Russell 2000 And Semiconductors Crack

The Russell 2000 lost over 2% as it undercut the 20-day MA in a move which could pull the other indices down with it. The ROC is well below the mid-line and the -DI is on the verge of a bearish cross with its +DI following the earlier lead of the MACD.

The Dow Jones Index confirmed its channel break but is still holding 20-day MA support. In addition, selling volume declined on the price loss. However, there are confirmed 'sell' triggers in MACD, On-Balance-Volume and relative loss trigger to the Nasdaq 100.

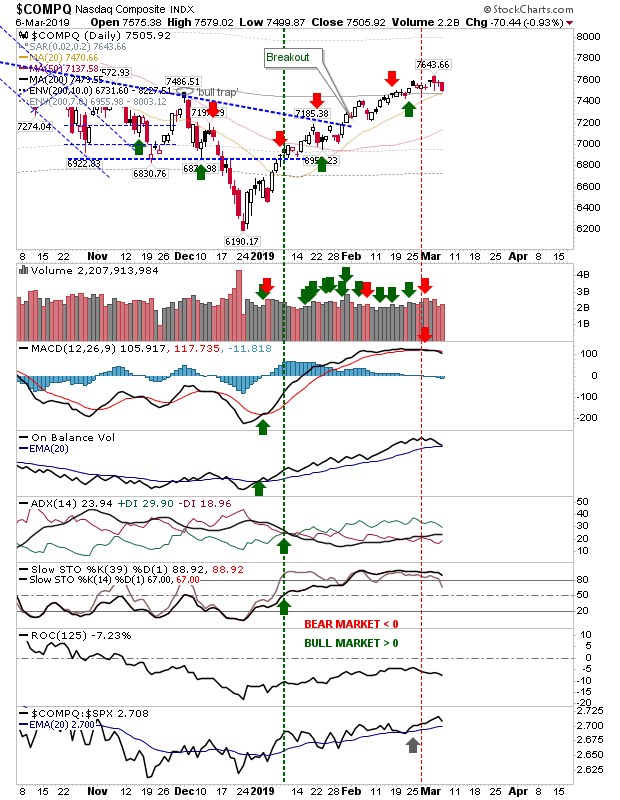

Today's decline in the Nasdaq wasn't enough to break the 20-day MA and 200-day MA but there is limited room for maneuver for further losses. There is a MACD trigger 'sell' and pending On-Balance-Volume 'sell' trigger but bulls still have a workable edge.

The S&P finished with a 'bull trap' and a new 'sell' trigger in On-Balance-Volume. A big test of the 200-day MA is coming up.

The Semiconductor Index finished with a clean channel breakdown. This switches pressure on to the Nasdaq and Nasdaq 100, especially the upcoming tests of their respective 200-day MAs.

For tomorrow, the pressure will be on those indices still holding their 200-day MAs to stay above them. Should these fail, then the question will be how far will indices fall - Fibonacci will be our guide.