Sept. 30 Stocks And Grains Reports

Market Analysis

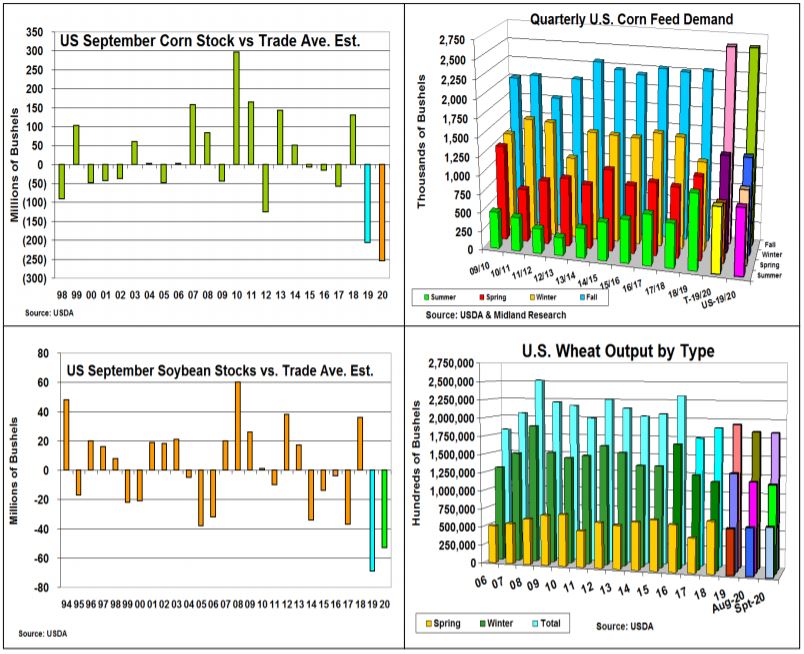

The latest US Quarterly Stocks & Small Grains reports provided big surprises for both corn and soybean for the 2nd year in a row while wheat’s 2020 US crop was modestly lower by 12 million bu. than its August level. This year’s final corn & bean stocks were sharply lower than the USDA’s previous month’s levels & the trade’s estimates.

Despite some erratic previous stocks reports, the trade average estimate of 2.25 billion was near the latest USDA forecast. Instead, corn’s final carryover was measured at 1.995 billion, 255 million bu. lower. This was similar decline to last year’s 314 million miss that was revised to a 207 million drop after a stock change. Our concerns about delayed livestock marketing because of Covid, reduced DDGs availability & reduce wheat/sorghum feeding on high prices were factors. However, this year’s reduced quality (low test weight/protein) from 2019’s erratic growing & harvest periods was likely the biggest factor. This appeared in a 205 million lower June stocks with 78% being reduced from on-farm storage levels resulting in a likely 1 billion bu. spring feeding level, similar to recent feed usage for this quarter and a 5.825 billion yearly demand. Measuring the size of a poor quality crop in farm storage has been difficult in previous years before.

Soybeans stocks were also lower than expected by 53 million bu. Despite previous high quarterly residuals, the USDA didn’t increase the 2019’s crop size. Slight late season decline in export and crush levels (5 mil) and bean’s smaller final stocks helped balance the data with a modest 15 million residual.

Wheat’s total US supplies were lower because of smaller hard red (-36 mil) & soft red (-11 mil) crops while white wheat rose 20 million and other spring & durum increased 16 million bu. These smaller crops, a less-than-expect stocks of 2.16 billion bu. and ongoing dryness threatening wheat seeding levels across Ukraine and Russia lifted this food grain after the report.

What’s Ahead:

The biggest impact of the smaller US final corn & soybean stocks will be on the total available 2020/21 supplies for the upcoming crop years. Early US yields have been mixed, but Brazil’s and Black Sea’s dryness are delaying soybean & wheat seedings adding output uncertainty.

Field results remain important. Looking to add 10-15% sales to 30-33% levels at $3.90-$3.94 & $10.60-$10.75 new crop prices.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more