Sector Ratings For ETFs & Mutual Funds: 1Q19

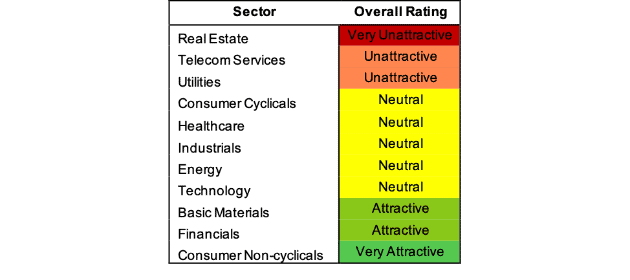

At the beginning of the first quarter of 2019, the Consumer Non-cyclicals, Financials, and Basic Materials sectors earn Attractive-or-better ratings. Our sector ratings are based on the normalized aggregation of our stock ratings for every stock in each sector. Our stock ratings are based on five criteria that assess a firm’s business strength and valuation. See last quarter’s Sector Ratings here.

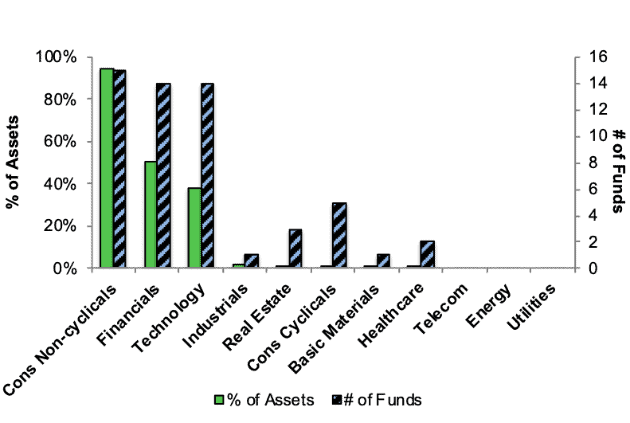

Investors looking for sector funds that hold quality stocks should look no further than the Consumer Non-cyclicals and Financials sectors. These sectors house the highest rated funds. Figures 4 through 7 provide more details. The primary driver behind an Attractive fund rating is good portfolio management, or good stock picking, with low total annual costs.

Attractive-or-better ratings do not always correlate with Attractive-or-better total annual costs. This fact underscores that (1) cheap funds can dupe investors and (2) investors should invest only in funds with good stocks and low fees.

Our Robo-Analyst technology[1] empowers our unique ETF and mutual fund rating methodology, which leverages our rigorous analysis of each fund’s holdings.[2]

See Figures 4 through 13 for a detailed breakdown of ratings distributions by sector.

Figure 1: Ratings for All Sectors

Source: New Constructs, LLC and company filings

To earn an Attractive-or-better Predictive Rating, an ETF or mutual fund must have high-quality holdings and low costs. Only the top 30% of all ETFs and mutual funds earn our Attractive or better ratings.

Fidelity MSCI Consumer Staples Index ETF (FSTA) is the top rated Consumer Non-cyclicals fund. It gets our Very Attractive rating by allocating over 72% of its value to Attractive-or-better-rated stocks.

Rydex Series Real Estate Fund (RYREX) is the worst rated Real Estate fund. It gets our Very Unattractive rating by allocating over 59% of its value to Unattractive-or-worse-rated stocks. Making matters worse, it charges investors annual costs of 8.39%.

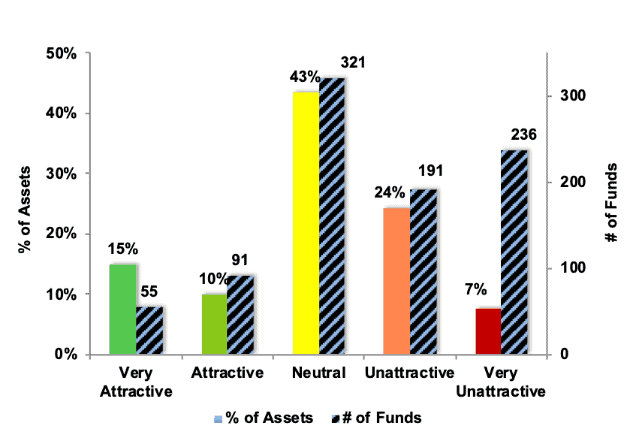

Figure 2 shows the distribution of our Predictive Ratings for all sector ETFs and mutual funds.

Figure 2: Distribution of ETFs & Mutual Funds (Assets and Count) by Predictive Rating

Source: New Constructs, LLC and company filings

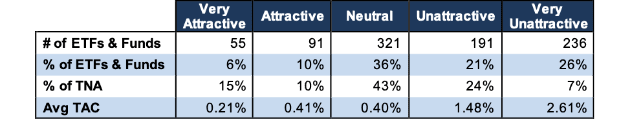

Figure 3 offers additional details on the quality of the sector funds. Note that the average total annual cost of Very Unattractive funds is almost 12 times that of Very Attractive funds.

