Rates Spark: Push And Pull Galore

While US long rates are rising with some conviction, technical factors are liable to place downward pressure on US front end rates ahead. An ever steeper curve is the outcome, but then again a consolidative phase looks overdue. EUR rates continue to digest the flurry of supply, where we still eye the possibility of further long end deals.

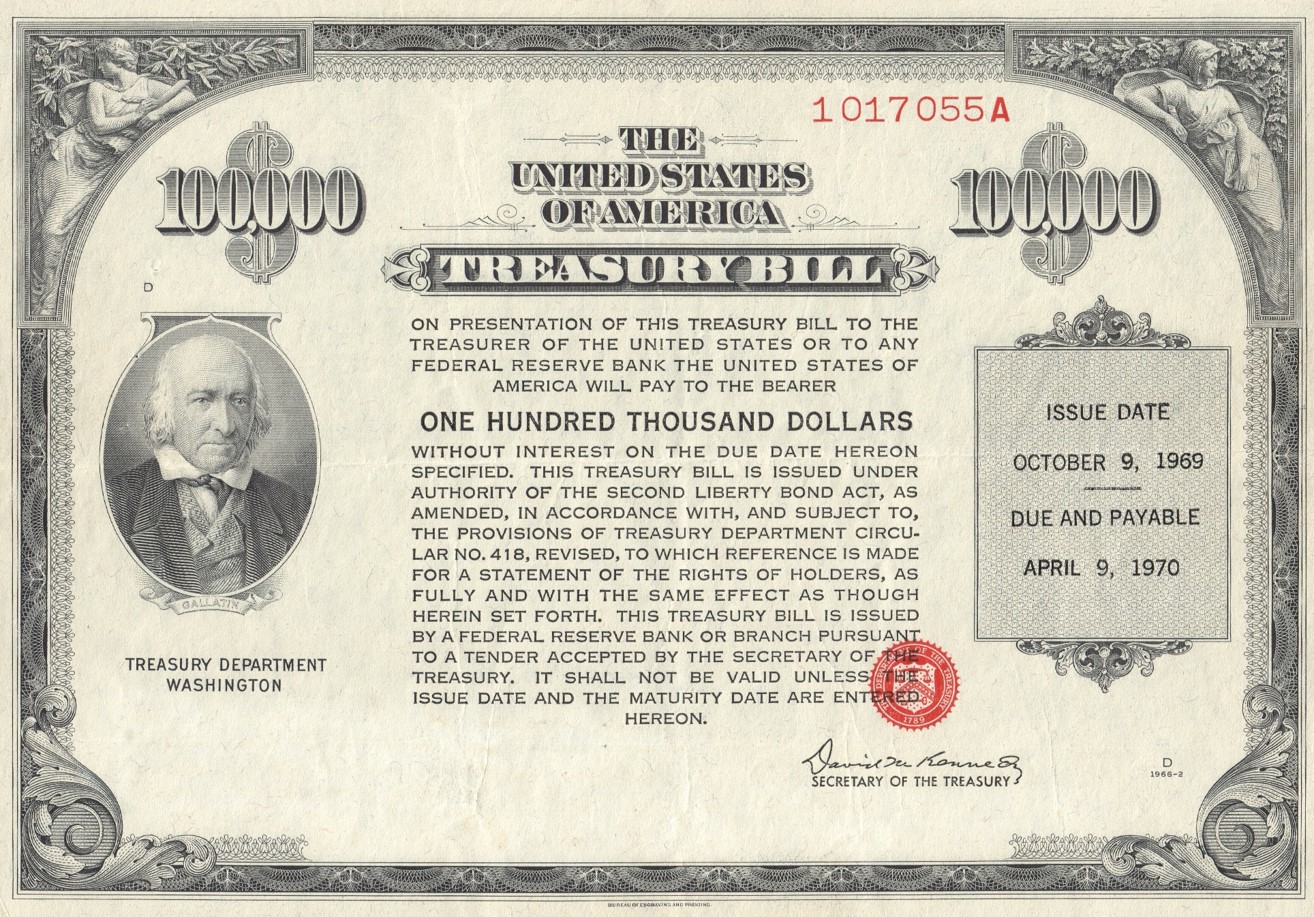

Overnight: Mr T

Tapering is a focus for FOMC members, and more particularly the timing for reducing the Fed's asset purchases. Bostic sees it starting this year (he also sees the first Fed Fund hike in late 2022 or 2023 but we expect this opinion is not shared by most of his colleagues), as he warns of upside risks to the economy. Kaplan and Barkin struck a less decisive tone but are nonetheless open to the debate happening as soon as the economic recovery takes hold. This mixed messaging was insufficient for bonds to find a base in overnight trading, with the 10Y US Treasury yield now flirting with 1.15% (SPTL, IEF). We see a chance of a rebound but not before this week's supply is out of the way (see next section).

The US curve trades with impressive conviction

The break above 1% for the US has been convincing, in the sense that there has been no looking back. The touch of 1.15% marks another key level. Our end-Q1 target of 1.25% is already looking within reach. We still think that there will be a consolidative phase first. We note that the structure of the US curve is still not one that we could consider as marking a bear market for bonds.

With the 5yr still quite rich to the curve, the structure is more akin to a benign uplift in long dated rates. It's also a heavy lift, as all of the steepening is coming from the back end. The front end continues cosy up to the effective fed funds rate.

In addition, there are technical factors in play that will likely place downward pressure on front end rates in the early months of 2021. Until a new stimulus is actually in place and needs financing, the dominant impact will come from the US Treasury spending the cash that sits with the Federal Reserve. As this makes its way into the system, downward pressure on ultra-front end rates will be the consequence.

The front end anchor is a consequence of very easy policy. On the one hand this provides stimulus and has a reflationary effect that can push up long end rates, but on the other it is a reminder that there are pull factors from the front end that are acting to keep rates under wraps.

The reflation trade is becoming less clear

It has been a recurring pattern in recent sessions. With the opening of the US markets, a sell-off in Treasuries also drags European yields higher. If this is the extension of the blue-wave reflation trade, we’d point out that this time around equities have struggled to keep up, even shedding some of last week’s gains. The picture is starting to get muddied pointing towards a possible turning point: The Biden administration's economic agenda should receive more scrutiny as it gets unveiled this Thursday. And this also coincides with the end of this week's UST supply slate culminating in a US$24bn 30Y note sale. That is, provided the rates sell-off doesn't enter a self-fulfilling dynamic before.

The upward pull effect from the US aside, EUR rates are also feeling the busy primary markets. Yesterday the EFSF sold €5bn across 10Y and 30Y lines. Belgium mandated a new 10Y benchmark, very likely today’s business, but not unexpected. That comes on top of scheduled supply from Austria and the Netherlands.

Italian politics warrant near-term caution

At the start of this week Italian bonds have faced some resistance. To be fair, some of last week’s spread tightening versus Bunds may have been more mechanical, driven by the sell-off in core rates, rather than fundamentals. But it took place amid Italy coming to the market with a new 15Y and ECB buying not yet up at full speed again – overall net purchases under the public sector and pandemic emergency programs amounted to less than €9bn settled in the first week.

But there are reasons for caution in the near term given the political tensions within the government coalition over how to make use of the EU funds, even though a break up and new elections are only a tail risk. According to the news agency Ansa tonight’s cabinet meeting to approve the spending plan is aimed at placating the junior coalition partner around former PM Renzi. Italy hopes to receive €209bn from the EU recovery fund.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more