Shifting Trade Politics Should Not Be Ignored

Following the breakdown in US/China trade negotiations earlier this month, US and Chinese actions since then point in our view to a protracted period of tariffs. While Trump has placed additional tariffs on Chinese goods, China has allowed the renminbi to depreciate markedly since May 10. Furthermore, Trump’s announcement of restrictions on telecoms suppliers, aimed indirectly at Huawei, indicates the probability of a trade deal in the short-term is remote. We note forecast earnings momentum is easing again after improving earlier in the year and cyclical sector PMIs are under pressure. As tensions in respect of Iran continue to rise, it remains a good time to re-appraise risk levels in portfolios in our view.

It is becoming increasingly likely in our view that the breakdown in US/China trade negotiations is serious and will take some time to resolve. There appears to be disagreement in principle in respect of any enforcement mechanism. Press reports indicate an unacceptable redrafting of the text of the agreement by China. This is likely to weigh on markets where the prevailing consensus still seems to be hopeful of some kind of deal in the short-term.

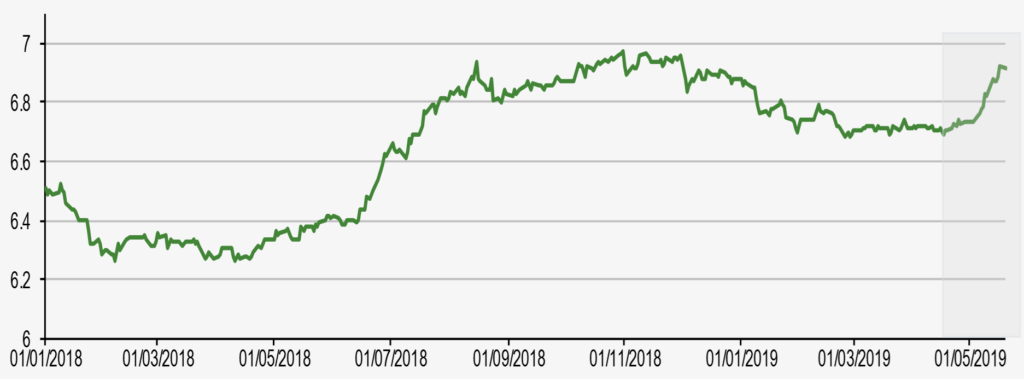

The actions of the parties since the breakdown in negotiations are not encouraging, however. The Chinese delegation sent to Washington left with no schedule for further talks. Since then, the Chinese renminbi which represents the most direct riposte to new US tariffs has been allowed to decline sharply, Exhibit 1. Trump has followed through with new tariffs on China. In addition, last week’s US executive order implicitly targets the Chinese telecoms firm Huawei by shutting it out of US markets. Reports that intelligence-led briefings are being held at US companies detailing China’s threat to the US technology sector are also unhelpful. We suspect the actions of the US will have caused significant antagonism within China’s administration and have created an environment hostile to any formal agreement.

Exhibit 1: China’s currency has been allowed to depreciate during May, as US/China trade talks collapse

