Relative Value Says 3% Won’t Hold

FUND MANAGERS SAY 3% IS WHERE THEY WILL INCREASE TREASURY POSITIONS

A number of fund managers have indicated that a 3% yield on the ten-year yield is where they would increase treasury positions. Even if this is the case, they are highly dependent on asset flows since they are sitting on historically low levels of cash. Meanwhile, the $2 Trillion of fixed-income fund inflows is in jeopardy of reversing. After all, fund flows tend to mimic performance, and fixed-income performance over the last year has been less than robust.

As the Federal Reserve embarks on Quantitative Tapering, effectively becoming a net seller of treasuries, the Treasury continues to ramp-up issuance due to increasing fiscal deficits, and foreign investors step away, a 3% ceiling is highly dependent on domestic funds ramping up treasury exposure.

VALUE SAYS 3% WILL NOT HOLD

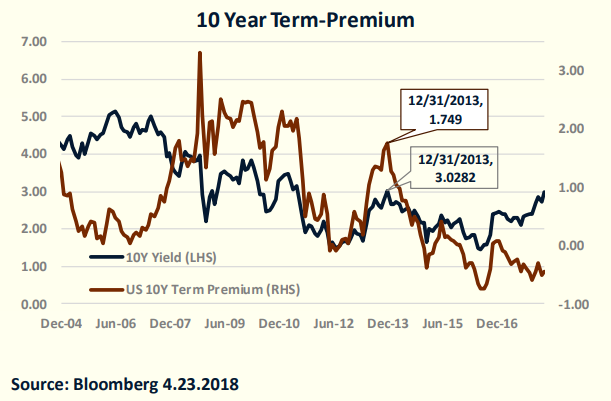

The last time we tested 3% on the ten-year treasury was the fourth quarter of 2013. The market had spent much of the latter part of the year reacting to Bernanke’s indication that QE would be tapered (the Taper Tantrum). Furthermore, on a relative basis, long-term treasuries offered decent risk/reward prospects. The ten-year term-premium (the premium investors demand to hold longer-term treasuries instead of continually reinvesting three-month T-Bills) was 1.75%. This compares favorably to the term-premium today which is -44 bps. That effectively means that long-term treasury investors are actually paying to take on duration risk. Negative term-premiums have persisted over the last couple of years, but prior to 2012, the last time they were negative was the early 1960’s. Treasury bulls should be asking themselves if the current environment is an anomaly or are we about to experience some sort of mean reversion. I am in the latter camp. In any case, investors in the ten-year treasury bond in late 2013 were being compensated for their duration risk. Today? Not so much.

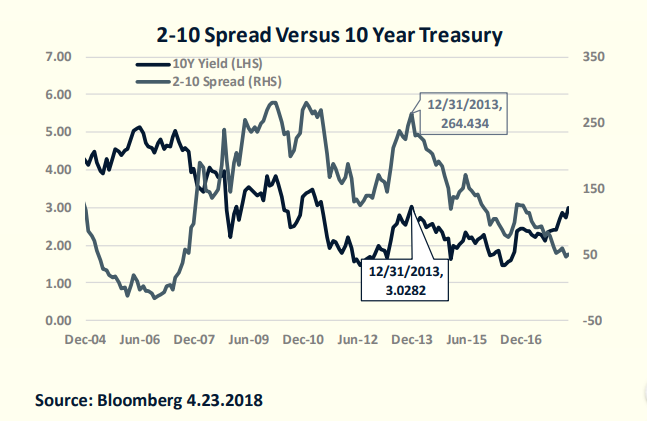

Similarly, and somewhat related to the previous point, the yield curve is offering little value on the long-end. Below is a chart of the ten-year yield and yield curve steepness. The last time we tested 3%, a ten-year bond offered 264 bps of yield pick-up over a 2-year treasury. Investors were incentivized to extend duration so as to pick-up yield. Today, due to aggressive Fed policy on the short-end of the curve, that yield pick-up is only 50 bps. As more and more rate hikes get priced into the market, the risk becomes that the Fed will NOT be as aggressive or that they will shift their QT program from short-term reinvestments to outright selling of long-term bonds. Both would result in significant steepening.

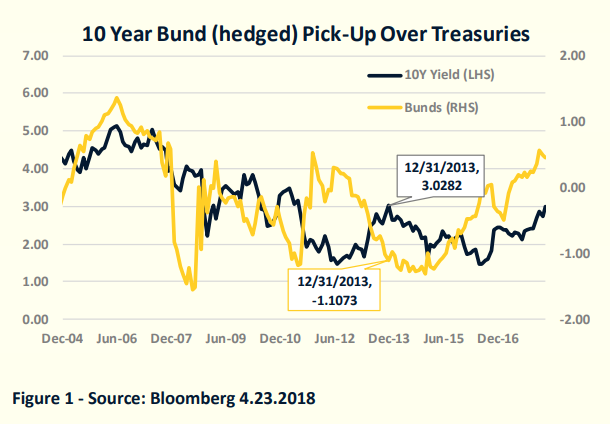

Recent trends at treasury auctions have been characterized by weakness in the indirect bid (foreign Central Banks). This makes sense given that treasuries, although providing significant nominal yield pick-ups, are actually relatively expensive when currency risk is hedged. The chart below shows that in 2013, the last time we flirted with 3%, a German investor could get an additional 111 bps of yield on a hedged basis by investing in treasuries over bunds. Today, that same investor is 45 bps better off by staying in Bunds. I expect continued weak indirect bids at auctions since treasuries are offering little value to foreign investors.

CONCLUSION

Pinpointing the direction of interest rates is a difficult endeavor. However, analyzing relative value tends to work over time. As market pundits argue about the direction of yields over the next six months, I think the risk of a significant breach of the 3% level on the ten-year yield is high. On a relative basis, in 2013, 3% offered value for domestic and foreign investors alike. Today, not only have we lost the largest buyer of treasuries in the Federal Reserve, but current ten-year hedged yields offer little value to foreign investors, and domestic investors are better off in the short-end of the curve. This, against the backdrop of burgeoning fiscal deficits and rising inflation expectations, might very well mean a three handle (or even a four) on the ten-year treasury yield will become commonplace.

Disclosure: This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. ...

more