Significance Of An Index Dividend Yield Greater Than 10-Year Treasury Bond Yield

It probably goes without saying but bond market interest rates have been driven down to unforeseen levels, near-zero, causing investors to search for yield in other places. The actions of Central Banks around the world are contributing to this low or no interest rate environment. As the bottom panel in the below chart shows, since the financial crisis in 2008/2009, the spread between the dividend yield on the S&P 500 Index and the 10-year Treasury yield has oscillated between a positive and negative level. Currently, the S&P 500 Index yield is greater than the 10-year U.S. Treasury yield with a spread of 88 basis points.

When drilling down into the S&P 500 Index, 337 stocks have a higher yield than the 10-year Treasury yield. In total, this represents almost 90% of the 381 dividend payers in the Index.

Since the 2008/2009 recession, when the positive spread of the index's yield over the Treasury yield has peaked, this has occurred at a bottom or near the bottom in the index. At the recent March 23 equity market low, the stock to bond spread peaked at nearly 2 full percentage points. Since that time the S&P 500 Index has enjoyed a rally of over 52%.

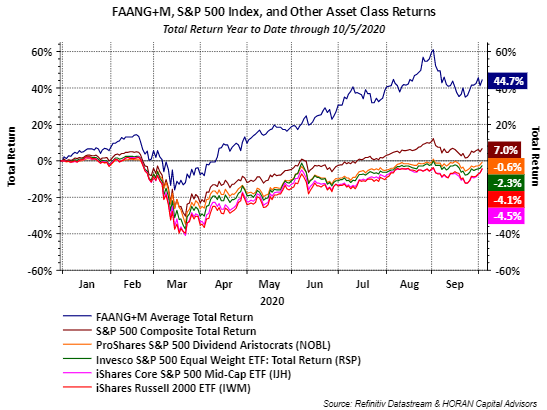

For investors navigating a market where the mega-cap technology stocks have dominated and trade at elevated valuation levels, dividend payers might be an area where one can uncover attractive investment opportunities. As a caution though, stocks that trade at high yields often do so as a result of negative underlying fundamentals. So chasing yield alone can result in negative performance consequences in one's portfolio. Also, dividend-yielding stocks can be just as volatile as all other stocks and sometimes more so. This was the case in the February to March market decline as seen in the below chart. The orange line represents the ProShares Dividend Aristocrats Index (NOBL) and the blue line is the FAANG+M average return, Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), Google (GOOGL) or Alphabet, and Microsoft (MSFT). During this period of market decline, the Aristocrats underperformed the FAANG+M stocks.

In summary, looking for quality dividend-paying stocks in a low-interest-rate environment can uncover attractive investments; however, dividend payers are still stocks and can provide the same level of volatility as any other non-dividend-paying stock.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more