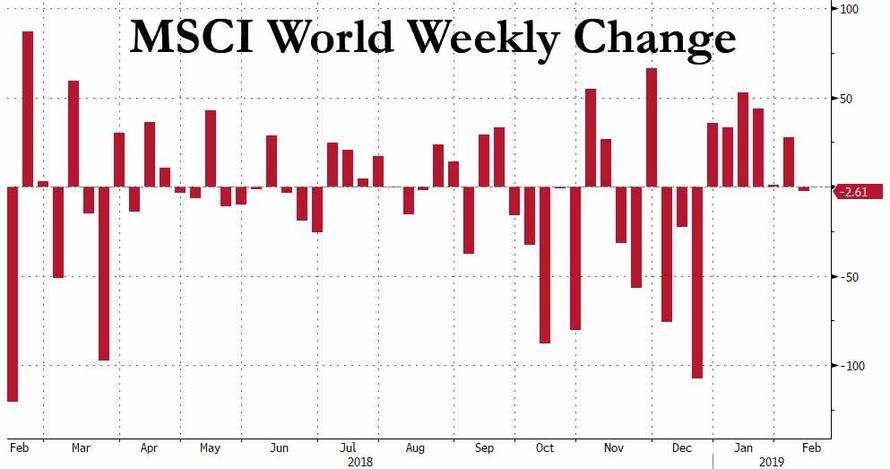

Rally Ends: Global Stocks Break 6-Week Winning Streak; Iron Ore Soars

One day after the post-Christmas rally appeared to finally reverse, when the S&P posted its 3rd biggest loss of 2019, overnight US equity futures and Asian markets continued to sink as concerns over economic growth and the lack of any sign of a resolution to the U.S.-China trade row pushed global stock markets toward their first weekly loss since December, even as European stocks were steady.

As a result, global shares fell for a third straight day on Friday and were set to post their first weekly loss in seven. The MSCI All-Country World Index was down 0.3% on the day. It was down for a third straight day and was set to break a six-week streak of gains.

Treasuries and bunds edged higher, with the German 10-year bund yield falling closer towards the zero percent mark and the U.S. 10-year Treasury yield hitting its lowest point in a week, while the Bloomberg Dollar Index headed for its best week since August as traders rushed to havens amid a broader risk-off mood. The Australian dollar fell as traders positioned for an interest-rate cut, while the pound slid as U.K. Prime Minister Theresa May looked to break an impasse over her Brexit plan.

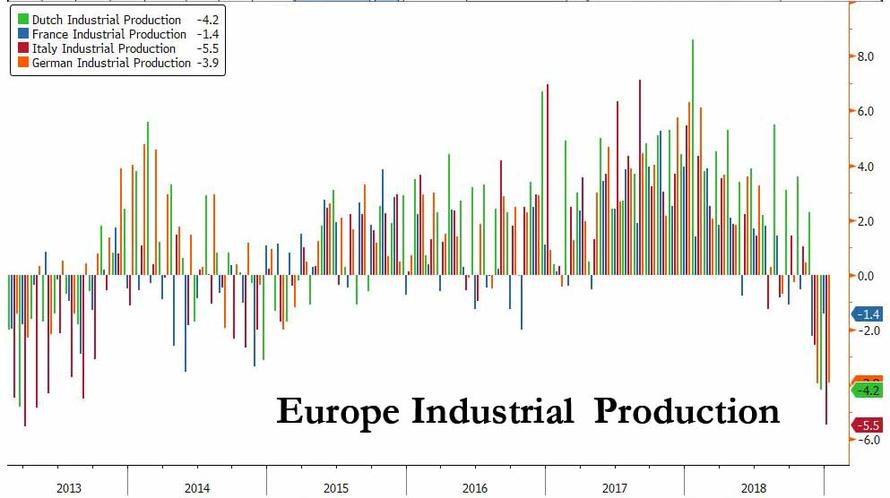

The Stoxx Europe 600 Index was mixed, with drops in automakers offsetting increases in chemicals and media shares. Weak earnings saw a subdued open for European stocks although most major indices climbed into the black for the day, putting the pan-European STOXX 600 in positive territory before fading -0.3% at publication time. Autos were the worst-performer sector in the broader index, declining for a third day amid growing China trade war fears. Valeo (-3.8%), Faurecia (-2.3%), Hella (-1.9%) among leading fallers; Fiat drops 1.4% as sector gauge retreats 1.1%. Spain’s IBEX fell half a percent. As usual, there was fresh dismal economic news out of Europe, which today came from Italy, where Industrial Output plunged -5.5% Y/Y, and the Netherlands, whose Industrial Production plunged 4.2%

Following the latest Industrial Production data out of Europe, there can be no doubt the continent is now in a recession

Earlier, Asian markets dropped, with MSCI’s index of Asia-Pacific shares ex-Japan shedding 0.5%, easing back from a four-month peak touched the previous day.

