Revisiting “Disruptive Growth”

Don’t worry, about a thing

’Cause every little thing, gonna be all right

Singin’, don’t worry, about a thing

’Cause every little thing, gonna be all right(From “Three Little Birds” by Bob Marley, 1977)

In February, we posted a blog piece about our Disruptive Growth Model Portfolio. Two of our primary investment themes for 2021 and beyond are “disruptive growth” and thematic investing. As a reminder, we believe that, even as the global economy reopens and recovers, the COVID-19 pandemic fundamentally and perhaps permanently altered the way we work and socialize, and take care of and entertain ourselves.

We believe this has led to dramatic growth in certain “thematic” megatrends, and we think these trends will be with us for years to come. This prompted us to launch our disruptive growth model in August of last year. We identified six thematic sectors and ETFs and built a diversified portfolio accordingly. It is intended for growth-focused advisors and end clients who can tolerate highly valued companies and potentially higher volatility in exchange for potentially higher long-term growth rates.

The six sectors we are currently allocate to include cloud computing (via our own WCLD), diversified platform-based companies (via our own PLAT), cybersecurity, financial technology, genomics and biotechnology, and online gaming and e-sports.

How is the portfolio performing?

Like many technology firms and the so-called “FAANGM” stocks—Facebook, Amazon, Apple, Netflix, Google (Alphabet) and Microsoft1—the ETFs in the disruptive growth model hold many highly valued companies that currently do not generate much in the way of current earnings or dividends. That is, investors are paying high valuations today in exchange for the potential of higher earnings in the future.

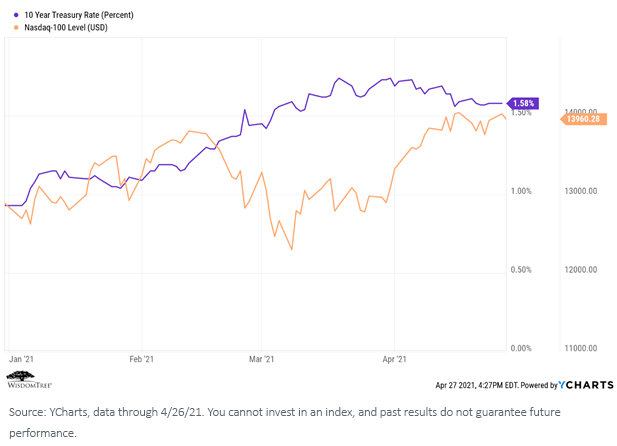

Thus, when interest rates began rising late last year and through roughly mid-March of this year, many of those stocks fell fairly hard. The Nasdaq-100 Index holds many similarly valued companies, and here is a YTD comparison of the rise in the 10-Year Treasury rate and the performance of that Index.

Note (a) the sharp decline in the Nasdaq-100 commensurate with the sharp increase in rates beginning in February, but also (b) the stabilization of the Nasdaq-100 over the past few weeks (it is once again positive for the year) as rates have also stabilized.

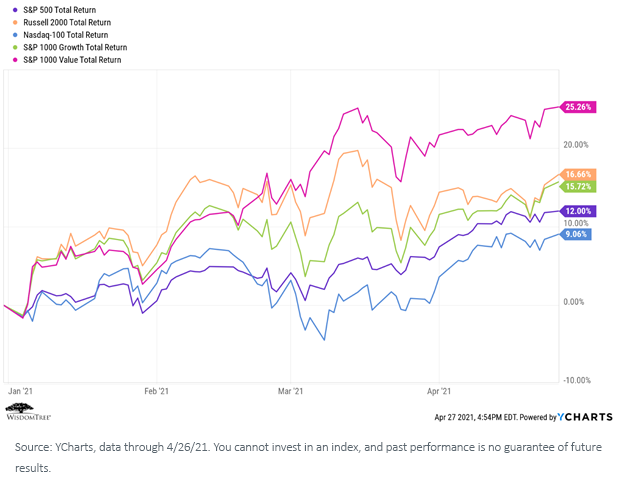

It’s not that growth stocks have performed badly in 2021. They simply have not kept up with the cyclical rotation trades (small cap and value)—a phenomenon advisors and investors have not seen for most of the past 10 years.

