Regardless Next Year’s Elevated Earnings Expectations Come Through Or Not, Gap Between GAAP And Non-GAAP Persists

The sell-side, as well as equity bulls, have high hopes for S&P 500 earnings next year. Even if they come through, the gap between GAAP and non-GAAP will persist.

US corporate profits adjusted for inventory valuation and capital consumption snapped back with a quarter-over-quarter jump of 17.4 percent in 3Q to a seasonally adjusted annual rate of $2.33 trillion. This followed a back-to-back q/q decline of 12 percent and 10.3 percent in 1Q and 2Q, respectively.

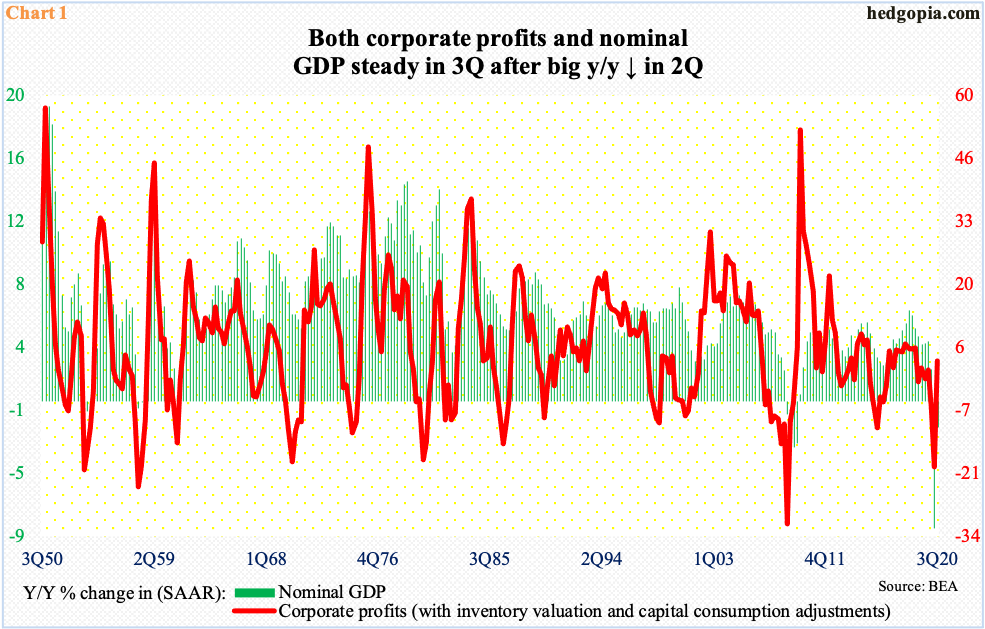

Over the long term, profits move together with nominal GDP (Chart 1); in 3Q, the latter increased to an annual rate of $21.2 trillion from $19.5 trillion in 2Q, with the all-time high of $21.7 trillion posted in 4Q19. Profits, however, rose to a new high in 3Q.

The two are diverging a bit.

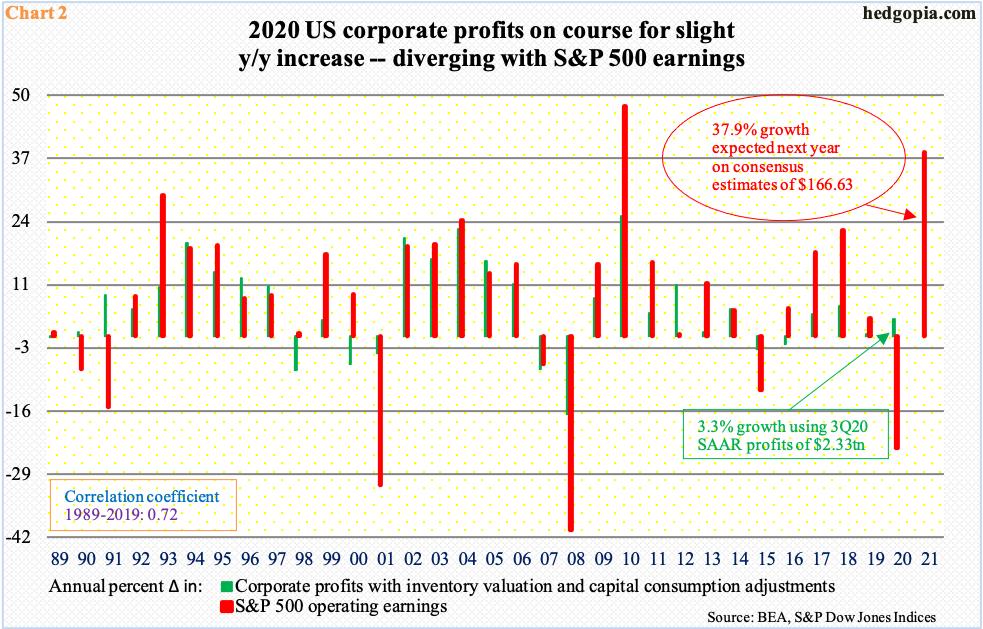

When it is all said and done and the year 2020 is over, US corporate profits are likely to also diverge with S&P 500 operating earnings.

Going back three decades, the two have maintained a correlation coefficient of 0.72 (Chart 2). This year, however, they are going their separate ways. With one quarter of earnings yet to be reported, S&P 500 companies are on pace for a decline of 23.1 percent this year over 2019. In contrast, as mentioned earlier, corporate profits made a new high in 3Q, growing 3.3 percent over 2019, and likely will rise further in 4Q. The Atlanta Fed’s GDPNow model is currently forecasting a 11.1 percent rise in real GDP in the current quarter.