The European Commission on Thursday slashed its forecasts for eurozone economic growth this year and next, stoking concern that a global slowdown is spreading to Europe as businesses and investors grapple with trade friction.

Contracts on the S&P 500, Dow and Nasdaq Composite all declined alongside shares in Asia following news that President Donald Trump is unlikely to meet Chinese President Xi Jinping before the March 1 deadline for more tariffs. The renewed fears over further protectionist measures also pushed emerging market equities lower. China’s markets remain shut for Lunar New Year

Meanwhile, the global economic picture is becoming gloomier by the day: central banks and governments from Brussels to Sydney cut growth forecasts. As Bloomberg notes, hours after the European Commission slashed forecasts for the euro region’s major economies Thursday, the Bank of England said the U.K. may grow at its slowest pace in a decade. Then Reserve Bank of Australia lowered its growth and inflation forecasts Friday, while expectations have dimmed for the Bank of Japan to edge toward normalizing its monetary stimulus, joining the U.S. Federal Reserve and the European Central Bank in signaling policy shifts. The Fed has all but abandoned plans for further rate hikes, while the ECB also sounded less certain that it will start tightening policy this year.

“If there was a single takeaway from the last few days it would appear to be this - ever since the Fed started to backtrack on its growth expectations for the U.S. economy, the global economic skies, to coin an aphorism from the recent World Bank report, have started to darken further,” said Michael Hewson, chief markets analyst at CMC Markets in London. Hewson added that the tone in markets on the day wasn’t helped by remarks from U.S. President Donald Trump’s chief economic adviser Larry Kudlow, that U.S.-China trade talks still had sizable differences to overcome.

In a report last month titled ‘Darkening Skies’, the World Bank said global economic growth is expected to slow to 2.9 percent in 2019, compared with 3 percent in 2018.

“Many of the central banks are reacting to the fact that the global economic situation has worsened,” Komal Sri-Kumar, founder and president at Sri-Kumar Global Strategies told Bloomberg TV.

Adding to the dovish tide wrapping the world, overnight the Fed's uberdove Jim Bullard said FOMC has moved in a more dovish direction and needs to tread carefully moving forward amid weak inflation and other signals the economy is facing greater risks than had expected. Bullard also stated the Fed is likely to end up with a larger than anticipated balance sheet and that he considers current level of rates as restrictive, while he sees growth this year at 2.5% and considerably weaker than the prior year, with risks for an even sharper slowdown.

Elsewhere, Treasury Secretary Steven Mnuchin and Robert Lighthizer are expected to kick off another round of trade talks in Beijing next week to push for a deal to protect American intellectual property and avert a March 2 increase in U.S. tariffs on Chinese goods. However, as reported last night, Trump is expected to sign an executive order just prior to the deadline, banning the use of Chinese telecom equipment in the US.

In rates, the flight to safety trade prevailed, with 10-year Treasury yields extended overnight declines to a one-week low of 2.6393%. The 20-year Japanese government bond yield dropped to a 27-month trough of 0.400 percent, while the New Zealand 10Y yield dropped to a record low. In Europe, the 10-year German bund yield fell to 0.105 percent on Thursday, its lowest since November 2016 after the European Commission’s sharp cuts to growth and inflation forecasts.

In currencies, the Bloomberg dollar index rose as much as 0.1%; set for 0.9% increase this week while the euro dropped a fifth day, its longest losing streak since October and on course for its biggest weekly loss in more than four months against the dollar, though traders seemed to be puzzled that it was finding support. The single currency was 0.1 percent lower on the day at $1.13240 after dropping to a two-week low of $1.1325 the previous day. It was on track for a 1% weekly loss, its steepest weekly decline since September.

