Short-Term Uncertainty - Just Flat Correction Before Another Leg Up?

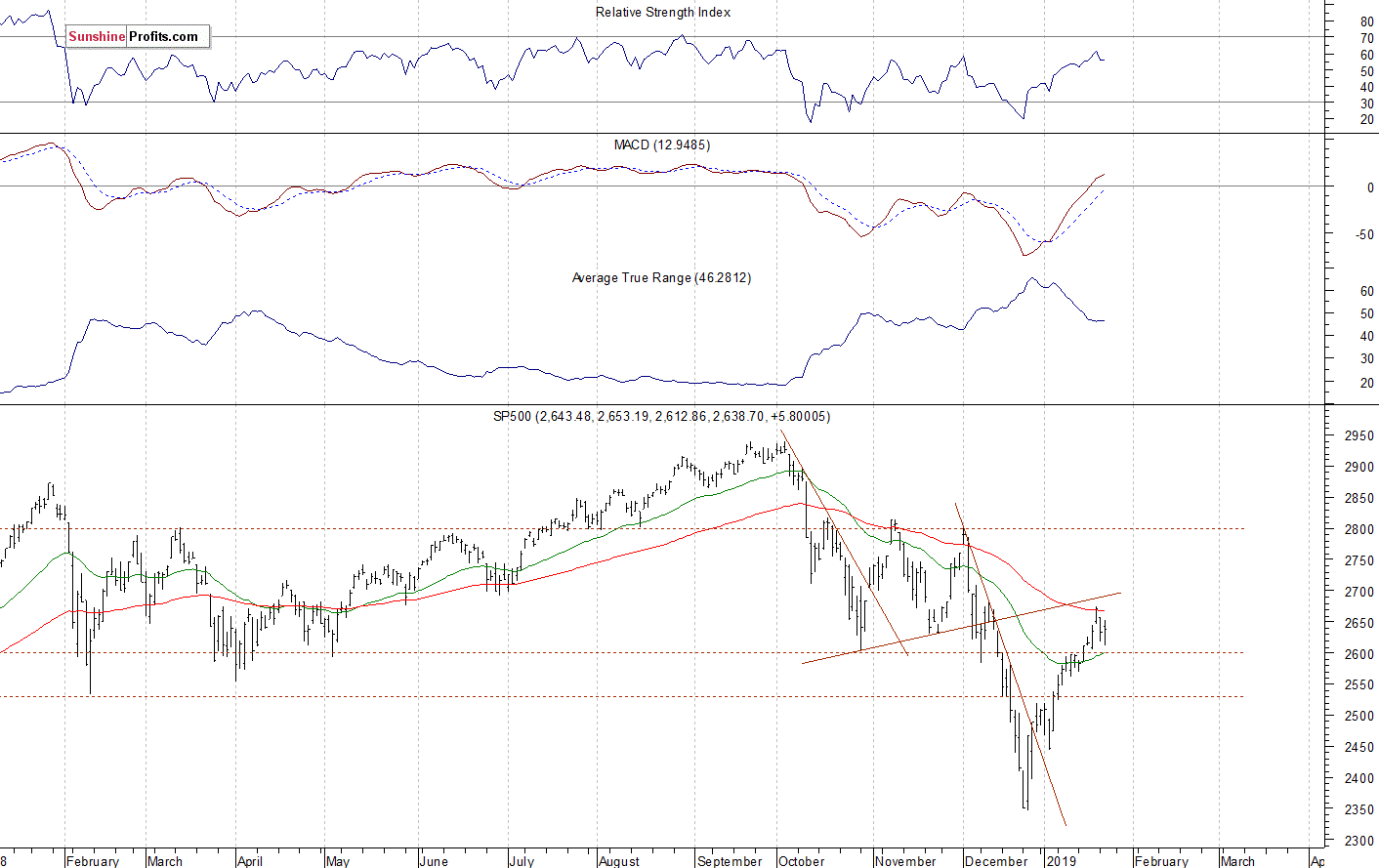

The U.S. stock market indexes gained 0.1-0.7% on Wednesday, as they fluctuated following Tuesday's decline. The S&P 500 index continued its rebound off the December the 26th medium-term low of 2,346.58 recently. The index traded 20.2% below September the 21st record high of 2,940.91 on that day. Then the market rallied and retraced more than 50% of the downtrend (at 2,643.74). It broke slightly above 2,600 mark last week and it got closer to 2,700 on Friday. The Dow Jones Industrial Average gained 0.7% and the Nasdaq Composite gained 0.1% yesterday.