Source: Refinitiv

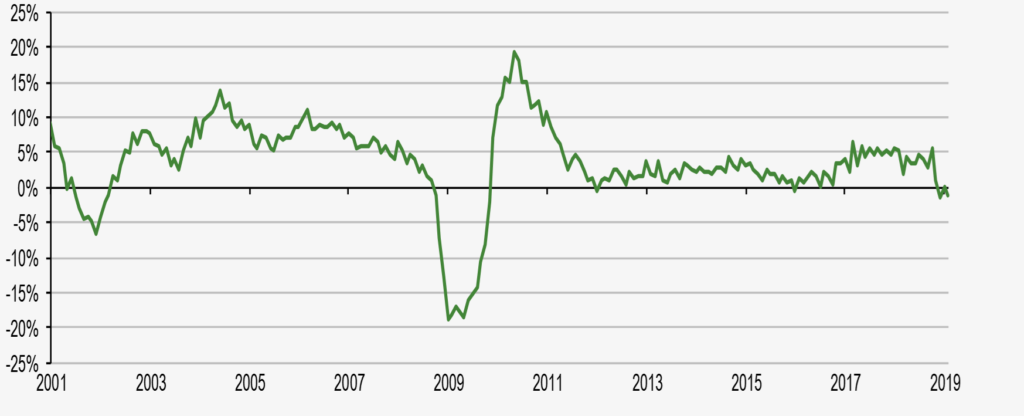

Financial markets may have moved on from the global financial crisis of 2008 but echoes continue to be heard in the West’s political domain in terms of populism. Political shifts which have had a much longer time-lag compared to monetary or fiscal dynamics are only now starting to bite the real economy with the pivot in US trade policy and more recent increases in US tariffs. In another example of the lagged impact of populism, the UK is still attempting to negotiate its way out of the free trade area of the EU, following the referendum result of 2016. Although investors may have become inured to talk of tariffs the effects, with the expected lag, are now becoming evident in the data. Global trade volume growth is currently softening at a rate not seen since the global financial crisis, Exhibit 2.

Exhibit 2: Global trade volumes have declined year-on-year

Source: CBP world trade monitor, Edison calculations

Being such a recent phenomenon, there is little direct quantitative evidence linking the slowdown in trade to the re-imposition of tariffs. Over many decades, worldwide tariffs have been carefully and technically dismantled, under the auspices of global organizations such as the WTO. The rapid re-imposition of US tariffs, therefore, represents a dramatic reversal in US trade policy, compared to recent decades of trade liberalization.

US/China tariffs are now at a level which will interrupt supply chains in our view as rates of 25% are difficult to absorb in in profit margins or by the US consumer. It is unfortunate that in some respects, the success of central banks in engineering an aggregate recovery through innovative monetary policy (albeit with some politically important distributive effects) has created space for sub-optimal government policy on trade. In addition, the lack of political “ownership” of the global recovery by governments may have created the well-known rental-car risk of not looking after it.

We believe policy uncertainty in respect of US/China trade in combination with actual tariffs imposed to date are responsible for a slowdown in global trade which may have been masked by the relative resilience of global markets during 2019. Markets have been driven by globally easier monetary policy and modest fiscal stimulus measures in China. However, with developed market valuations now significantly above levels prevailing earlier in the year, a resolution to the US/China trade dispute and steadily improving economic data are in our view prerequisites to maintaining the relatively high level of optimism and confidence implied in financial market prices.

The improvement in survey data since the beginning of the year cannot, however, disguise the relatively poor mood amongst global manufacturers and the difficult environment for industrial commodities such as metals. Trade-related profit warnings continue to impact markets. Last week, Deere blamed ongoing trade uncertainties for causing a much more cautious environment amongst US farmers for equipment purchases for example.