Australia’s dollar dropped to a five-week low after the central bank cut its growth and inflation forecasts. Aussie bonds rallied along with New Zealand’s, where the benchmark yield slipped to a record low. The two nations have led growth concerns this week, with their currencies sliding more than 2 percent. Yield on Australia’s 3-year bonds dropped to its lowest since November 2016 as overnight-index swaps signaled more than an even chance of policy easing this year. RBA Governor Philip Lowe shifted Wednesday to a neutral policy outlook, even before the release of the central bank’s quarterly Statement on Monetary Policy Friday. Finally, USDJPY rose 0.1% to 109.89, reversing an earlier drop; the pair has gained 0.3% for the week.

In commodities, Iron ore futures topped $90 a ton to hit the highest level since 2014 on concern that the increasingly severe crisis at top producer Vale SA will reduce global supplies.

Oil fell, pulled down by worries over a global economic slowdown, although OPEC-led supply cuts and U.S. sanctions against Venezuela provided crude with some support. U.S. crude futures slipped half a percent to $52.39 per barrel, extending losses after dropping 2.5 percent in the previous session. Brent crude was down 0.3 percent at $61.47 per barrel.

In the latest Brexit news, UK PM May approached Labour MPs to table an amendment for the withdrawal motion and will guarantee the UK matches EU regarding workers’ rights post-Brexit following a deal with the Labour Party.

Scheduled earnings include Exelon and Phillips 66, and there are no major economic releases scheduled.

Market Snapshot

- S&P 500 futures down 0.3% to 2,696.50

- STOXX Europe 600 down 0.02% to 360.02

- MXAP down 1.1% to 154.81

- MXAPJ down 0.5% to 510.80

- Nikkei down 2% to 20,333.17

- Topix down 1.9% to 1,539.40

- Hang Seng Index down 0.2% to 27,946.32

- Shanghai Composite up 1.3% to 2,618.23

- Sensex down 0.9% to 36,624.04

- Australia S&P/ASX 200 down 0.3% to 6,071.46

- Kospi down 1.2% to 2,177.05

- German 10Y yield fell 0.8 bps to 0.107%

- Euro down 0.1% to $1.1327

- Brent Futures down 0.08% to $61.58/bbl

- Italian 10Y yield rose 9.0 bps to 2.589%

- Spanish 10Y yield fell 1.8 bps to 1.224%

- Brent Futures down 0.08% to $61.58/bbl

- Gold spot down 0.06% to $1,309.38

- U.S. Dollar Index up 0.2% to 96.67

Top Overnight News

- Amazon.com Inc. Chief Executive Officer Jeff Bezos accused the National Enquirer and its publisher David Pecker of extortion and blackmail, stepping up a war of words between the world’s richest man and a confidant of President Trump

- Prime Minister Theresa May and her top lawyer will travel to Dublin on Friday as she races to forge a breakthrough with European leaders resisting changes to their Brexit plan

- Donald Trump said he won’t meet Chinese President Jinping before a March 1 deadline to avert higher U.S. tariffs on Chinese goods, intensifying fears the two won’t strike a deal before the end of a 90-day truce

- Cracks are appearing in the U.K. labor market, with the number of people placed in permanent jobs falling last month for the first time since the 2016 vote to leave the European Union

- Oil headed for its biggest weekly loss this year as pessimism over the prospects for global economic growth damped the outlook for demand, while U.S. output stayed at record levels

- A series of soft data out of the euro area and the common currency’s inability to hold above $1.14 provide the impetus for another rally in risk reversals, puts over calls

- Italian industrial production fell for a fourth straight month in December, in a sign the recession that started late last year may persist

- The rally in Asia’s bond markets is picking up pace as growth forecasts are trimmed day-by-day and traders rush to reprice the odds of central banks turning dovish

Asian stocks traded negative with global risk appetite subdued by growth concerns and after trade-related fears resurfaced. ASX 200 (-0.3%) was led lower by underperformance in the energy sector following the recent drop in crude prices and with financials downbeat amid a management shake-up due to fraud allegations at NAB. Nikkei 225 (-2.0%) was pressured by a firmer currency and as individual stocks also reacted to earnings, while the Hang Seng (-0.2%) suffered a bout of post-holiday blues on return from the Lunar New Year celebrations, as hopes for a quick trade deal were dampened after US President Trump ruled out meeting with his Chinese counterpart prior to the tariff deadline. In addition, reports suggested that President Trump is likely to sign an order banning Chinese telecoms equipment next week which subsequently weighed on ZTE shares. Finally, 10yr JGBs were higher as the widespread risk averse tone underpinned safe-haven demand and BoJ presence in the market for nearly JPY 1.2tln of JGBs with maturities of up to 10yrs, which also coincided with declines in long-term yields with the 20yr, 30yr and 40yr yields at their lowest in more than 2 years. RBA Statement on Monetary Policy stated the probability of rate hike or cut is more evenly balanced than previous and that the board does not see a strong case for a near term adjustment in rates. RBA noted that higher rates would be appropriate at some point if progress is made but added that they might lower rates if there is sustained increase in unemployment and too low inflation, while it cut its GDP and inflation forecasts through to June 2020. (Newswires)

