Seeing Green In The Housing Market

Here’s some great news for investors, the housing market is finally starting to heat up. With positive coverage starting to trickle out, now is the opportunity to pick up shares of housing-related stocks while they are still undervalued. Bret Jensen gives his top three picks for an industry that is ready to start moving.

It is becoming fairly apparent to me that activity in the housing market is starting to pick up as of late, both in better home sales, as well as increased remodeling activity. You can see this is in robust results reported in the last week by the likes of Home Depot (NYSE: HD) and Lowe's (NYSE: LOW). A better housing environment also was apparent in the solid numbers being reported by the likes of Toll Brothers (NYSE: TOL) and Meritage Homes (NYSE: MTH). Monthly home sales and home price appreciation have also have shown some strength recently.

As the cold winter gives way to spring, the housing market seems poised to accelerate. The jobs market is as strong as it has been in over a decade, consumer confidence is surging and mortgage rates remain near historical lows. Even credit seems to be starting to loosen again. A better housing market is necessary if the domestic economy is going to hit the 3.6% GDP growth predicted for it in 2015 by the IMF. This is one of the major themes I am playing within my own portfolio. Here is a couple of those names that I believe should have a very solid 2015 as they ride an improving housing market.

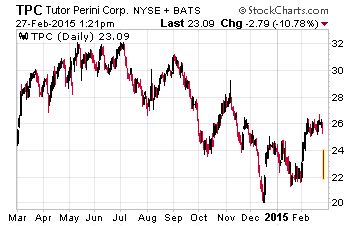

Construction firm Tutor Perini (NYSE: TPC) is very cheap at current valuations. This Small Cap Gem has been on the move since mid-December after it settled some long standing litigation in Las Vegas and Boston, removing negative overhang from the stock.

The company gets about a third of its revenue from big residential construction projects including an eighty story condominium complex going up right behind my abode along Biscayne Bay here in downtown Miami. Tutor Perini gets more than a third of its revenue from federal, state and local government projects and despite talk about “austerity”, spending here is quite robust. The rest of Tutor’s revenue come from specialty construction and services.

The company easily beat quarterly estimates both on a top and bottom line basis when it last reported results in November. Earnings are tracking to a 30% year-over-year gains in FY2014. Analysts believe another 20% to 25% increase is in store for FY2015. Revenues are rising approximately 10% annually. Given the company’s growth prospects, the shares are very cheap at just over nine times forward earnings in a market with an overall multiple of 16 times forward earnings.

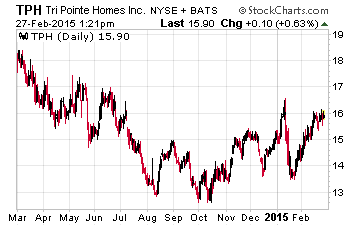

Let’s move on to home builder TRI Pointe Homes (NYSE: TPH), which has been on the move in the rally in the overall market over the last six weeks or so. TRI Pointe is now one of the top home builders by annual units built after merging with Weyerhaeuser’s (NYSE: WY) home building operations in 2014 even if it is not a household name.

The merger gave TRI Pointe major economies of scale as well as geographical diversification. It is also goosing growth. Earnings are tracking to 30% year-over-year gains in FY2014 which officially closes when TRI Pointe reports fourth quarter earnings in early March. The company has beaten expectations easily both on the top and the bottom line in the last few quarterly reports. Earnings are currently projected to roughly double in FY2015 on better than 40% increase in year-over-year revenue. Even with the recent rally, the stock is attractive at under 13 times FY2015’s consensus earnings estimates.

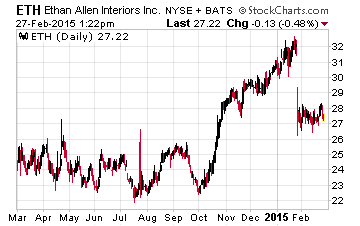

One of the unique features of the current housing market is that it is very tilted in that luxury sales are much more robust than sales to the middle and lower ends of the market. This should be a good tailwind for the retailers that cater to this high-end segment. It is also why Ethan Allen Interiors (NYSE: ETH) is an interesting pick for consideration here.

The shares have pulled back some 10% recently partly as the result of the current west coast port slowdown which is in the middle of being resolved. Both earnings and revenues are tracking to be up in the low single digits for FY2015 which ends on June 30th. Both these metrics are projected to accelerate in FY2016 with the consensus having earnings increasing in a 20% to 30% range in the upcoming year. The shares are attractive given this at 15 times forward earnings and with a dividend yield of 1.8%.

The huge rally in the equity markets over the past few years have left the overall market in at least fairly valued territory with the S&P 500 priced at 18 times trailing earnings, especially now that the Federal Reserve has ended quantitative easing and should be raising rates by the end of 2015. Housing-related stocks are offering good value here if some of the recent green shoots in the housing market turn out to be full-fledged blooms.