Record-High Wednesday – Here Come Those Tears Again

WOW!!!!

The market has been running like a rocket. Like one of those reusable Space X rockets as it keeps going up every time it falls. The Nasdaq is retesting 7,200 on the 100 Index (/NQ)and we shorted that line this morning only because the last time we tested it (mid-March) we plunged 10%, back to 6,322, which was the 200 dma back in April. This time, the 200-day moving average is back at 6,500, so still a 10% gap down if we fail to punch over. That means our RISK is stopping out at 7,205 with a $100 loss while the potential REWARD could be $14,000 on a 700-point drop – that's the kind of bet we like to make!

In our Options Opportunity Portfolio and our Short-Term Portfolio, we are using the Nasdaq Ultra-Short, SQQQ as a primary hedge because the index is full of overpriced stocks. It's not a bet though, it's a hedge as it's crazy to BET that the Apple-driven index will go lower while AAPL is still under $1Tn in market cap (now "just" $950Bn). $1Tn is more than the GDP of Turkey ($849Bn) so, if Apple were a country, it would rank 17th in the World. Above them is Indonesia and Mexico – both at about $1.1Tn, which would be about $225/share for AAPL.

![]()

I suppose if we're going to learn to accept valuations in the Trillions, we should start thinking about Corporations more like countries or maybe we should just start trading countries – it's a work in progress – anyone want to go long on North Korea at $17.4Bn? With 25M people, that's just $696 per person – seems like a bargain compared to South Korea, which is "valued" at $1.7Tn for just 50M people so $34,000 per person's share. Life is good below the 38th Parallel!

How does a country with just $17.4Bn develop nuclear missiles? That means Carl Icahn can develop nukes – he has $17Bn and Icahn is "only" ranked 73rd on the Forbes 500 list. Jeff Bezos can buy a dozen nukes with his $112Bn and he's already got rockets, as does Elon Musk with $20Bn and he already looks like a James Bond villain! We worry about tin-pot dictators abroad but do we really know what the Kochs and Waltons are keeping in their bunkers?

As we know with Billionaires – once one gets a cool toy, they all want it and Trump is leading the Billionaire Class into the nuclear age with his finger firmly on the button. That's why Trump is worried about Kim Jung Un, not because he threatens our nation's security but because he threatens Trump's bragging rights that he has nukes and no one else at the club has any. I know it sounds silly but maybe you've never heard a guy talking about the helicopter pad on his yacht for 2 hours…

Speaking of Elon Musk, last night they had a shareholder meeting and, amazingly, his cousins decided he could continue to be Chairman and CEO of Tesla (TSLA) and Musk CLAIMS the company will be building 5,000 Model 3s a week "by the end of June" AND that they were currently producing 3,500 vehicles per week. As noted by Reuters, however:

The company has been engaging in so-called "burst builds," temporary periods of full-scale production. Tesla then extrapolates the number of cars built during these short-term burst builds over a longer time period.

Analyst Brian Johnson of Barclays warned investors in March to be wary, however, of brief "burst rates" of Model 3 production that were not sustainable.

Musk repeated his assertion that the company was not planning on raising additional debt or equity, without providing a timeframe, and said he expected positive net income and cash flow in the third and fourth quarters. If he pulls that off, it will be amazing and we should let him have all the nukes his heart desires.

TSLA's stock has been struggling to get back over $300 since Musk's March melt-down when he talked about "production Hell" and refused to answer analysts questions during a conference call. Shares are about 25% off the highs and we've been shorting them but now we'll watch and wait to see if he's lying or not. Musk has only given himself 3 weeks to put up or shut up – we can be patient.

Let's say Musk isn't full of crap and Tesla is really going to push out 5,000 cars a week by the end of the month. Figure they've built 65,000 cars so far this year and this would give them another 130,000 through 12/31 so call it 200,000 cars at about $65,000 avg price (there are no cheap Model 3s yet and still plenty of S's and X's get sold) so that's $13Bn in sales, not up much from last year's $11.7Bn, when they lost $2Bn for the year. So they are selling more cars than last year (115,000) but the mix shifting to the Model 3 at half the price of the S/X is going to keep the revenues from growing very much.

So, the question is, do we want to pay $50Bn at $300/share for an auto company with $13Bn in sales and a $2Bn loss? I know I don't. GM's market cap is $61Bn and they have $145Bn in sales and make $12Bn in profits so 10%. Musk has to double his sales to $26Bn (10,000 cars/week) and double them again to $52Bn (20,000 cars/week) and makes 20% (double the competition) on those revenues just to get to 20% LESS than GM's current profits. That is, of course, a complete and utter fairy tale as far as this decade goes – and that's just to justify the CURRENT price of the stock!