Top Asian News

- Thailand’s Movie Star Princess Is Running for Prime Minister

- Chinese Stocks Decline in Hong Kong on Renewed Trade Concerns

- Anil Ambani Group Says Sale of Pledged Shares Motivated, Illegal

- Indonesia’s Current Account Deficit Widens to Four Year- High

Major European equities have been flat throughout much of the session [Euro Stoxx 50 Unch], with some mild outperformance seen in the FTSE MIB (+0.1%) where Bper Banca (+0.8%) and UniCredit (+1.9%) are in the green following earnings and the Co’s CEO stating they do not see any upcoming cross border banking mergers respectively. Sectors are mostly in the green, with IT names leading. Other notable movers include Wirecard (+2.7%) who are towards the top of the Stoxx 600 having retraced some of the prior sessions’ losses following the FT reporting an analysis of the Co’s accounting scandal; recently the Co. have stated they are taking legal action against the FT over the reporting as they believe that no misconduct has taken place. Skanska AB (-6.9%) are at the bottom of the Stoxx 600 following their earnings and the Co. stating they are planning a dividend cut. Elsewhere, L’Oreal (+0.4%) are slightly firmer following their earnings, and Travis Perkins (+1.5%) are higher after being upgraded at RBC. US are reportedly considering 3 potential car tariff options, one of which includes a 10% levy; according to German press.

Top European News

- Germany’s Scholz Says EU Stands by Ireland in Brexit Impasse

- Italy’s Escalating Feud With Macron Puts Business at Risk

- Italy’s Industrial Output Drop May Signal Longer Recession

- European Bank Valuations Fell ‘Beyond What’s Realistic’: Goldman

In FX, looking at the AUD/GBP/EUR - It’s tight at the foot of the G10 table, with the Aussie and Pound looking particularly weak, but the single currency also on the precipice after more signs of Italy’s economic woes via a sharp decline in IP. Aud/Usd is only just off fresh lows of 0.7060 having filled bids and tested chart support around 0.7075 in wake of RBA’s SOMP that effectively confirmed the shift in policy stance to neutral from tightening signalled by Governor Lowe earlier in the week. However, hefty option interest between 0.7090-0.7105 may provide some respite with 1.1 bn expiries rolling off at the NY cut. Meanwhile, Cable has lost more recovery momentum from just shy of the 1.3000 mark after BoE super Thursday, as UK PM May returned from Brussels empty handed with the Irish border backstop issue unresolved. A 1.2926 Fib level is now being probed, ahead of 1.2900 and then the 100 DMA at 1.2893. Back to Eur/Usd, the headline pair is currently cresting yesterday’s 1.1325 low, and if breached 1.1300 looms before stronger downside chart support at 1.1289.

- CHF/NZD/JPY/CAD - All relative outperformers, or at least holding up better vs a generally firm Usd as the DXY nudges back up to 96.700. The Franc is resisting 1.0030 and the Kiwi is still pivoting 0.6750, albeit partly due to favorable cross flows as Aud/Nzd retreats below 1.0500 again. Usd/Jpy is consolidating between 109.50-110.00 and the Loonie has pared some losses after declining through 1.3300 to 1.3330 at one stage, perhaps in preparation for Canadian unemployment data due later.

In commodities, Brent (+0.3%) and WTI (-0.2%) prices have seen some modest strengthening throughout the European session, after prices were largely subdued overnight. Recent news flow from Energy Intel has seen sources state that OPEC and partners are heading towards a rollover of the current deal in April; which follows yesterdays comments from Russian Energy Minister Novak stating that the charter on indefinite cooperation with OPEC could be discussed in April. Elsewhere, TransCanada have declared a force majeure on keystone oil flows; and the two Canadian pipelines which were shut due to a potential leak are yet to reopen. Looking ahead we have the Baker Hughes Rig Count, which previously saw total rigs fall by 14 to 1055. Gold was unchanged, continuing from the uneventful price action seen overnight. Elsewhere, Vale has informed of a pre-emptive evacuation of around 500 people in the Gongo Soco iron mine area. Separately, copper prices have fallen for the second day on demand concerns following poor data from several global economies, including German industrial output; although, copper is in the green for the week.

