Restaurant Recession? Just The Facts

On July 26 2016, the Stifel Restaurant Team wondered via published research if we were in a restaurant recession, as a possible harbinger for a US recession coming up. They noted negative same store sales trends and the lack of restaurant pricing power, among other problems.

The Washington Post picked up this same question on August 22 2016:

A ‘restaurant recession’ sounds scary. Are we really on the brink of one?

Is a restaurant recession really happening? We looked at some background data points to get a better view.

Chain Restaurant Store Sales Softness Unquestionable: Reported chain restaurant same store sales are unquestionably soft, with all of the major restaurant trackers, Knapp Track, MillerPulse and Black Box showing one year SSS declines in all sub segments, QSR, fast casual, casual dining and fine dining. The latest industry peak seems to have been early 2014. The view on a two year and five year stackedbasis is more positive, however. The best data source to see this is MillerPulse, a comprehensive restaurant business conditions tracker. [1]

July 2016 was especially weak, with the lowest July restaurant estimated seasonality value reported since 1992. This has impacted both high and low average ticket operators.

Vast majority of US Restaurants are not in the Comps Sales Base: There are many chain restaurants, and even more US restaurants that are not a part of the publicly reported chain comparable sales data base. Big worldwide operators like Subway, Dairy Queen and Red Lobster are privately held and do not report. Of the Piper Jaffray comprehensive Cookbook of Restaurant data [2], 64 companies included represents 13% of the Technomic 500 chain restaurant concept count. There are 110,000 units in Piper’s 2016 Cookbook, which represents about 11% of the National Restaurant Association’s count of over 1,000,000 restaurant and food service venues in the US.

Food Away from Home Trends: We have historical data on food away from home expenditures, tracked by US BLS via surveys. It has grown from about 17% in 1929 to 47% in 2014. Since World War 2, food away from home as a percentage of total food expenditures has grown on a real basis (excluding inflation) every year except for the following:

Table One: Years of Food Away from Home Spending Contraction (1945-2014) [3]

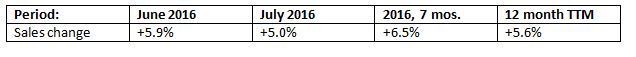

BLS Food and Drinking Place Data More Favorable: US Bureau of Labor Statistics continues to report higher food and drinking place sales month after month, over prior year, per their survey. The BLS data is a sample submission of both independents and chains.

Table Two: BLS Monthly Advance Food and Drinking Place Sales vs. YAG [5]