Gosh, I'm talking myself into shorting TSLA again…

On the whole, we're hoping the hype punches them back to their $380 highs and then we'll load up the shorts again because, if Musk did ramp production up to 5,000 cars a week (not 20,000!) – it certainly cost him an arm and a leg to hit that number and that will not bode well when they report Q2 earnings in July!

Speaking of things that do not bode well, the Social Security Agency will have to dip into it's $3Tn Trust Fund to cover program benefits three years sooner than projected just last year. The reason stated by the Agency is lower than expected economic growth hampering revenues – interesting… Low interest on that $3Tn has been killing them and look for Team Trump to argue that the money be placed in the stock market – so they can wipe it out quickly instead of slowly.

On the bright side, if the markets aren't concerned about this they aren't likely to be concerned about anything and we can carry on to new record highs. The ECB will debate ending QE next month – so what? The Fed will hike rates next Weds – so what? The Bank of India just raised rates for the first time in 4 years (6.25%) – so what? What's a little Global Tightening (QT) among friends? Citibank credit strategist Matt King told CNBC about how QT is creating the current market turmoil:

“What we are seeing is relatively modest withdrawals from the central banks suddenly have broader consequences than the central banks have been anticipating, and that therefore does constitute a greater tightening as if we had two extra Fed hikes more than they were anticipating.

“So far it is not systemic, yes we are not worried about banks falling over in the same way as 2008 or even 2012. At the same time, we would expect a broadening out of the stresses, or the tensions, beyond where they are at the moment. So far it’s just Libor-OIS it’s not cross-currency bases, and yet there are reasons to think that as the Fed drains excess reserves from the system, we will see that tension broaden out.”

Jeff Gundlach thinks 2.63% on the 10-Year Note is the interest line we dare not cross and that's the line we're standing at right now (below 118.5 on 10-year Futures).

Venezuela is about to declare Force Majeure for failure to deliver on oil contracts – so what? Europe is considering retaliatory bans on US goods and China has offered to purchase just $70Bn of US product (Farm, Energy, Manufacturing) to "balance" what Trump claims is an $800Bn trade deficit – is that something we celebrate? How will Trump declare that a victory? Well, we know how – loudly and often! ZTE is already back in business after China lent Trump's Company $500M.

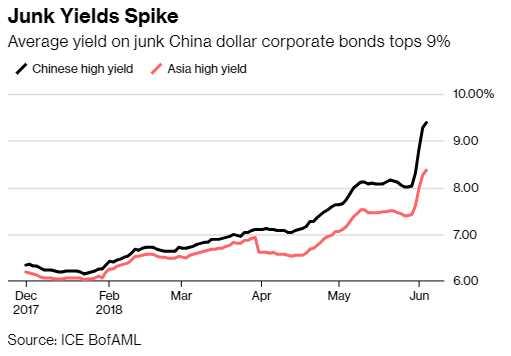

Money has been flying out of Emerging Market Funds with $12.3Bn being withdrawn in May, the most since Trump's election. Default risks in Asia are rising sharply as Governments can no longer afford to bail out the number of businesses that have over-extended themselves in the "rally". Even in China, junk yields have been flying higher this month, outpacing the rest of Asia by a full point and just under 10% – that's an implied 1 in 10 chance of default for Chinese companies!

“It certainly looks like defaults will pick up in Asia,” said David Kidd, a partner at Linklaters, who focuses on restructuring and insolvency matters. “There seems to be a political willingness to allow defaults.”

Five companies in the region have defaulted on dollar bonds this year, up from two in all of last year. China Energy Reserve defaulted on its bonds in May, as did Hong Kong developer Hsin Chong Group Holdings Ltd. A record $282 billion of dollar bonds are due in Asia ex-Japan in the two years through 2020, coming at a time when analysts forecast the 10-year U.S. Treasury yield to rise to 3.56 percent by the first quarter of 2020. The yield has climbed more than fifty basis points this year, exceeding 3.1 percent in May before falling back.

"So what?" you say? Well, then you are suited to be a US Equity Investor in this madness but me, I'm in CASH!!! and taking the Summer off until there is either a correction or a base is formed at the levels we are now testing.

What can I say – I'm risk-adverse…

Disclosure: Our teaching theme at Phil's Stock World is "Be the House, NOT the Gambler." Please see " more