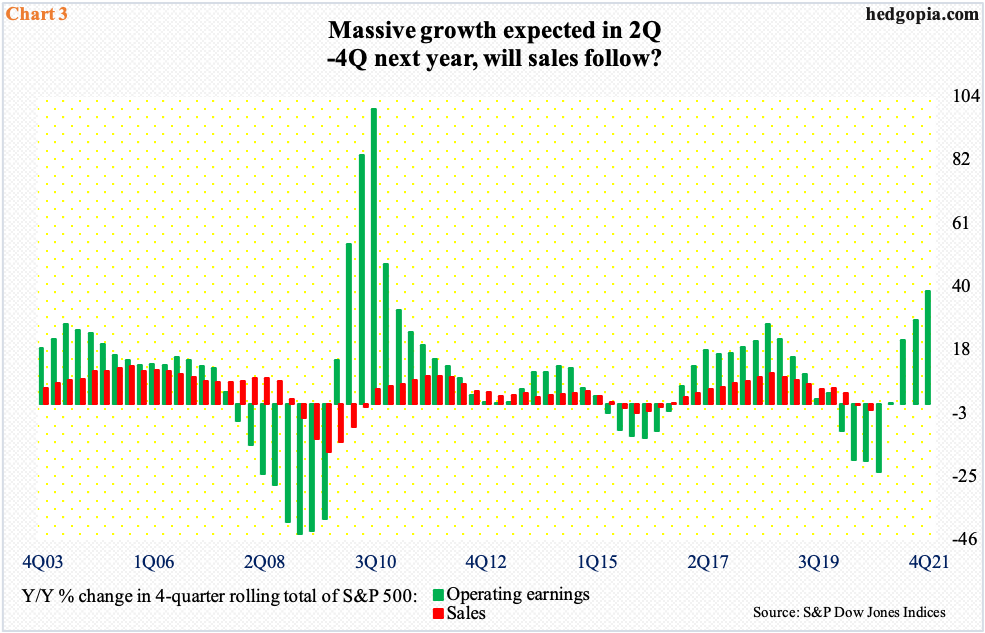

Next year, private-sector economists expect real GDP to grow in the four to five percent range. At the end of the year’s last FOMC meeting last Wednesday, the Fed raised its 2021 real GDP forecast from four percent to 4.2 percent. This optimism better come through.

GDP correlates tightly with sales of S&P companies. Among others, a better top line filters through to the bottom line. The sell-side has high expectations next year. S&P 500 companies are penciled in to ring up $166.63 in operating earnings, up from this year’s consensus $120.81, with the year-over-year growth in the four-quarter total expected to accelerate each quarter (Chart 3).

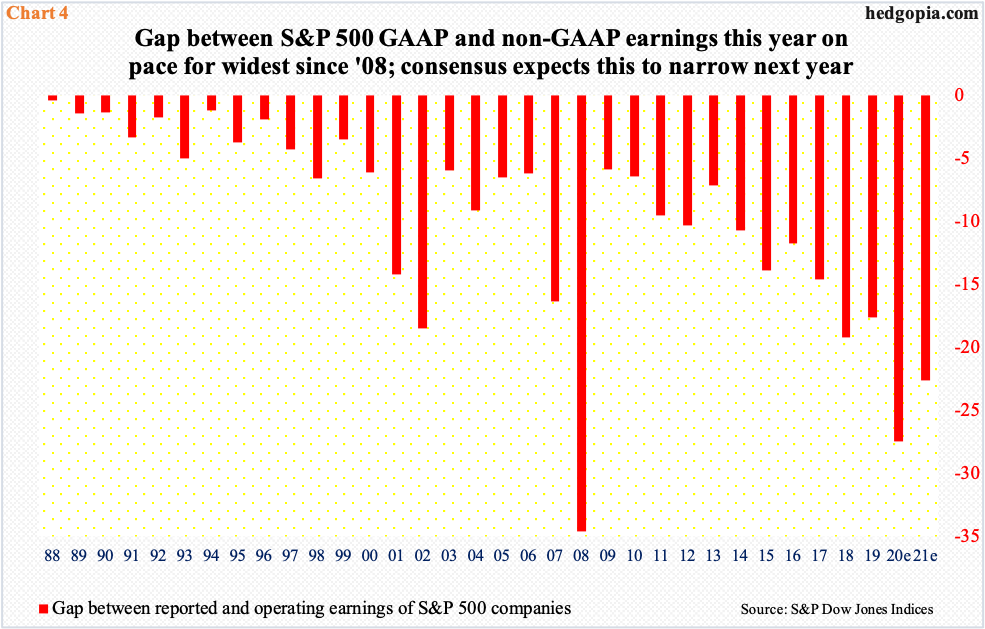

Even if next year’s estimates are realized, there is not going to be much improvement in a trend that has plagued US corporate earnings for a while. Over the years, the gap between GAAP and non-GAAP earnings is getting starker. Both are important in their own right. It is very possible non-GAAP tends to overstate earnings, while GAAP does the opposite. On balance, the lesser the discrepancy between the two the higher the quality of earnings.

In this respect, S&P 500 companies this year are expected to realize $93.36 in reported earnings. The $27.45 gap with operating earnings is the widest ever since 2008. During recessions, GAAP earnings collapse as companies take asset write-downs, etc. That said, although the economy is expected to grow in the four to five percent range, the gap between GAAP and non-GAAP next year is only expected to narrow to $23.63 (Chart 4).

Thanks for reading!

This blog is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any security or ...

more