Re-Financing Corporate Debt When The Economies Slow Down

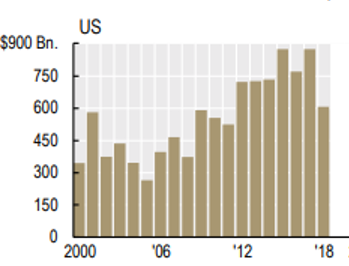

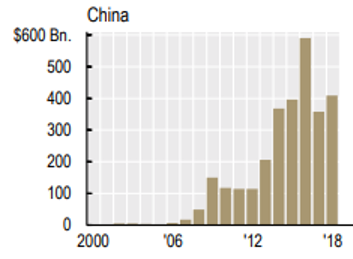

Corporate bond markets have increasingly become the most important source of financing for nonfinancial companies. The OECD[1] puts the total outstanding corporate debt worldwide at USD 13 trillion as of end-2018. In the aftermath of the 2008 financial crisis, corporations have looked to the bond market to supply operational and capital investment funding. While the United States remains the largest market for corporate bonds, the most significant development has been the rapid growth of the Chinese corporate bond market. The Chinese debt market has burst on the scene starting from virtually zero in 2006 to a record issuance amount of USD 600 billion in 2016, ranking second highest in the world.

Figure 1 Total Issuance of Corporate Debt in USD / Source: OECD

As growth in both the advanced and emerging economies slows, how will corporate debt affect future growth? What are the implications for bondholders now and in the near future?

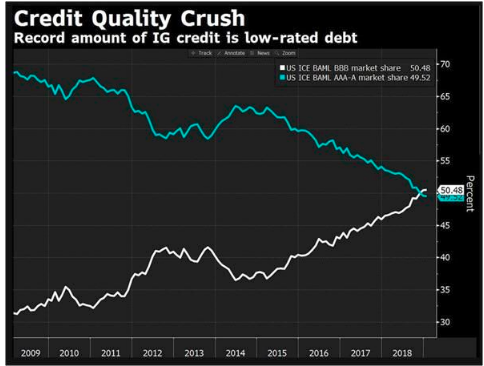

To begin with, there could be an increase in the number and size of “fallen angels”. These are the bonds that were initially issued at investment grade quality but have since been downgraded to “high-yield “ or “junk” status. We have already seen this trend in motion as the quality of lending has been deteriorating steadily over the decade. The rise of BBB-rated corporate debt, the lowest form of investment grade, has been dramatic.

(Click on image to enlarge)

Figure 2 Decline in Credit Quality

Any downgrade of previously issued BBB -rated debt to non-investment grade will come at the expense of increased borrowing costs. Rising borrowing costs and weakening revenues will present major challenges to corporate treasurers to find low-cost ways to finance expansion. Highly leveraged companies would face difficulties in servicing their debt, which, in turn, through lower investment will exacerbate a downturn.

Turning to the demand side, there will be fewer major pools of investors who will be allowed to hold their non-investment grade corporates. Regulatory requirements dictate that certain types of institutional investors, such as insurance companies, will be forbidden to hold non-investment grade bonds. Also, in many cases, internal investment policies at mutual funds, pension funds, and alike, will also be restricted from holding non-investment grade bonds. This could result in some market de-stabilization as these institutions are then forced to unload large positions. With fewer available buyers, corporate treasurers must pay more to attract funding for capital projects. And, the OECD estimates that in the next three years corporations will have to pay back or refinance about USD 4 trillion worth of corporate bonds (or about 30% of the current outstanding balances).

As my colleague, William Chin of Caldwell Securities sums it up: “to protect their investment grade rating, ‘BBB’ companies will ‘shape up’ by trimming capital spending or corporate buybacks so as not to increase indebtedness. These are headwinds to the economy”.

[1] http://www.oecd.org/corporate/Corporate-Bond-Markets-in-a-Time-of-Unconventional-Monetary-Policy.pdf