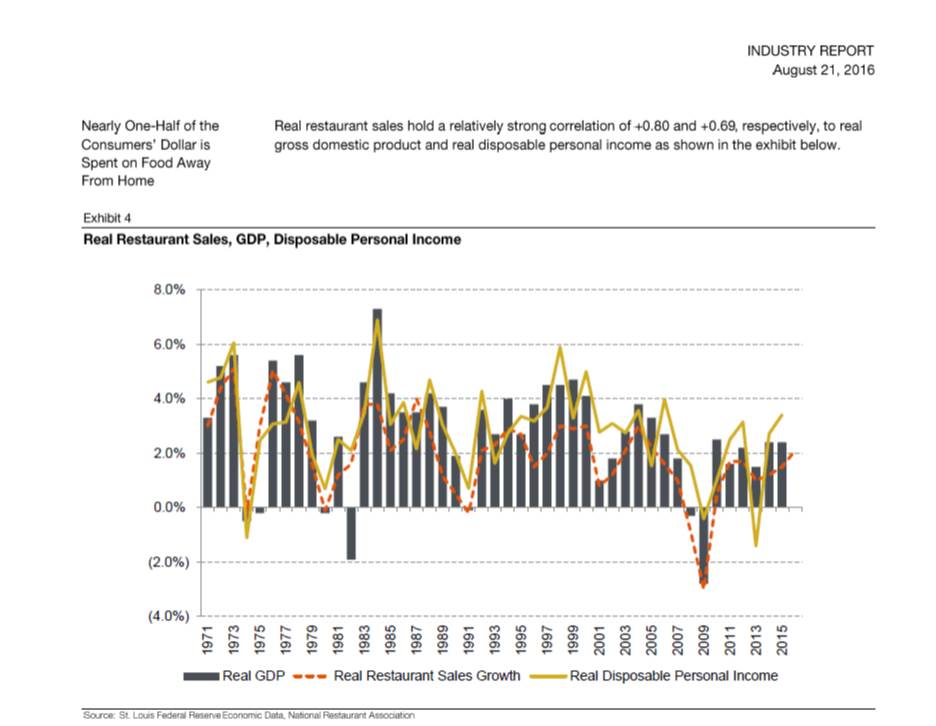

Restaurant Fundamentals Haven’t Changed: there is still no biological imperative to go out to eat other than social and convenience, but those are powerful motivations. Real gross domestic product (GDP) and real consumer disposable income (DI) continue to drive the business, as the very recent Piper Jaffray [6] Report shows. There have been only two periods of GDP contraction, 1982 and 2008/2009, as below.

(Click on image to enlarge)

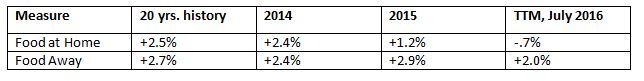

Grocery Store Gap Problem: grocery store prices have deflated while restaurant prices have increased steadily since 2014: this is the food at home versus food away from home gap that McDonald’s is so fond of measuring. See Table Three:

Table Three: Grocery Store v. Restaurant inflation [7]

Conclusion: For a US restaurant recession to occur and deepen there has to be some kind of catalyst factor—in the last two cycles, 911 and the Great Recession of 2008-2010. It is true restaurant sales began to decelerate and then decline in 2001 and 2008, principally in the casual dining segment, prior to the shock and awe events those years. With employment, GDP and disposable income trends now solid, an economy wide recession isn’t seeable now. However, it seems also true that chains who report same store sales are not getting the share of growth that we all want.

We see the effect of the food at home versus food away from home gap factor as the industry slowed in 2015 and 2016. This does not explain same store sales softness at the higher average ticket restaurants, where we know incomes and the propensity to dine out are higher. Many comments from them point to a slowdown in corporate expense account sales activity, the so called private dining segment, however. This is she so called election effects that Malcolm Knapp properly called earlier this year.

The overall problem, called a malaise by some, does still seem to be a mystery with both the Fogo de Chao and Popeye’s CEOs noting in the last week they wish they knew what the problem was.

The industry QSR players didn’t do itself any favors by its hamburger wars tactics in Q3 and Q4 2015; in fact, there was little overall sales gain from that. It came at a time of generally robust job and employment growth, and falling food commodity prices that could have been banked. It seems to have set off unfavorable competitive dynamics that even some casual diners (example, Chili’s) have mentioned. The industry needs to police itself better; the discounting and unit growth issues hurt a mature industry.

The industry remains investable and vibrant, there are strong building new concepts and highly differentiated concepts that will provide a pathway for the future. And the next McDonald’s (MCD), Panera (PNRA), Starbucks (SBUX) or Cheesecake Factory (CAKE) has to start somewhere.

References:

[1] https://www.millerpulse.com

[2 ]Piper Jaffray 11th Annual Restaurant Benchmark Analysis, Cookbook, July 2016.

[3] Bureau of Labor Statistics display.

[4] St. Louis Federal Reserve, Real Disposable Personal Income Display, August 2 2016.

[5] US Bureau of Labor Statistics, Advance Retail and Foodservice Sales, August 15 2016.

[6] Restaurants Remain Investable in Current Pay for Performance Cycle, Nicole Miller Regan and Josh Long, Piper Jaffray Research Report August 21 2016.

[7] US Bureau of Labor Statistics, updated 7/25/2016.

Disclosure: The author has no positions in any stocks mentioned.