September 28, 2020 to September 28, 2021, we are looking at $2164 as the first target and $2442 as the second target. If those targets are hit, then a reversion back to the mean is likely. The 9-year cycle is up to $2299 to $2712, so we have a long way to go. It's a question of being patient with your positions. The correction is probably behind us. Wait for the big move up.

In terms of Fibonacci trend lines, we appear to have found the bottom and reverted right back up above a descending wedge. We are looking to complete the target of $1900 and the weekly target of $1917. We are likely to see a rally up into these levels. Buyers will take all the supplies available and lead to higher prices.

Silver

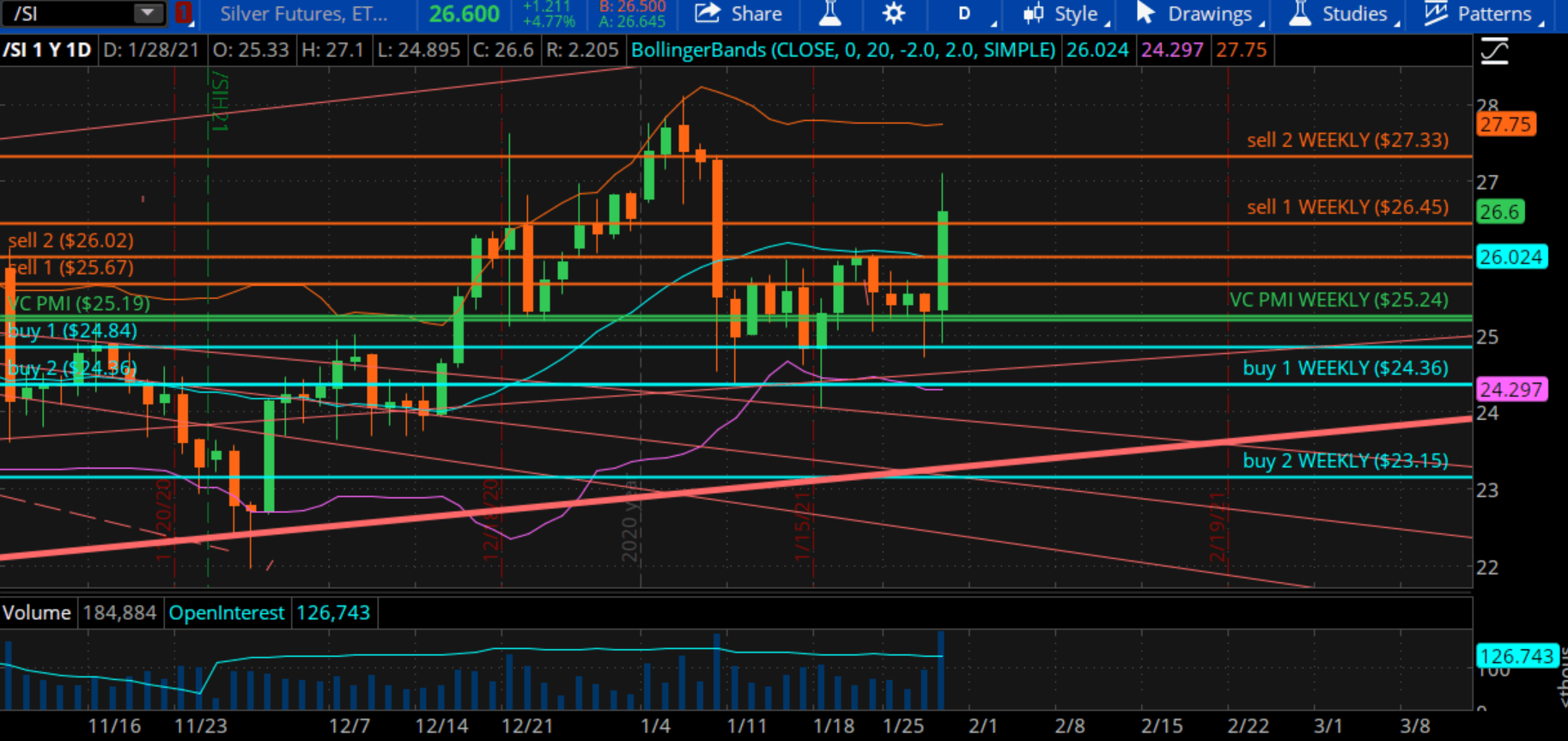

(Click on image to enlarge)

Courtesy: TDAmeritrade

Silver is up $1.17, exploding to the upside. Silver traded above $27 this morning. We are seeing explosive volatility. We are recommending that you want to measure the risk according to your profile. These kinds of moves are becoming average; $3 or $4 moves in a day. As we reach the end of January, we are more likely to see the winter lows into the middle of February. Depending on the short covering that occurs, if the short side of the market is pressured to liquidate their positions, we could see a massive short-covering rally.

When the market is like this, you don’t want to sell short on the open. You want to get into the market at the Buy 1 and Buy 2 levels, especially when the daily, weekly and monthly signals are in harmonic alignment. We appear to have put in the winter lows and are on target to reach the Sell levels in gold and silver.

Silver reverted from the average price. The daily and the weekly VC PMI levels were almost perfectly aligned. Now $27.33 is the target.

If you are not in silver or gold when no one wants them, you are always going to be chasing the market. We recommend that you go long in gold and silver.

Disclosure: I am/we are long SLV. I wrote this article myself, and it expresses my own opinions.

To learn more about how the VC PMI works and receive weekly reports on the E-mini, gold, and ...

more