Record US Corn & Bean Yields, But Derecho Prompts Questions

Market Analysis

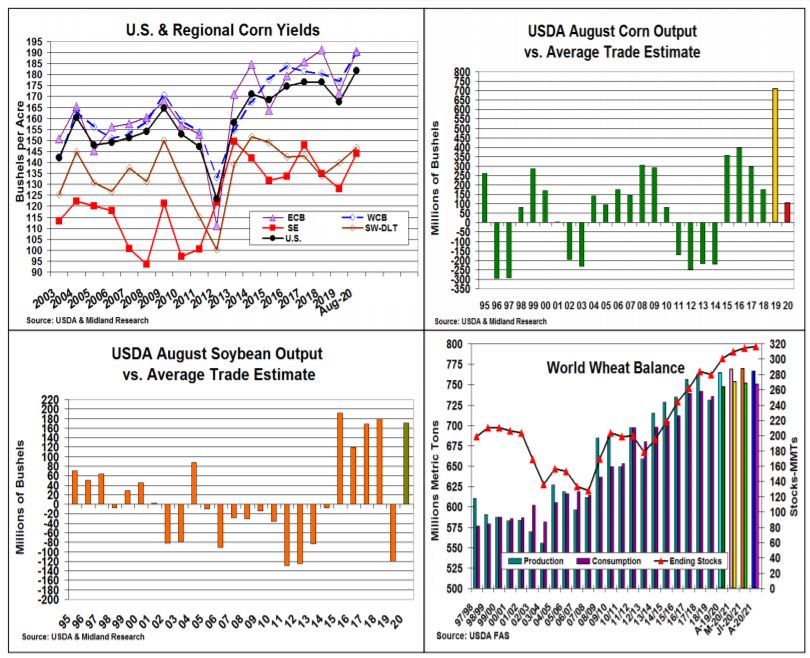

Given the recent high crop ratings, the market was expecting strong August US corn & soybean crops this week. The USDA didn’t disappoint with record yields and record/ near record output for US corn and soybeans this month. However, the highly unusual Derecho with hurricane level winds that streaked across the Midwest on Monday causing significant damage (particularly in Iowa’s corn fields) limited the trade’s initial selling and prompted some modest post-report recovery. (SOYB)

The USDA’s record US corn output of 15.278 billion bu came from strong yields across the Midwest lead by IL (207) and IA (202 bu). This advanced the US yield 3.3 bu. to 181.8 bu/acre vs. July’s 178.5 level with 8 other states also posting record yields (MN, SD, WI, MI, KY, TN, GA & SC). Interestingly, the USDA’s August corn crop forecast has been above the trade for 5 years, but this year’s difference was only 104 million bu. Despite concerns of possible old-crop export or ethanol demand cuts, the USDA dropped old-crop stocks by 20 million from higher exports. They also upped corn’s 20/21 feed & export outlooks which kept new-crop’s stocks at 2.756 billion. (CORN)

The USDA also advanced its August US soybean yield sharply (3.5 bu.) & crop size (278 million bu.) vs. its July levels. This pushed 2020’s crop to within 3.4 million of 2018’s 4.428 billion bu. record. This year’s trade estimate was 171 million below the USDA which is similar to 4 out of the last 5 years. Nationally, 9 states are projected at record yields (IL, IN, OH, MI, NE, SD, MO, KY & MS). A rise in the US crush slipped old-crop stocks by 5 million while the USDA upped its new-crop crush & export demands. This kept 20/21’s stocks at 620 million (up 185 million vs July).

US wheat supplies only rose 14 million bu. this month on higher Spring wheat output and lower WW bushels, However, the 2 mmt increase in Black Sea crops & World ending stocks weaken this food grain after the report. (WEAT)

What’s Ahead

After the recent price break, corn & soybean values could be oversold. Given 2020’s erratic US weather & next week’s virtual US crop tour sponsored by a long-time industry information provider, their field updates could provide some price recoveries.

Hold new crop sales at previous 15% & look to disperse remaining 10% of your old-crop corn if you have strong new-crop corn prospects in your field.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more