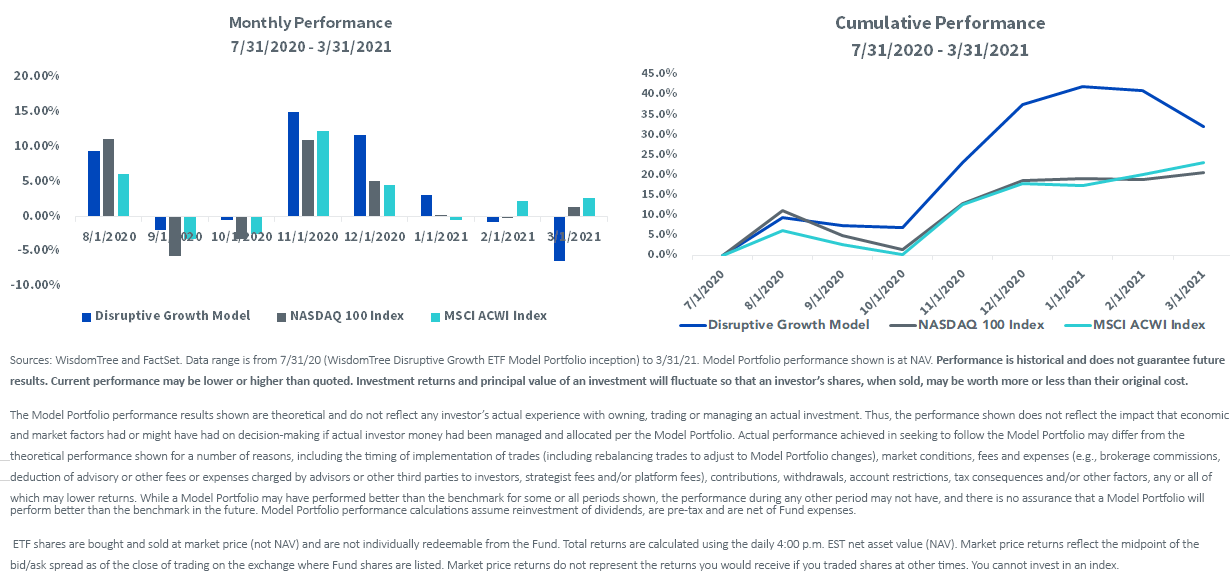

The disruptive growth model shows similar performance characteristics as the Nasdaq-100 Index. It actually holds more highly valued positions and so fell faster when rates rose, but it is recovering and has been outperforming the Nasdaq-100 since inception on July 31, 2020.

(Click on image to enlarge)

In addition, although three of our current six ETF allocations have generated slightly negative performance YTD (NAV) over their common investment period dating back to October 2019, each of those individual six strategies has shown high double-digit returns (NAV).2

The portfolio also continues to show a distinct lack of security overlap between the different allocations. As of March 31, 2021, no two of the current six ETF positions have had more than 18% of securities overlap each other, and most had less than 10%. (Holdings and weightings are subject to change.) There likewise is a nice diversification of sector exposures.

This portfolio carries high valuations corresponding to its high growth rates, and its performance will likely continue to be influenced by changing interest rates and may be volatile (and has been YTD), but we believe the level of diversification provided by the current lack of sector and securities overlap will help to generate a more consistent performance while still taking advantage of each individual strategy’s potential future growth.

Conclusion

With COVID-19 vaccinations accelerating and the global economy in what we believe is the early stages of a steady recovery, we anticipate that 2021 generally will be a constructive “risk-on” market environment.

We believe our disruptive growth investment theme will play out well in this environment, as will our corresponding Model Portfolio. It can be allocated to as a stand-alone equity model or as a complementary “sleeve allocation” in broader portfolios where advisors are seeking to improve performance. Financial advisors registered on the WisdomTree website can learn more about this and other WisdomTree models by accessing our newly launched Model Adoption Center (“MAC”).

Despite recent volatility, we continue to like how we are positioned to take advantage of what we believe will be enduring megatrends in global markets. So, for the most part, we are “not worrying about a thing.”

1As of March 31, 2021, the WisdomTree ETF PLAT held positions in Alphabet (9.35%), Microsoft (8.02%), Amazon (7.05%) and Facebook (6.80%), but it did not hold positions in Netflix or Apple. The WisdomTree ETF WCLD does not hold any positions in any of the “FAANGM” stocks.

2Past performance does not guarantee future results.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more