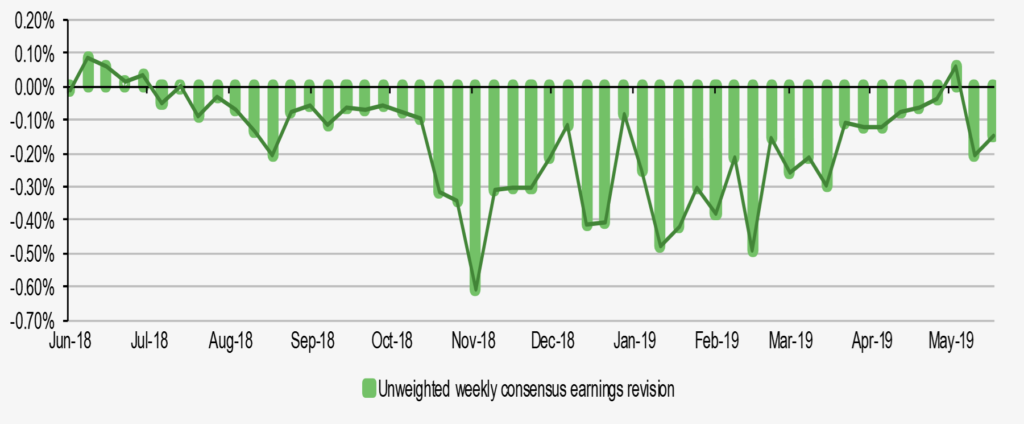

Mid-single digit projections for 2019 earnings growth are not in our view sufficiently compelling to keep investors in equities regardless of political risks. We have noted the stabilization of earnings forecasts during Q119 but the very recent data suggest that earnings forecasts are starting to edge lower once more, Exhibit 3. This is consistent with the poor relative performance of cyclical sectors over the last 6 weeks and the slowdown evident in the trade statistics. A few weeks data may not make a trend but it is discouraging to see profits momentum ebb so quickly.

Exhibit 3: 2019 Consensus earnings forecast momentum ebbs

Source: Refinitiv, Edison calculations

It is not just in respect of China where the US administration has radically shifted its position on the benefits of global trade. The designation of car imports as a threat to national security is on the face of it barely credible but opens the door to the imposition of tariffs on US auto imports, even if a six-month delay has been ordered. The immediate reaction of the industry in the face of this uncertainty will be to slow investment spend. Should tariffs be imposed on a permanent basis, supply chains will have to be re-established within country borders and the absence of skill, cost and scale advantages are likely to lead to inflation in prices for consumers.

We believe in order to shift its now entrenched position on trade, the Trump administration would have to see a slump in the US stock market or US economy sufficiently large to impinge on the prospects for the 2020 US Presidential election. We would prefer to be in a position to take advantage of this potential trading opportunity and therefore are becoming increasingly cautious as the dust settles on the US/China trade dispute impasse.

The idea of a market swoon followed by an agreement on trade is in some respects a least bad outcome, short of an unexpected re-acceleration of global growth even as tariff conflicts escalate. We also believe the probability of a much longer trade stand-off is rising, given the political “prisoner’s dilemma” dynamics of trade negotiations. Trump’s steady drumbeat of criticism of US Federal Reserve monetary policy could even represent an harbinger of further political interference in monetary policy, should the economy slow because of US government policy.

Furthermore, should there be a policy-driven slowdown, it is difficult for a sitting policymaker to admit a mistake, give rise to the risk that a U-turn on trade policy could be delayed. However, given the upcoming Presidential election, the US administration is likely to ultimately respond to the inevitable financial market pressure in this scenario. In our view, an extended period of years of sub-optimal US trade policy is, therefore, a tail-risk scenario for now.

Adding to the risks on trade, we note the recent escalation of tensions in respect of Iran which are also unhelpful for global sentiment. The sending of an aircraft carrier to the Persian Gulf, US embassy evacuations and evidence of Iranian provocations coincide with a New York Times report that a US force of 120,000 troops against Iran has been discussed recently. It is unclear how much of this activity merely represents psychological pressure on Iran’s regime. However, changes to UK travel advice to avoid the area is suggestive that some action may be planned shortly. Such an intervention would distract public attention from the difficulties of resolving the US/China conflict but would only add to the risk premium for global equities.

We believe there is still time for investors to re-appraise portfolio risk given the strong start for global equities in 2019. Due to the increased likelihood given recent events of a prolonged period of stalemate in US/China trade talks, we believe underweight positions are warranted in sectors exposed to global trade. An ebbing of profits forecast momentum also suggests a lower allocation to cyclical sectors is warranted, even following recent relative underperformance. We continue to believe that a highly targeted approach to equities is key to portfolio outperformance at present as benchmark indices may come under further pressure if there is increased evidence of a trade-induced slowdown

Disclaimer: Past performance is no guarantee of future results. Inherent in any investment is the potential for loss. This material is being provided for informational purposes only and nothing ...

more