Looking at the day ahead, we’ve got further December industrial productions prints in France and Italy, and December trade data in Germany. There is no data due in the US however the Fed’s Daly is due to speak tonight at an economic forecast conference. It’s also a quiet day for earnings with Exelon and Hasbro the most notable.

US Event Calendar

- Nothing major scheduled

DB's Jim Reid concludes the overnight wrap

Markets appear to have finally woken up from their mid-winter hibernation this week. Indeed we’ve seen a decent rally across rates over the last twenty-four hours while risk assets have finally had a bit of a session to forget. We’ll touch on some of the newsflow shortly but just quickly on markets and in particular bonds, we saw 10y Treasuries and Bunds close -3.7bps and -4.7bps lower last night with Treasuries also down a further -1.4bps overnight. Bunds outperformed most other European countries however yields were still generally speaking up to 4bps lower with the exception of BTPs which sold-off +9.0bps. That puts the Bund-BTP spread at 284bps and the most since December 11th last year. In fact that spread has widened 42bps in just over a week.

Bunds are now at 0.112% and the last time they closed lower was 835 days ago. Back then, ECB QE was in full flow with €80bn of net purchases being made per month. Core CPI in the Euro Area was also lower than it was now at +0.8% yoy and Arsenal were sitting joint top of the Premier League which is a depressing thought. The last time OAT yields were lower was November 2016 and Dutch yields were last lower also in October 2016, so this isn’t just a Bund story.

If we look back at yields since the ECB cut the deposit rate to -0.40% in March 2016, nominal Bund yields sit in the 86th percentile over that time (with 100 being the most expensive). OATs sit in the 80th while yields in Spain, Portugal and Netherlands sit in the 85th, 88th and 96th percentiles respectively. Contrast that to BTPs which sit in just the 10th percentile. So we’re very much still at the extremes. A final point on this stats binge is that the Bund curve is now negative again up until the 9y maturity point and amazingly the amount of negative yielding debt in the world is now back up at $8.9tn and up over 50% from October. You can be excused for feeling all a bit Déjà vu reading this.

As for risk assets, well the S&P 500 (-0.94%) is now more or less back to where it closed last week while the NASDAQ (-1.18%) fell a bit more. Earnings were actually fairly mixed however Twitter (-9.84%) did grab some headlines after disappointing the market with its Q1 sales forecast. White House advisor Kudlow’s comments about there being a “pretty sizeable distance” to go in US-China trade talks also didn’t help with the CNBC headline that Trump and Xi were unlikely to meet before March 1st adding further fuel to the fire. Without a meeting by the deadline, it becomes more likely that the US will raise tariffs as planned. At best, we might see an interim agreement to continue negotiating but it’s not obvious if this would be risk friendly and if instead the US just continues with upping the ante. Time will tell. On the other key area of US policy, there was some encouragement that the two parties may be approaching a budget deal to avoid another shutdown next Friday with Republican Senator Richard Shelby saying that “we hope by Monday or over the weekend” to finalize a deal.

Meanwhile, moves were similar here in Europe with the STOXX 600 (-1.49%) finally bringing to an end it’s run of seven consecutive gains after falling by the most since December 27th. The DAX (-2.67%) closed lower by the most in 40 sessions and the FTSE MIB (-2.59%), also by the most in 40 sessions, while European Banks were hit to the tune of -3.01%. The pain spread to EM also where the MSCI EM index closed -0.62%. With all that, volatility has finally picked up again with the biggest move for the VIX (+0.99pts to 16.37), VSTOXX (+2.55pts to 16.17) and MOVE (+1.53pts to 48.97) indices in 8, 28 and 24 days respectively. Meanwhile, HY spreads were +11bps and +7bps wider in the US and Europe, respectively, while WTI oil down was -2.54%. It’s worth noting that flying under the radar in all the moves yesterday was three-month USD LIBOR falling by the most in just under 10 years with some confusion in the market as to why the move was so severe.

