Red Flags

When bulls see red in the ring, they are meant to charge at the Matador. The brutality of the bull ring and the lopsided odds against the bulls make this a fitting place to see the present red tape in global risk assets and push the analogy that the current recovery in price may be like a bull charging towards its end as the business cycle turns over. Even with UK PM May surviving a no-confidence vote and US 4Q earnings upside surprises are insufficient to extend the present feel-good moment for traders. Between ongoing China growth doubts, threats of US tariffs on European autos, the ongoing US government shutdown and the doubts that a Brexit delay brings any real positives to the UK for the economy or politics – all that list drives the present red on screens.

- EU auto makers are off 1.5%after US Senator Grassley said he thought Trump was inclined to impose tariffs on European cars to win a better deal with the EU on agriculture.

- The UK votes on UK May’s Plan B for Brexit set for January 29 with much speculation that a new referendum will be called on the subject, along with an extension to Article 50 beyond the March 29 deadline. Hope for a “soft Brexit” deal continues as options in FX reveal 1-month buying back in vogue for GBP.

- US government shutdown hit on GDP seen over 0.1% a week. The New York Times reported that White House adviser Kevin Hassett has indicated that U.S. quarterly growth will be hit by 0.13 percentage points for every week the shutdown lasts – higher than previous estimates. The Fed Beige Book yesterday added to fears that the government shutdown hurts - “Outlooks generally remained positive, but many districts reported that contacts had become less optimistic in response to increased financial market volatility, rising short-term interest rates, falling energy prices and elevated trade and political uncertainty,” the report said.

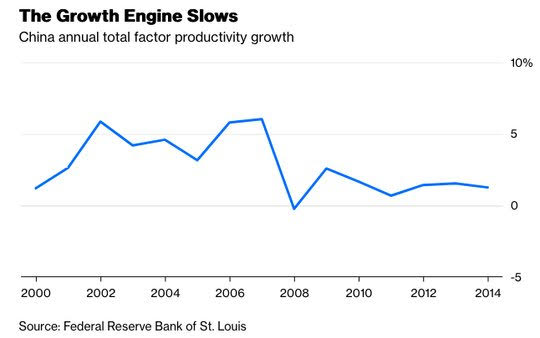

- China growth doubts linked beyond Trump trade issues. The Noah Smith’s Bloomberg Opinion piece highlights the key worry about China in 2019, that the investment-led growth gets diminishing returns as it clashes with demographics and stalling productivity. The ability to spur domestic demand will require more than a trade deal.

The list isn’t really new but the reaction of markets maybe making clear that the equity market needs more to not meet the Matador’s sword. Namely, US yields and the USD both need to keep going down to hold the rally up – this puts the EUR/USD chart into the spotlight as it seems to capture the difficult mix of risks on trade, politics, and global growth. Watching 1.13 as key for the bulls’ survival.

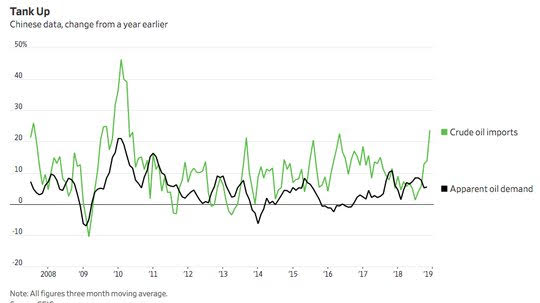

Question for the Day: Is Oil the best barometer for global growth? The rally back in Oil prices matches the recovery in the S&P500. China growth stimulus plans led to a 2.8% rally in Brent on Tuesday, which extended as US weekly EIA inventories reported a larger than expected drawdown yesterday. The two biggest economies in the world are central to the demand side of the oil price equation. Unfortunately, the US government shutdown leaves much of the US economy data uncollected and so markets will have to find other ways of measuring demand – by private or Fed surveys. As for China, the distrust of the official data continues and with the New Year celebration approaching, few expect much but noise in the next 2 months of releases (Jan+Feb). This puts oil as key for many but for the inventory cycle issues that make imports from China even more confusing. The WSJ highlights this point today.

What Happened?

- Australia November home loans drop 0.9% m/m after revised 2.1% m/m gain – slightly better than -1.5% m/m drop expected. The investment lending for houses fell 4.5% after a 0.6% m/m gain while owner occuplied fell 1.4% m/m.

