Risk And Reward In Netflix Stock

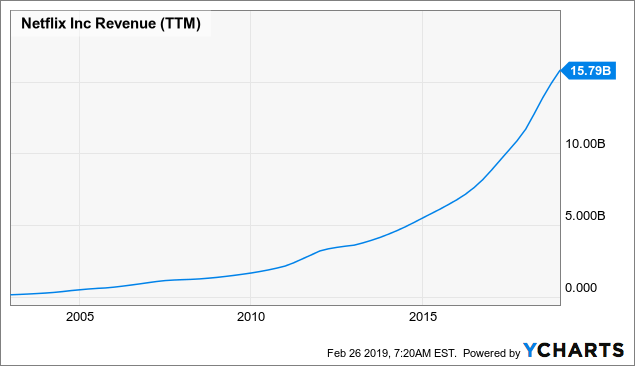

Netflix (Nasdaq: NFLX) is a spectacular success story. Back in the year 2009, the company was making only $1.67 billion in annual revenue. Fast forward ten years and Netflix is expected to produce $20.23 billion in sales during 2019.

Data by YCharts

The most recent earnings report from Netflix shows that the company keeps firing on all cylinders. Total revenue during 2018 amounted to $15.8 billion, growing by 35% versus 2017. Operating margins are also moving in the right direction. Operating income nearly doubled year over year to $1.61 billion.

Netflix gained 8.8 million new paid members in the fourth quarter of 2018, surpassing the company's expectations and representing acceleration in growth versus 6.07 million additions in the third quarter of 2018 and 6.62 million in the fourth quarter of 2017. For the first quarter of 2019, management is expecting 8.9 million global streaming net paid additions.

Source: Netflix Investors Letter

Growth typically slows down as a company gains size over time because it's obviously much harder to sustain rapid growth in percentage terms from a larger revenue base. However, Netflix is not only still growing at an impressive speed, but user growth is even accelerating versus prior years and quarters.

The company's strategy of betting on original content and international expansion is clearly producing results, at least when it comes to top-line expansion.

Rising Margin And Falling Cash Flows

Netflix management puts a lot of attention on contribution margin when evaluating profitability levels. This is basically calculated as revenue less cost of revenue and marketing expenses incurred by the segment.

Based on contribution margin, profitability metrics are quite solid. Netflix reported a contribution margin of 29.6% in the U.S. and 3.9% in international markets during the fourth quarter of 2018. In the first quarter of 2019, those contribution margins are expected to increase to 34.2% and 9.8% in the U.S. and international markets, respectively.

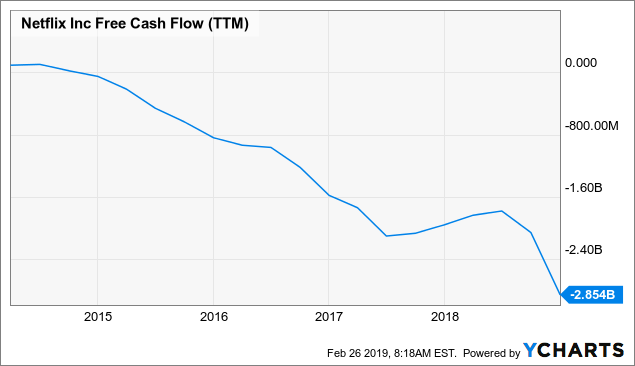

Free cash flow, on the other hand, is telling a completely different story. Free cash flow generation has materially deteriorated in recent years, and the company reported a negative $2.85 billion in free cash flow for 2018.

Data by YCharts

Moving forward, management is expecting another year of negative cash flows in 2019. Cash flow generation is expected to improve beyond 2019 due to expanding profit margins.

From the company's letter to investors:

We expect 2019 FCF will be similar to 2018 and then will improve each year thereafter (assuming, as we do, no material transactions). This FCF improvement will be driven by growing operating margin, which will allow us to fund more of our investment needs internally.

This discrepancy between accounting profits and free cash flow is due to the fact that Netflix is increasingly focused on original productions in recent years.

