Retest Or False Breakout? Rotation Within The QQQ, RH Earnings & Signs Of Market Exhaustion

Yesterday, we finally had a day that might have meant something. After the slow, relentless grind higher the last few weeks, the major indexes, especially the Nasdaq (QQQ), finally had a decent selloff. Here were the returns for yesterday:

S&P -0.79% Nasdaq -1.94% Russell -0.82%

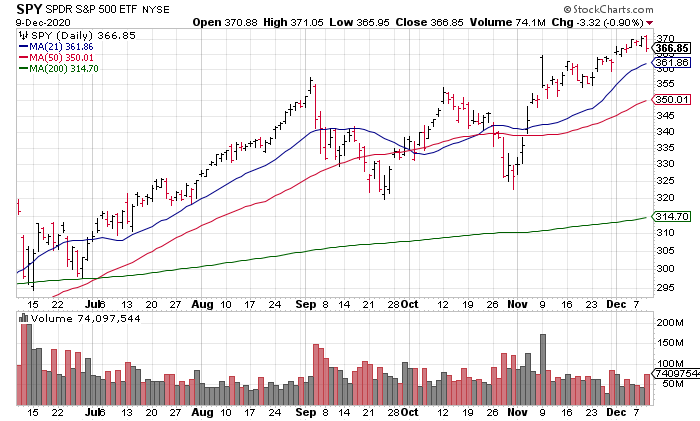

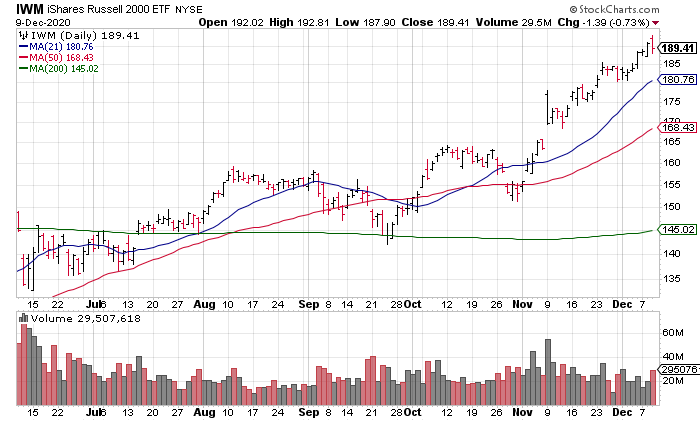

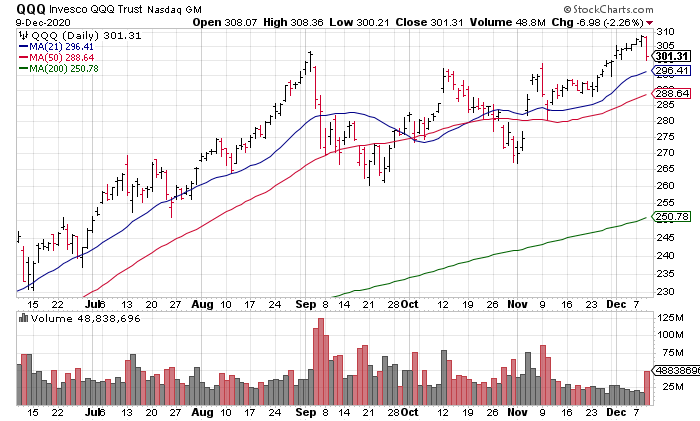

No technical damage was done to the S&P (SPX, SPY) or Russell (IWM) but the Nasdaq-100 (NDX) is a different story. After breaking out above its September 2nd closing high of $302.72, the QQQ closed below it yesterday at $301.31.

