Q4 GDP Growth Estimate Beat - Stocks Ignore It

Q4 GDP Growth Beats Estimates

The stock market fell on Thursday. Yet quarter over quarter annualized GDP growth beat estimates for 2.2%. It was 2.6%. 2018 was the first year since 2004 where GDP growth was above 2% in all four quarters (2.2%, 4.2%, 3.4%, and 2.6%).

Stocks ignored the solid report because information on Q4 is old news. We are in Q1 where growth estimates are very low. The Atlanta Fed’s Nowcast is calling for just 0.3% growth in Q1. This quarter’s initial estimate is more useful than it usually is. Nowcast is getting a late start.

Potentially negative growth is one way to put a damper on Q4 estimates being beaten.

GDP growth is looked at either on a quarter over quarter basis or an annual basis. That’s nothing new. Personally, I like looking at annual growth which is shown in the chart below.

As you can see, growth was 3.08%. This is the first 3% print since 2005. The difference between quarter over quarter and annual growth was a hot topic on Thursday.

Quarter over quarter annualized growth rate has been falling for 2 straight quarters. And it's about to fall a 3rd time. The chart below shows annualized growth is in an uptrend. This controversy will be immaterial after Q1 because it should look weak anyway you look at it.

(Click on image to enlarge)

Q4 GDP Growth - Strong Consumption Growth & Labor Market

GDP price index was up 1.8% which beat estimates by 0.1% and was the same as Q3. It’s great to see low inflation continue.

Real consumer spending growth was 2.8% which makes the December retail sales report look like a temporary blip. Weak consumption growth won’t remain in a situation where there are low jobless claims and high real wage growth.