- BOJ Kuroda opens G20 bankers meeting: Pushes international trade, forward-looking policy, inclusive growth. The introductory remarks set up expanding cross-border trade, policy response to demographic pressures and increasing inequality as issues for discussion. Japan FinMin Aso pushed the same themes: “Dissatisfaction with economic inequality is growing. There is a serious risk that we will revert to a closed and fragmented world,” Aso said in his opening remarks at the G20 gathering.

- Indonesia central bank keeps rates unchanged at 6%- as expected– sees global economic moderation with slightly less uncertainty, projects robust national economic growth. The central bank sees GDP 5-5.4% in 2019 backed by domestic demand and improvements in net exports.

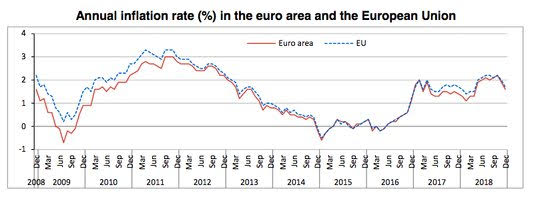

- Eurozone December final HICP unrevised at 0% m/m, 1.6% y/y after -0.2% m/m, 1.9% y/y – as expected. The core also unchanged at 1% y/y. The highest contribution to prices came from services up 0.58%, energy 0.53%, then food/alcohol 0.34% and non-energy goods 0.12%..

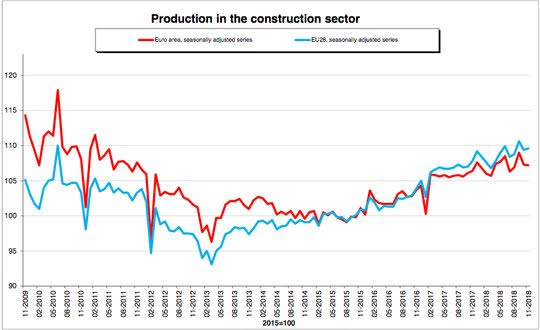

- Eurozone November construction output fell 0.1% m/m, +0.9% y/y after a revised 0.6% y/y gain – worse than the +1.5% y/y expectedand October revised from1.8% y/y. The civil engineering slowed to 2.1% from 2.3% while building rebounded to 0.7% from -0.1%.

Market Recap:

Equities: The US S&P500 futures are off 0.3% after a 0.22% gain yesterday. The Stoxx Europe 600 is off 0.2%. Bank earnings in Europe hurt as did chip producers warning on earnings drove tech lower in Asia. The MSIC Asia Pacific fell 0.2%.

- Japan Nikkei off 0.2% to 20,402.27

- Korea Kospi up 0.05% to 2,107.06

- Hong Kong Hang Seng off 0.54% to 26,755.62

- China Shanghai Composite off 042% to 2,559.64

- Australia ASX up 0.27% to 5,909.80

- India NSE50 up 0.14% to 10,05.20

- UK FTSE so far off 0.6% to 6,823

- German DAX so far off 0.3% to 10,894

- French CAC40 so far off 0.4% to 3,426

- Italian FTSE so far off 0.2% to 19,436

Fixed Income: Between Brexit and the US shutdown, yields in Europe are lower. German Bunds are up 1bps to 0.23%, French OATs are up 0.5bsp to 0.64%, UK Gilts are up 1bps to 1.32% while periphery is bid with Italy off 0.5bps to 2.755%, Greece off 0.1% to 4.22%, Portugal off 3bps to 1.62%, Spain off 2bps to 1.36%.

- Spain Tesoro sold E1.413bn of 3Y Oct 2021 Bonds at -0.047% with 2.13 cover down from -0.0339% previously, and also sold E1.66bn of 5Y Jul 2023 bonds at 0.289% with 1.68 cover down from 0.329% previously.

- UK DMOsold GBP2.5bn of 1% 2024 5Y Gilts at 1.018% with 2.22 coverup from 0.966% previously.

- US Bonds slightly bid with eye on stocks – 2Y off 1bps to 2.53%, 5Y off 1bsp to 2.53%, 10Y off 1bps to 2.71%, 30Y off 1bps to 3.06%.

- Japan JGBs mixed with BOJ/equities and G20 focus– 2Y of 1bps to -0.17%, 5Y off 1bps to -0.16%, 10Y up 1bps to 0.01%, 30Y up 1bps to 0.70%.