Figure 3: Predictive Rating Distribution Stats

* Avg TAC = Weighted Average Total Annual Costs

Source: New Constructs, LLC and company filings

This table shows that only the best of the best funds get our Very Attractive Rating: they must hold good stocks AND have low costs. Investors deserve to have the best of both and we are here to give it to them.

Ratings by Sector

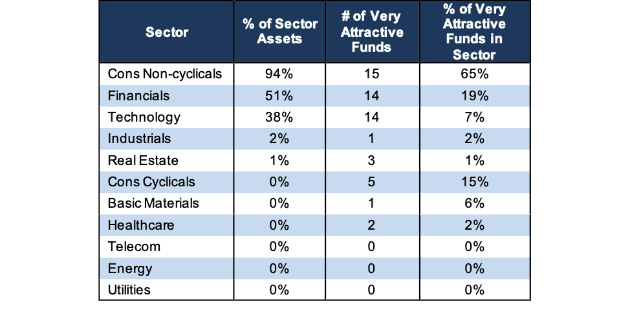

Figure 4 presents a mapping of Very Attractive funds by sector. The chart shows the number of Very Attractive funds in each sector and the percentage of assets in each sector allocated Very Attractive-rated funds.

Figure 4: Very Attractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Figure 5 presents the data charted in Figure 4.

Figure 5: Very Attractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

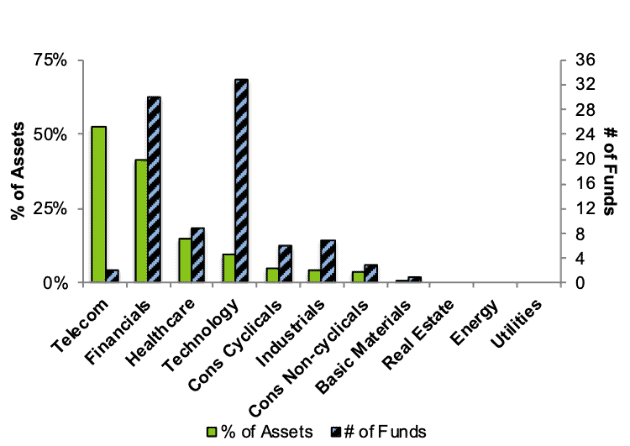

Figure 6 presents a mapping of Attractive funds by sector. The chart shows the number of Attractive funds in each sector and the percentage of assets in each sector allocated to Attractive-rated funds.

Figure 6: Attractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Figure 7 presents the data charted in Figure 6.

Figure 7: Attractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

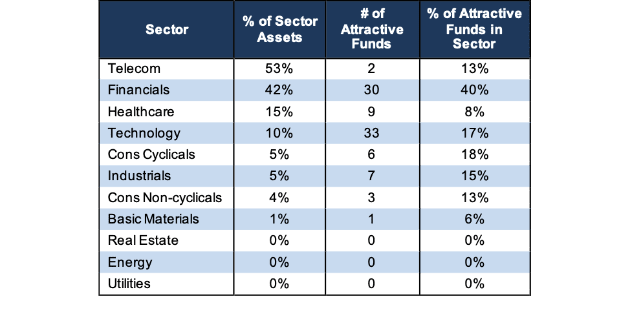

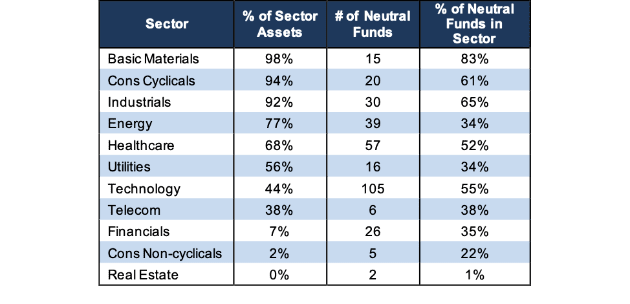

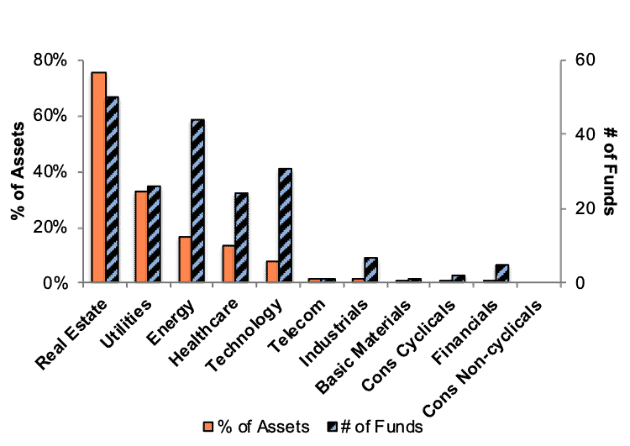

Figure 8 presents a mapping of Neutral funds by sector. The chart shows the number of Neutral funds in each sector and the percentage of assets in each sector allocated to Neutral-rated funds.

