Serious Structural Problems Will Remain Even After The US Economy Recovers From The Pandemic

Serious Structural Problems Will Remain Even After the US Economy Recovers from The Pandemic. Among the Worst Is the Huge Number Of Women Who Have Dropped Out Of The Labour Force

“Recent projections based on economic scenarios modeled by McKinsey and Oxford Economics estimate that employment for women may not recover to pre-pandemic levels until 2024—two full years after the recovery for men….Female workforce participation has already dropped to 57%—the lowest level since 1988, according to the National Women’s Law Center.” (Fortune, Feb. 13, 2021)

The US economy was experiencing major structural challenges even before the pandemic began, but of course, the unique nature of the supply side pandemic recession has made matters much worse.

As is well known, the service industries which have been ravaged in the pandemic (e.g., hospitality, travel, etc.,) will find it exceedingly difficult to recover compared to the goods-producing sectors of the economy.

Many small establishments have already gone out of business, and re-entry will not be obviously easy. There clearly will be a time lag issue, normalcy is really in the distant future, and of course, there is the indebtedness of the individuals and firms to be managed.

Then there is also the issue of the number of zombie companies which will continue to require governments to support them.

Even before the pandemic emerged working from home was becoming a growing phenomenon.

But the pandemic has served as an incredibly important catalyst for this new direction. Outsourcing work to the home in a major way not only affects the way firms adapt but also could seriously change the outlook for the real estate market.

And then of course there will be perennial concerns among firms and the financial markets with the realization that the huge government debts cannot really be paid off.

Of course, it is really not necessary for the US government to pay off its debt, but nonetheless, the huge debt numbers will be scary to the public.

Post pandemic, the serious inequality issue in the US will likely become worse with rising income polarization making it more difficult for young Americans to realize their economic dreams.

Ultimately, there will be an increase in government interest payments as a % of GDP. This could result in a greater burden on future tax revenues. As well, there is always the risk that the reluctance of markets to buy government debt will cause rising bond yields.

So, among all of these structural concerns, there is also the fact that the labor force participation rate (the LFP) last reached a peak of 67.1% in 2000 and has been declining ever since.

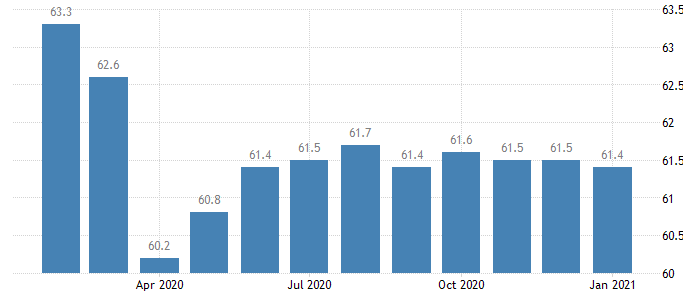

The decline in the LFP accelerated during the Great Recession of 2008 and 2009, and as the following two charts illustrate, the decline has re-accelerated since the pandemic recession started in 2020.

Recently the labor force participation rate in the US edged down to 61.4% in January 2021 from 61.5% in the previous month. More tellingly, the latest labor force participation rate was more than 1.9 percentage points below its February 2020 level.

In other words, about five million Americans have dropped out of the labor force because of the pandemic recession.

Shrinking Labour Force Participation, A Major Structural Problem For The US Economy