The nearest important level of resistance of the S&P 500 index remains at 2,675-2,685, marked by the early December local highs. The resistance level is also at 2,700-2,710. On the other hand, the support level is at around 2,600-2,610. The support level is also at 2,570-2,585, marked by some recent local lows.

The broad stock market broke below its two-month-long trading range in the mid-December, as the S&P 500 index fell below the level of 2,600. Then the market accelerated lower and it broke below 2,400 mark. The downward correction reached 20.2% from the September all-time high, surpassing January-February correction of around 12%. Since then, the market retraced more than 50% of the whole decline off the September high. The index trades close to a possible resistance level of its previously broken upward trend line, as we can see on the daily chart:

Short-Term Consolidation

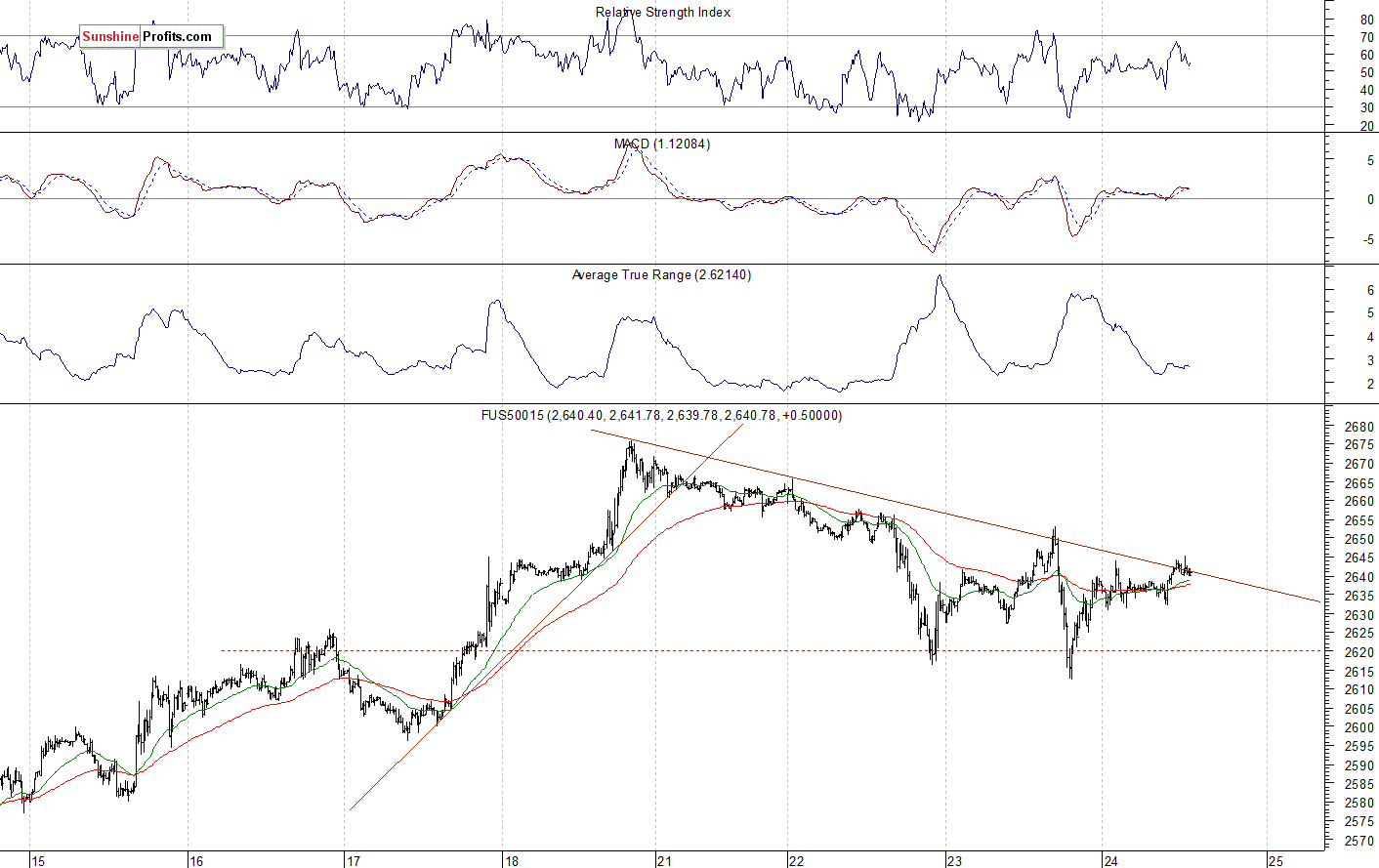

The index futures contracts trade 0.1-0.5% above their Wednesday's closing prices. So expectations before the opening of today's trading session are slightly positive. The European stock market indexes have been mixed so far. Investors will wait for series of economic data announcements today: Initial Claims at 8:30 a.m., Flash Manufacturing PMI, Flash Services PMI at 9:45 a.m., Leading Indicators at 10:00 a.m., Crude Oil Inventories at 10:30 a.m. They will also wait for more quarterly corporate earnings releases. The broad stock market will likely fluctuate following the recent advance and its Tuesday's downward correction. There have been no confirmed negative signals so far. But we saw some clear short-term technical overbought conditions recently.

The S&P 500 futures contract trades within an intraday consolidation, as it fluctuates following yesterday's rebound. The nearest important level of resistance remains at around 2,640-2,650, marked by the recent fluctuations. The resistance level is also at 2,660-2,670. On the other hand, the support level is at 2,615-2,620, marked by the local lows. The futures contract continues to trade along its short-term downward trend line, as the 15-minute chart shows:

Nasdaq Continues Sideways

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday consolidation after yesterday's advance and a rebound off 6,600 mark. The market gained over 1,000 points from December the 26th local low of around 5,820. On Friday it broke above 6,800 mark before quickly reversing lower. The nearest important level of resistance remains at 6,700-6,750. The next resistance level is at 6,800-6,830. The support level is at 6,600-6,650, among others. The Nasdaq futures contract remains close to the level of 6,700 this morning, as we can see on the 15-minute chart:

Apple, Amazon - Flat Corrections?

Let's take a look at Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). The stock sold off in the early January, as it reached the new medium-term low of $142. We saw clear short-term oversold conditions and then the stock retraced some of its recent decline. It broke above the month-long downward trend line, but it still trades at the resistance level of $155-160:

Now let's take a look at Amazon.com, Inc. stock (AMZN) daily chart. The stock accelerated its downtrend in the late December and it reached the new medium-term low of $1,307. Since then it was consequently advancing. The market broke above one of its three-month-long downward trend lines. There is a close resistance level at around $1,700-1,750, and the stock retraced its recent run-up recently:

Blue-Chip Stocks Close to Local Highs

The Dow Jones Industrial Average broke above the level of 24,000 last week, and it continued higher towards 25,000 mark on Friday. The market is back above its October-December local lows. So will it continue higher and reach the record high again? For now, it still looks like an upward correction. However, there have been no confirmed negative signals so far. The resistance level remains at the mentioned 25,000:

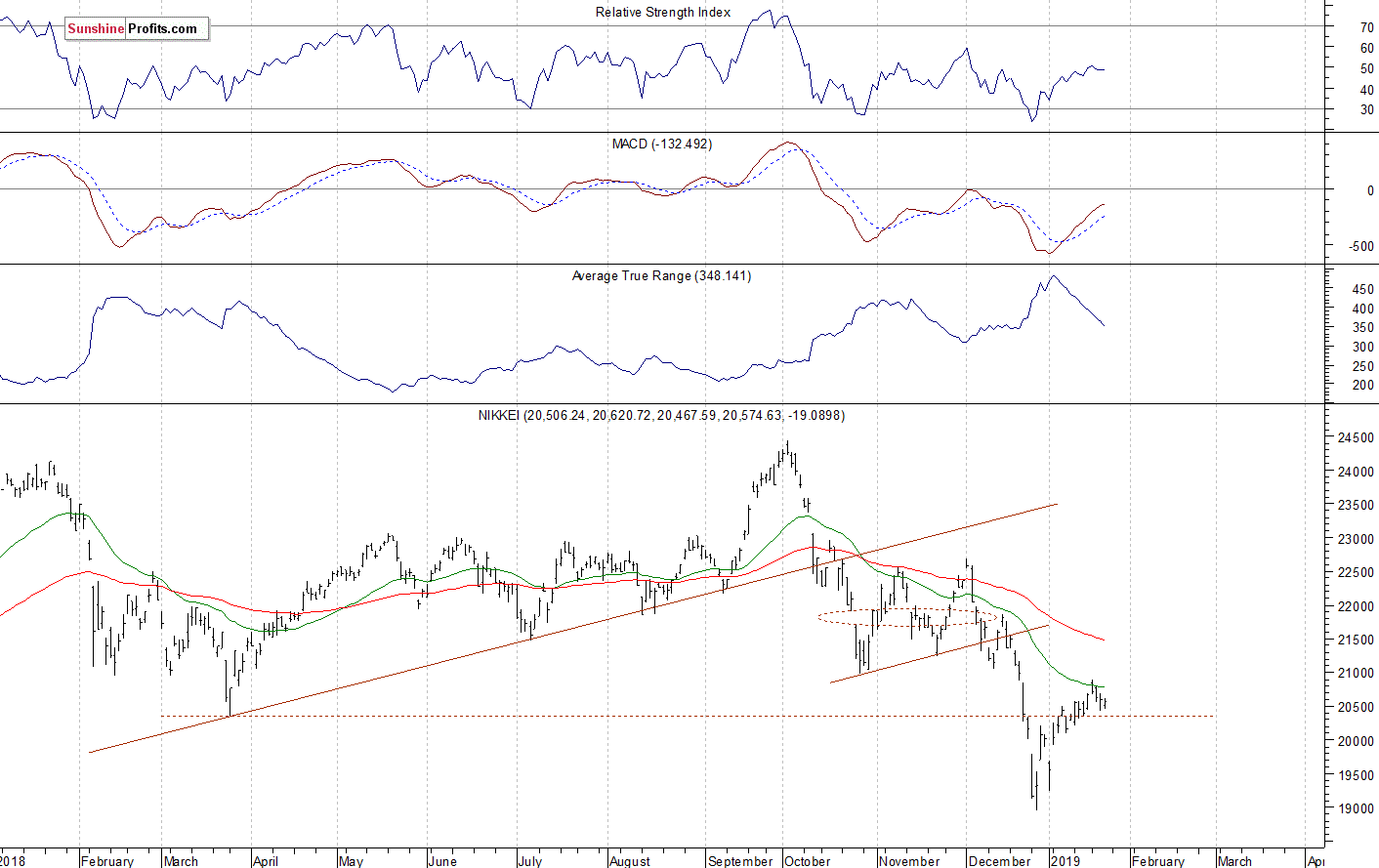

Japanese Nikkei Remains Relatively Weaker

Let's take a look at the Japanese Nikkei 225 index. It accelerated the downtrend in the late December, as it fell slightly below the level of 19,000. Since then it was retracing the downtrend. Recently we saw an advance above the level of 20,000. For now, it still looks like an upward correction and the Nikkei remains relatively weaker, as it remains way below the October - November local lows:

The S&P 500 index extended its short-term uptrend recently, as it broke above the mentioned 50% retracement of the whole downtrend from the record high. Is this a new medium-term uptrend? We can see a short-term downward correction. However, the medium-term picture is quite bullish at this moment.

Concluding, the S&P 500 index will likely open slightly higher today and then we may see some more short-term fluctuations. For now, it looks like a correction within an uptrend.

Disclosure: None.