Figure 8: Neutral ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Figure 9 presents the data charted in Figure 8.

Figure 9: Neutral ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

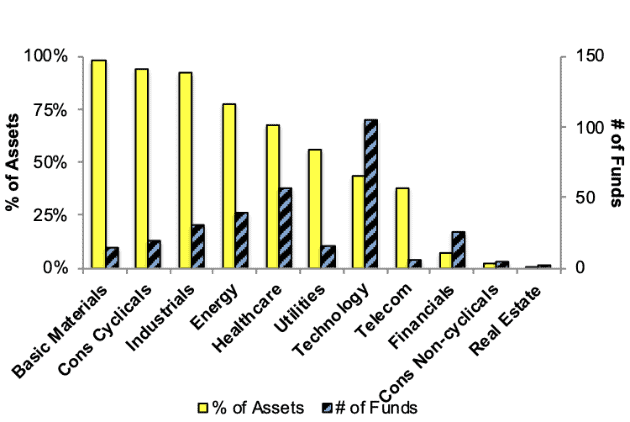

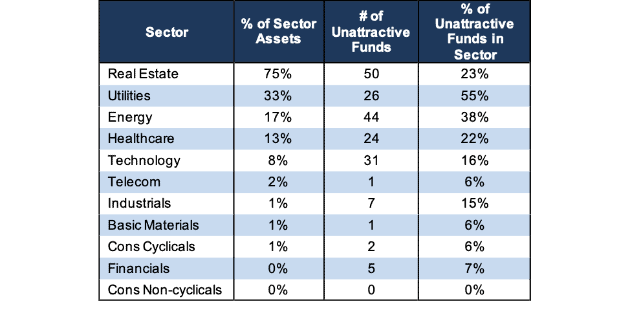

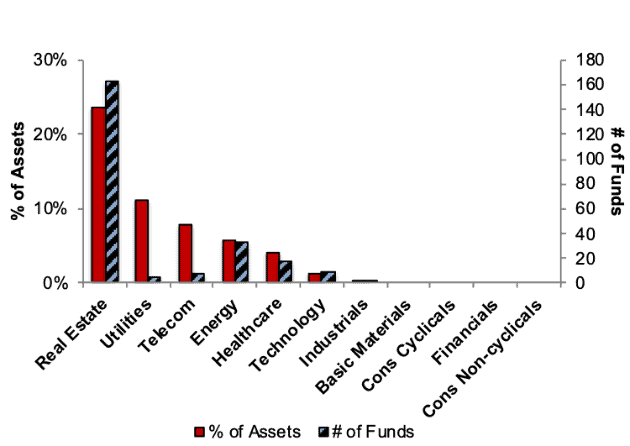

Figure 10 presents a mapping of Unattractive funds by sector. The chart shows the number of Unattractive funds in each sector and the percentage of assets in each sector allocated to Unattractive-rated funds.

The landscape of sector ETFs and mutual funds is littered with Unattractive funds. Investors in Real Estate have put over 75% of their assets in Unattractive-rated funds.

Figure 10: Unattractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Figure 11 presents the data charted in Figure 10.

Figure 11: Unattractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

Figure 12 presents a mapping of Very Unattractive funds by sector. The chart shows the number of Very Unattractive funds in each sector and the percentage of assets in each sector allocated to Very Unattractive-rated funds.

Figure 12: Very Unattractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

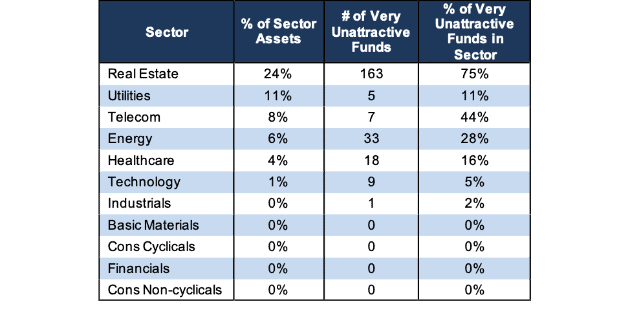

Figure 13 presents the data charted in Figure 12.

Figure 13: Very Unattractive ETFs & Mutual Funds by Sector

Source: New Constructs, LLC and company filings

[1] Harvard Business School features the powerful impact of our research automation technology in the case New Constructs: Disrupting Fundamental Analysis with Robo-Analysts.

[2] Ernst & Young’s recent white paper “Getting ROIC Right” proves the superiority of our holdings research and analytics.

See our ETF & mutual fund screener for rankings, ratings and reports on 7000+ mutual ...

more