- Australian bonds slightly lower with focus on US catch-up– 3Y up 1bps to 1.79%, 10Y up 1bps to 2.28%.

- China bonds extend rally on more easing hopes– 2Y off 6bps to 2.63%< 5Y off 4bps to 2.89%, 10Y off 3bps to 3.09%.

Foreign Exchange: The US dollar index flat at 96.04 with 95 base and 96.80 resistance key. In Emerging Markets, USD is bid – EMEA: RUB off 0.3% to 66.527, ZAR off 0.3% to 13.719, TRY off 0.6% to 5.363; ASIA: INR up 0.1% to 71.025, KRW off 0.25% to 1122.70.

- EUR: 1.1400 up 0.1%.Range 1.1371-1.1405 with focus on equities, USD negatives. 1.1330 hot point vs. 1.15 resistance.

- JPY: 108.80 off 0.25%.Range 108.70-109.12 with EUR/JPY 124.00 off 0.25%. Weaker equities, less optimism driving with EUR/JPY 125 key.

- GBP: 1.2900 up 0.2%.Range 1.2832-1.2911 with focus on Brexit delay and hope for referendum – EUR/GBP .8835 off 0.05%.

- AUD: .7170 flat. Range .7147-.7175 with China growth doubts and rates key - .7050-.7250 consolidation. NZD off 0.55% to .6740 with rate cut talk rising.

- CAD: 1.3290 up 0.3%.Range 1.3247-1.3309 with oil and rates and data driving – 1.3250 base building for 1.34 again.

- CHF: .9920 up 0.2%.Range .9895-.9926 with EUR/CHF 1.131 up 0.25%. All clear sign for risk? 1.00 key resistance for $.

- CNY: 6.7705 up 0.25%.Range 6.744-6.774 – with growth doubts rising, focus on equities and 6.80 resistance.

Commodities: Oil lower, Gold flat, Copper off 0.3% to $2.6820.

- Oil: $51.76 off 1.05%.Range $51.46-$52.65 with $50 back in play as $52.75 holds. Brent off 1.35% to $60.50 with $60 pivot back in play and $62 resistance key.

- Gold: $1294 flat. Range $1290.90-$1295 with focus on equities and rates as USD bounce holds. Silver off 0.2% to $15.61, Platinum up 0.7% to $813.90 and Palladium up 4.4% to $1377.60.

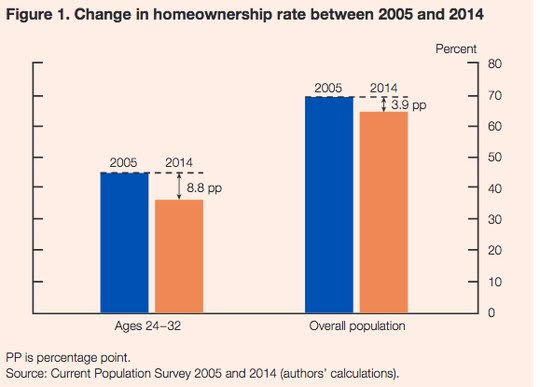

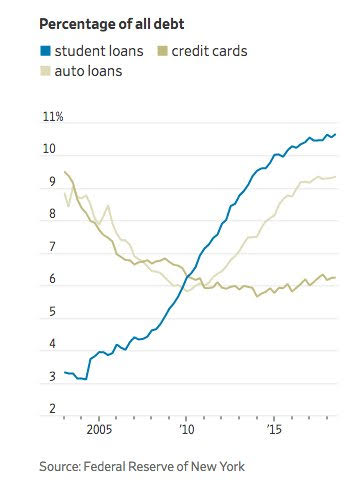

Conclusions: Is the Student Loan Debt bubble knocking down US housing? The Federal Reserve research publication published yesterday links the two, highlighting the 9% drop in homeownership for young adults from 2005 to 2014. The complexity of the debt hurting credit vs. improving potential income makes this issue link to the business cycle.

In fact, the real issue for markets in the slowing US economy maybe a return to consumer debt worries. The de-leveraging risk to autos, retail and other hits to the consumer balance sheet make the focus on jobs and wages that much more important – leaving the weekly claims as the bellwether for data today, likely beating the Philly Fed for downside risks.

Economic Calendar:

0800 am SARB rate decision - no change from 6.75% expected

0830 am US weekly jobless claims 216k p 220k e

0830 am US Jan Philly Fed manufacturing 9.4p 10e

0100 pm US sells 10Y TIPS

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.