This morning in Asia, markets are following Wall Street’s lead with the Nikkei (-1.94%) leading the decline while the Hang Seng (-0.49%) - which has now reopened - is also trading lower along with the Kospi (-1.16%). The good news is that volumes are slowly returning to more normal levels. China’s markets remain closed today but will reopen on Monday. Elsewhere, futures on the S&P 500 are down -0.43%. In commodities, iron ore prices are up another +4.30% this morning to take them to the highest since 2014. Despite that the Aussie Dollar (-0.31%) is weaker however the RBA did make the move to downgrade growth and inflation forecasts this morning.

Coming back to yesterday, the spark which really seemed to ignite yesterday’s moves appeared to be the latest European Commission growth forecasts. At a headline level, they cut the 2019 growth forecast for the Euro Area from 1.9% to 1.3%. Germany was cut from 1.8% to 1.1% and Italy from 1.2% to 0.2%. What’s a bit puzzling is that the Italy forecast was leaked in an ANSA report on Wednesday. So it was a bit of a delayed reaction. At this point it’s worth noting that our European Economics team recently cut their 2019 forecast for the Euro Area from 1.2% to 0.9%. They’ve also pegged Italy at 0.3%. They believe that the Euro Area is in a recessionary orbit – close to recession, at risk of being pulled into one temporarily given the non-linear dynamics of recessions, but unlikely to linger in recession unless risks like no-deal Brexit, trade conflict or a China crisis materialise. See more in their report here and our global report from the day prior here .

In the midst of the rates move we also had a BoE meeting to digest. The reaction for GBP which initially sold-off as much as -0.60% and then rallied +1.11% from the lows (and eventually closed +0.15%) suggested there was a bit of both for the hawks and doves however in fairness there were Brexit headlines in the middle of this. Just on the BoE firstly, rates were unanimously left unchanged as expected. However the minutes struck a more dovish tone with risks surrounding the external and domestic environment elevated. Indeed they pointed to a sharper and more persistent slowdown to global growth than previously anticipated. On the domestic front, downgrades to the economic outlook were also material. Interestingly, despite the weaker outlook in the near term, the MPC retained its tightening bias, calling for "limited" and "gradual" rate hikes over the forecast period. In summary though our economists tone reflected a more cautious one from the December meeting with Carney doing little to push back on more dovish current market pricing in the front end of the UK curve. While the MPC maintained the need for ongoing rate hikes, a rate hike before August remains off the table, in our colleagues view. They retain their call for one rate hike in August, albeit with weaker conviction.

As for the latest Brexit news, PM May is due to travel to Dublin today and have dinner with Irish PM Varadkar with May’s attorney general Cox meeting counterpart Woulfe this morning to discuss the Irish border issue. Yesterday we found out that May plans to stick with the February 14th deadline to present the Brexit motion in Parliament. The EU stance hasn’t changed however with Juncker rebuffing a demand from the UK to reopen the Withdrawal Agreement while the EU and UK have agreed to meet again before the end of February with time perilously close to running out now.

Over at the Fed we heard from Kaplan yesterday, who largely reiterated his recent comments in support of a 1-2 quarter pause in rate hikes. He said that current uncertainties “are not going to get resolved in weeks” and “it gives the Fed at a minimum the luxury of being patient”. Kaplan is not a voter this year and has been slightly more dovish than the FOMC’s median, but his comments likely reflect the current consensus view. Elsewhere, Vice-Chair Clarida gave an upbeat assessment of the economy by saying “the US economy is, by many measures, either at or close to full employment; growth is either at or perhaps somewhat above estimates of trend growth and inflation is right at the Fed’s 2% inflation objective”. MNI also quoted Harker saying that the decision on the level of Fed balance sheet is likely to be taken in the near future.

Staying across the pond, initial jobless claims data are becoming more and more relevant at the moment given the recent uptick with yesterday’s 234k reading – while down from 253k the prior week – still above expectations for 221k. The recent extreme weather is likely to be having an impact so we’ll need to see if there is some moderation over the coming weeks but it’s worth seeing how this develops. Prior to this Germany’s December industrial production reading was soft (-0.4% mom vs. +0.8% expected) albeit perhaps as expected given recent soft factory data in the country.

Finally, to the day ahead, where this morning we’ve got further December industrial productions prints in France and Italy, and December trade data in Germany. There is no data due in the US however the Fed’s Daly is due to speak tonight at an economic forecast conference. It’s also a quiet day for earnings with Exelon and Hasbro the most notable.