RealPage A Compelling Value For Growth Small Cap

RealPage (RP) was one of 30 stocks that hit a screen for outsized quality growth, one of the smaller more interesting names on a list that included market leaders like Amazon (AMZN) and Salesforce.com (CRM).RP offers a value-added solution that is meaningfully disruptive to a large industry, and has the ability to sustain above-average growth for a very long period of time.Its niche nature also makes it a potentially attractive M&A candidate as strength in Multi-Family housing starts increases its customer base, and it is also a EBITDA margin expansion candidate.

The $1.73B software company provides solutions to the rental housing industry such as asset optimization, leading/marketing, resident services, and property management.Its total addressable market includes 20M “Prospects”, 4.6M “Vendors”, 80K “Owners/Managers”, and 100M “Residents.”RP provides a value-added software solution that drives higher revenues, lower credit/property risk, and expense reduction for owners/managers, and convenience solutions to residents such as paying online, requesting services online, and other engagement functions.RP projects addressable units at 5X current levels, RPU at 6X, and TAM at 28X in terms of ACV (Annual Customer Value).RP also has the ability not only to sell more units and increase penetration, but also expand into new markets such as Senior Living & Student Living.

RP shares trade 24.6X Earnings, 3.56X Sales, 5.15X Book and 26.6X FCF with a strong balance sheet.RP has seen consistent revenue growth and with 88%+ of revenues subscriptions, a highly predictable revenue stream, and believed to be in the early innings of a large TAM.Annual Customer Value (ACV) is utilized as a metric for bookings which is driven by Units & RPU, and from 2010 to 2014 ACV has shown a CAGR of 18%.RP is seeing accelerating Y/Y revenue growth, 7.3% in 2014, 15.8% in 2015, and projected at 21.6% in 2016 and then normalizing at 14.7% in 2017.EPS jumped 41% in 2015, projected +31.5% in 2016, and +21.9% in 2017.Gross Margins have steadily declined, set to be 62.5% in 2016 after being as high as 66% in 2012, so any stabilization and potential recovery in margins can add to the positive outlook.On the other hand, EBITDA margins have risen since 2014 and projected to hit 22.6% in 2017, and reaching 30% is attainable according to management’s long term goals.At 2.6X FY17 EV/Sales, RealPage is a compelling value for a growth stock.RP also has been active with small tuck-in acquisitions including NWP Services for $68M and AssetEye for $4.8M in 2016.Comparable valuation is tricky with RP due to its niche nature, most of its competitors, such as Yardi Systems, are private without available financial data.

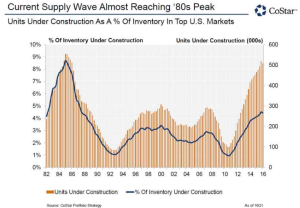

The US Census Bureau data shows that quarterly construction starts of apartments have declines the past two quarters after peaking in Q3 2015, though permit data is showing apartment-building may trend back higher the remainder of the year.The chart below shows the apartment boom, and this is a tailwind for RP’s service offerings.The record occupancy rates do have a slight negative impact for the need of RP’s leasing and marketing services, but the apartment construction sets up for more potential customers for RP’s many product offerings.One issue in its latest quarter was higher rental renewal rates, less residents moving translating to less leasing velocity and lower transactional revenues for the leasing/marketing product family.Pricing pressures in the Contact Center division was another notable area of concern due to increased competition, but management seems ready to counter this with software bundles.

Analysts have an average price target on RP shares of $24.60 with 2 Buys, 5 Holds and 1 Sell.CSFB is the lone bear on the stock with an Underperform rating and $19 target, concerns regarding leasing activity amidst adverse macro conditions.They see challenges to grow on-demand revenue organically greater than 15% due to a highly penetrated multi-family customer base, pricing pressure from increased competition, an acquisition strategy that increases risks, macro headwinds to certain products, and tepid sales of some newer products limiting ARPYU expansion over the next several quarters.

Short interest in RP is minimal at 3% of the float.In Q1 filings 23 funds started new positions, 54 added to positions, 19 closed out positions and 41 reduced positions.Stockbridge Partners, a $1.88B fund out of Boston, owns a large stake in RP, its 9th largest holding.The CEO owns more than 30% of the Company.

