Real Estate Dip

Real Estate (XLRE) has been the second-best performing sector today behind Energy (XLE). While earnings do play a role in these gains, technicals and interest rates have also been a major factor. All year, XLRE has been in a strong and steady uptrend. After getting a bit extended earlier this month, the sector saw some mean reversion back to the 50-DMA which also coincides with the sector’s uptrend line. The 50-DMA has acted as solid support in this year’s run higher with this most recent pullback being no exception.

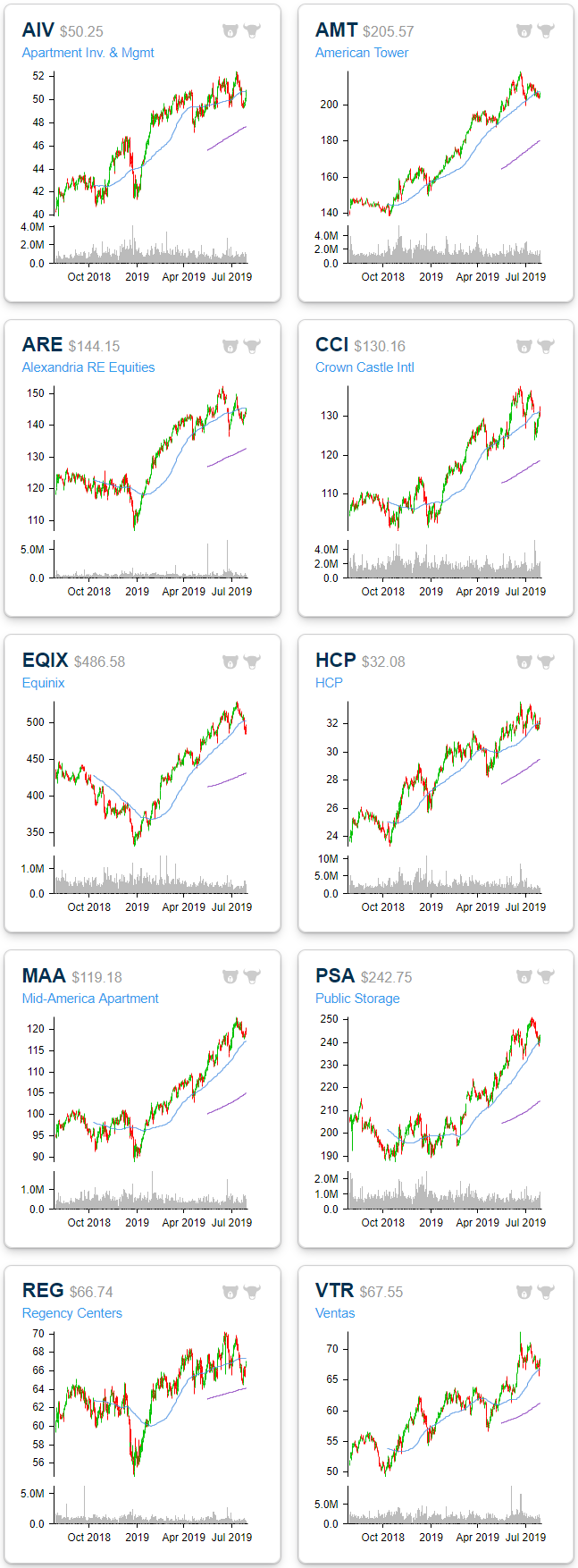

Some of the individual S&P 500 stocks within this sector have similar chart patterns to the broader sector. Below we highlight some of these that are both in uptrends and have good timing scores. Some like American Tower (AMT), HCP (HCP), and Mid-America Apartment (MAA) have only pulled back to the 50-DMA like the sector ETF (XLRE). But others such as Apartment Inv. & Management (AIV), Equinix (EQIX), and Regency Centers (REG) saw more dramatic mean reversion within their trading ranges. A number of these names are also due to report earnings this week including AIV, AMT, EQIX, HCP, PSA, MAA, and REG, so be aware of that.

Disclaimer: Read our full disclaimer here.