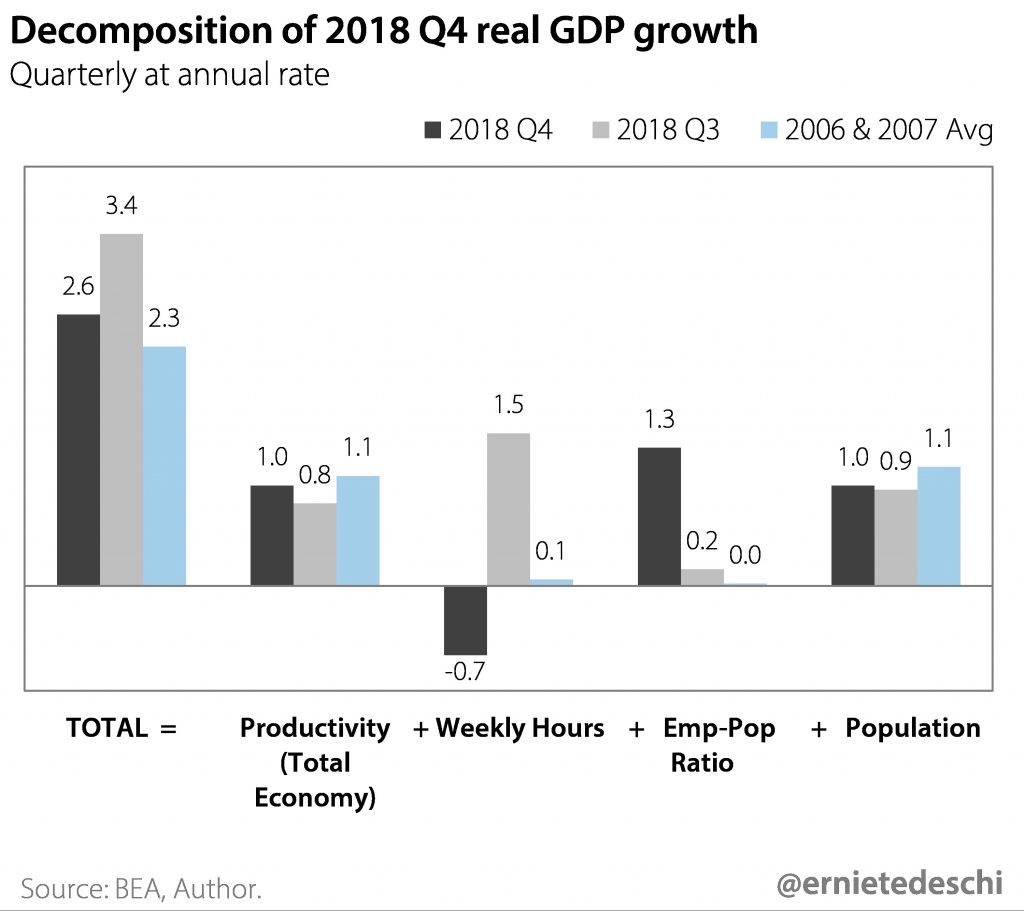

The chart below shows the decomposition of Q4 real GDP growth. It’s different from the normal viewpoint which breaks down GDP growth by personal consumption, domestic investment, net trade, and government spending.

As you can see, the improvement in the employment to population ratio catalyzed this growth beat as it added 1.3% to growth. That’s much more than the 0.2% addition in Q3. It didn’t add anything on average between 2006 and 2007 as the labor market was peaking then. Q4 saw many people coming off the sidelines and joining the labor force.

Population growth was steady as that doesn’t follow the cyclical changes to economic growth. Weekly hours growth was the black hole on this quarter’s report as it was -0.7% after being 1.5% in Q3.

Productivity growth was in line with Q3 and the 2006-2007 average. Stubbornly low productivity growth has flummoxed policy makers and has been blamed for the low GDP growth per capita of the past decade.

(Click on image to enlarge)

Q4 GDP Growth - Mixed Results

Residential investment growth fell by 3.5%; it was down every quarter in 2018. That’s not a surprise because the housing market has been weak.

Housing price growth is expected to be 1.2% quicker than wage growth in January, so residential investment growth may not improve in Q1. It depends on how much of a factor the decline in interest rates is. Consumers were widely expecting interest rates to rise. This was a bit of a ‘shock to the system’ which may energize interest in home buying.

Redfin’s CEO stated housing demand is stronger in January and February. But we aren’t out of the woods of the weakness that started last year.

Trade was a 0.2% drag on GDP growth. Government spending was up 0.4% and business investment had a big upside surprise as growth was 6.2%.

As you can see from the chart below, research and development was up 13.5% annualized in Q4. The grey line shows private research and development was 2.3% of GDP. There is a secular uptrend in research and development which has surprisingly led to mediocre productivity growth.

Many activists, who aren’t familiar with this trend, claim corporations need to invest more in research and development and less on the pay of top management. Unfortunately, like most issues in economics, mediocre productivity growth can’t be improved by making a simple change.

(Click on image to enlarge)

Q4 GDP Growth - December PCE & January Income Growth

December full PCE report finally was released Friday along with income growth from January. Personal income growth was 1% monthly in December. That beat estimates for 0.4% and the revised 0.3% (from 0.2%) growth in November.

Growth was -0.1% in January which missed estimates for 0.3%. Growth swung sharply because of shifts in proprietor’s income and return on assets; they fell sharply in January.

The savings rate spiked sharply in December from 6.1% to 7.6% which is the highest rate since January 2016. Coincidentally, the last recession scare occurred in early 2016.

The decline in consumption was catalyzed by fear even though income growth was strong. The good news is wages and salaries growth was 0.3% in January after growing 0.5% in December.

Specifically, consumer spending growth was -0.5% monthly in December. That missed estimates for -0.3%. The November reading was revised up from 0.4% to 0.6%. Durables and non-durables spending fell 1.9% and services spending growth was only 0.1%.

Q4 GDP Growth - Consistently Subdued Inflation

Headline PCE inflation was 0.1% monthly which beat estimates and November’s growth by 0.1%. It was up 1.7% year over year which met estimates and fell 0.1% from last month.

Core PCE was stronger than headline PCE because of the decline in oil prices. Core PCE growth was 0.2% monthly which met estimates and the revised growth rate in November. It was stagnant at 1.9% yearly which met the consensus.

Although this is old data, it’s still great to see inflation below the Fed’s 2% target as it allows the Fed to maintain rates.

The biggest news from the March Fed meeting will be the specifics on the end of QT and guidance for 2019 hikes because there is a 98.7% chance rates stay the same. Even though the Fed has been clear about being patient, it will still be news for the Fed to make a change in its guidance for hikes this year.

The December guidance called for 2 hikes which clearly aren’t going to happen.