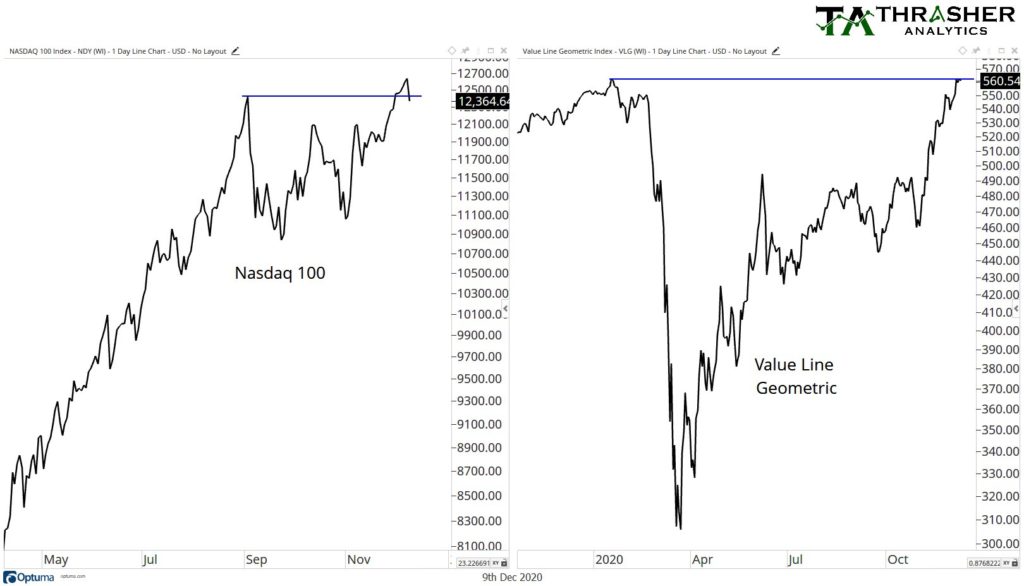

This raises the question, so nicely picked on up by Andrew Thrasher, of if what we’re seeing in the Nasdaq-100 is a retest or a false breakout (Source: Andrew Thrasher Twitter, Wednesday December 9, 4:46pm).

Therefore, today is actually an important day for the market. Keep your eye on the QQQ which has led the rally since March 23. A breakdown there could be the canary in the coal mine.

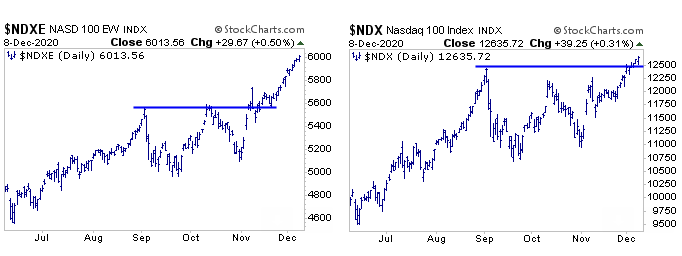

Next, I want to point out a fascinating rotation taking place within the Nasdaq-100 itself. While 4 of The Big 5 (AAPL, AMZN, MSFT & FB) have not made new highs since September 2nd (Source: Sarah Ponczek Twitter, Wednesday December 9, 1:17pm), the Equal Weight Nasdaq-100 has made a complete breakout (Source: Frank Cappelleri via The Chart Report Twitter, Wednesday December 9, 3:30pm). The technicians and I have, of course, been talking a lot about the rotation out of the QQQ and into the IWM. But, as brilliantly charted yesterday by Frank Cappelleri, there is rotation from the mega caps to the smaller companies within the Nasdaq-100 itself as well.

This brilliant pickup by Cappelleri is consistent with Ponczek’s chart. 4 of the Big 5 are not participating in the #COVIDVaccine breakout over the last month. Instead, it’s the small caps (IWM) and other #ReOpen names, including the smaller companies within the QQQ itself, that are leading the charge. With AAPL AMZN MSFT & FB making up almost 40% of the QQQ, you have to wonder if it can really breakout without them.

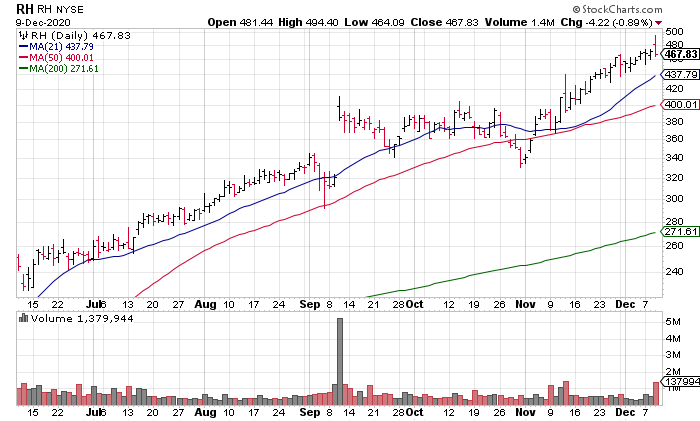

Lastly, let’s talk a little fundamentals, namely RH (RH), the former Restoration Hardware, earnings. RH reported a scorching quarter with Adjusted Net Revenue +25% and Adjusted EPS +122% to $6.20 Wednesday afternoon (Source: RH 3Q20 Earnings Release), but the extremely extended stock wasn’t able to get much out of it in terms of stock appreciation in yesterday’s after hours.

Keep an eye on RH today (as well as QQQ) to see if it, a small cap, reopen name is tapped out. If it is, others may be as well, suggesting the rotation from the #StayAtHome names into the #ReOpen names is starting to exhaust itself. Combined with the failure of 4 of The Big 5 tech stocks to participate in the #COVIDVaccine breakout beginning Monday November 9 and we may be starting to see signs of exhaustion in the market. Whether it’s the pause that refreshes or the start of something bigger remains to be determined.