Should Wabtec Continue To Pursue Faiveley Transport?

Wabtec WAB is a leading provider of equipment and services to the global rail industry. Its top line growth has been anemic amid a slowing global economy. The company's Q4 revenue only grew 1% Y/Y, yet the company trades at 20x earnings. To spur the top line it has been making smaller, bolt-on acquisitions. In October Wabtec struck a deal to acquire 51% of Faiveley FVLEF for an enterprise value of euros 1.7 billion ($1.9 billion). The transaction would add about a third to Wabtec's revenue but it may be coming after Faiveley has peaked.

The Situation

Faiveley is a leading provider of integrated systems and services for the railway industry. The company supplies railway manufacturers, operators and maintenance providers with technology-based systems and services in Energy & Comfort, Access & Mobility and Brakes & Safety.

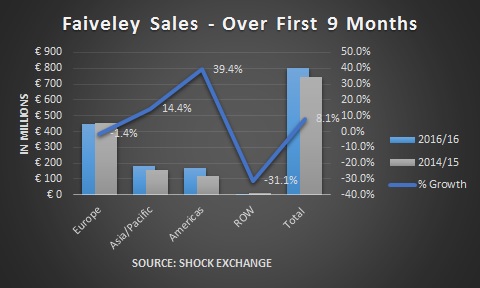

Over the first nine months of its 2016 fiscal year the company's revenue of euros 802 million was up 8.1% Y/Y. Europe (56% of revenue) was down slightly while revenue from Asia/Pacific and the Americas was up 14% and 39%, respectively.

The Asia-Pacific region (22% of revenue) was buoyed by high deliveries in China, India and Australia. The Americas (21% of revenue) was driven by high volume freight sales in the U.S. and delivery of major projects in Canada. However, that might represent peak performance for the following reasons:

Railroad Traffic In China And The U.S. Has Fallen Off

Railroad traffic is declining in both China and the U.S. Goods shipped by China's national railway fell Y/Y by 10.5% in 2015 -- the biggest annual decline ever; that followed a 4.7% decline in 2014:

The total volume of goods transported by China's national railway dropped by a tenth last year, its biggest ever annual decline, business magazine Caixin reported on Tuesday, a figure likely to fan concerns over how sharply the economy is really slowing.

Meanwhile, U.S. rail traffic for March 16th fell nearly 12% Y/Y. In my opinion, declining railcar traffic are harbingers of declining economic activity. Asia/Pacific and the Americas have delivered all of Faiveley's top line growth. The fact that both regions are experiencing double-digit declines in rail traffic does not bode well for the company.

Eventually, that could lead to lower railcar orders and lower demand for components for rail and freight cars. Another data point is that Greenbrier Companies GBX reported an 80% decline in railcar orders last quarter. Total railcar orders in the U.S. are also trending down and I expect it to have a negative impact on Faiveley by the first half of its next fiscal year.

The Global Economy Is In Shambles

The global economy is in shambles. China's February exports fell 25% Y/Y -- the worst monthly collapse in Chinese exports since 2009. 2015 world trade contracted for the first time since 2009 and the Baltic Dry Index -- another measurement of global trade -- is at historic lows. The scary part is that these economic indicators come after trillions in so-called stimulus from central bankers. The Federal Reserve even refused to raise U.S. interest rates last week on fears of global economic headwinds in China and emerging markets.

A combination of slowing railcar traffic, declining U.S. railcar orders and a global economy in tatters imply [i] Faiveley's best days are behind and [ii] Wabtec might be buying at the peak. With or without the transaction I believe Wabtec's top line growth with be anemic. Investors should continue to avoid the stock.

I am short WAB