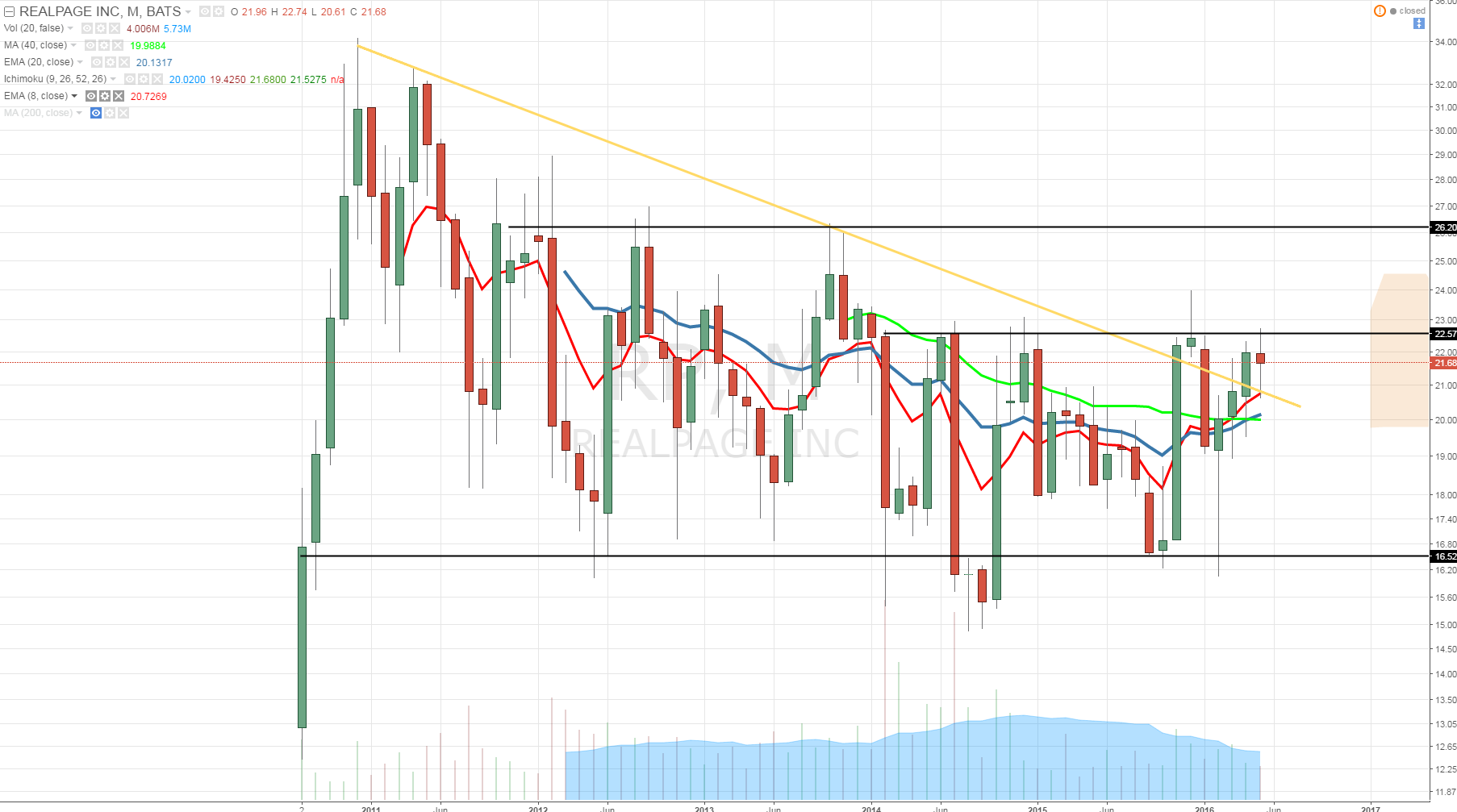

On the chart, looking at the long term picture RP is a stock that has bounced around in the $15.50 to $24 range for much of the past 5 years.RP shares on the weekly are currently consolidating with resistance levels at $22, $24, $26, and $32.Shares have moved back above a meaningful downtrend line from its 2011 and 2013 highs.The monthly chart is shown below.RP shows a strong Q4 seasonal tendency with shares averaging a 19.38% return over the past 5 years, positive 4 out of 5 years with October its best month of the year.

(Click on image to enlarge)

RealPage is a compelling niche growth stock trading at attractive valuation with plenty of room to grow its current core business as well as expand into other areas.If RP can execute on its cross-selling strategy and find ways to recover margins back closer to 65%, shares have at least 50% upside.An added bonus is its attractiveness as a strategic asset for M&A, and back in 2014 the Financial Times reported that RP rejected a buyout bid from Vista Partners.Zillow (Z) and Co-Star Group (CSGP) could also be potential suitors.

Not Investment Advice or Recommendation Any descriptions "to buy", "to sell", "long", "short" or any other trade related terminology should not be seen as a ...

more