Self-produced shows require more upfront cash, as the company starts spending cash during the creation of each show, substantially before its completion and release. Licensed originals are paid on delivery, and licensed non-originals are paid over the term of the licensing agreement.

Production costs are accounted for in the income statement over multiple years. However, the cash outflow tends to happen much earlier when it comes to original productions.

The Strategy Is Working

Management considers that self-producing is ultimately cheaper and more profitable over the long term because Netflix can work directly with the creators and eliminate overhead expenses and fees. Netflix also owns the intellectual property rights on a global scale for original productions, which provides more control over business decisions and creative aspects.

Importantly, original productions are a key differentiating factor for Netflix versus other alternatives in the streaming market. Netflix will be facing rising competitive pressure from other players in streaming over the years ahead, and content is arguably the main source of competitive strength in the industry.

Netflix tracks all kinds of data from customers, including traffic, ratings, recommendations, viewing habits, and social media interaction in order to better understand what kind of content is resonating well with subscribers. Data is the new gold, and Netflix has access to massive amounts of data that the company uses to make better decisions in terms of content creation.

The Timing Looks Good

The Stocks on Fire system is a quantitative algorithm available in real time to members in my research service, The Data-Driven Investor. This algorithm is a stock picking tool based on two main return drivers: price momentum and fundamental expectations.

Winners tend to keep on winning in the stock market, so you want to buy stocks that are not only performing well but also doing better than others. Momentum measures performance over different time frames in order to identify consistent winners.

Price performance does not depend on the fundamentals alone, but the fundamentals in comparison to expectations can be even more important. If expectations for the company are rising, this generally means that the stock price will be rising too. For this reason, the algorithm measures the adjustment in sales and earnings expectations to look for companies that are doing better than expected and also generating rising expectations about future performance.

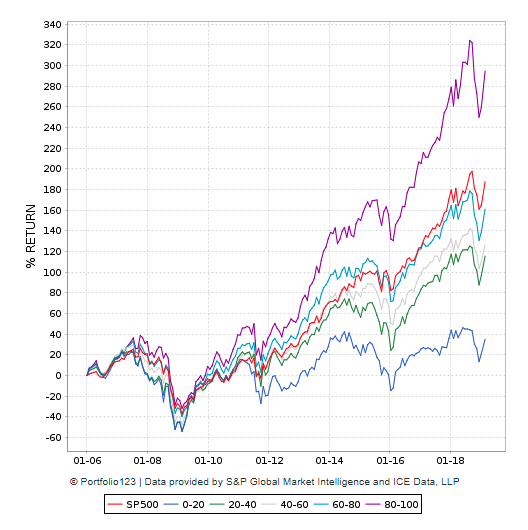

The Stocks on Fire algorithm has delivered market-beating performance over the long term. The chart below shows backtested performance numbers for companies in 5 different Stocks on Fire buckets over the years.

(Click on image to enlarge)

Data from S&P Global via Portfolio123

Companies with high rankings tend to produce superior returns, and stocks in the strongest bucket materially outperform the market. This shows that the system is not only effective but also consistent.

Netflix currently has a Stocks on Fire ranking of 87.6, meaning that the stock is in the top bucket. Based on this indicator, the timing for a position in Netflix stock looks quite solid.

It's important to acknowledge that momentum can be a double-edged sword. Companies with strong price performance and rising expectations tend to materially outperform when the market is doing well, but they can also fall much harder than average in times of market corrections and reduced risk appetite among investors.

In other words, Netflix is showing strong momentum, and this means both superior potential for gains but also higher-than-average downside risk if things don't work out well.

The Bottom Line

Netflix is doing a great job in terms of driving accelerating growth via original content and international expansion. The company is burning cash, but it's doing so for the right reasons, to consolidate its competitive strength in the much promising video streaming market.

The strategy is still risky, though. If the company fails to improve its cash flow generation after 2019 like management is planning to do, this could be a major disappointment to investors, and the stock could take a considerable hit on such setback.

Netflix looks well positioned for attractive returns going forward, but an investment in Netflix also carries substantial risk, so position size should be managed accordingly.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Disclaimer: I wrote this article myself, and it ...

more