Q1 Market Update: Sometimes Risk Assets Go Down…

Q1 Wrap Up

(Click on image to enlarge)

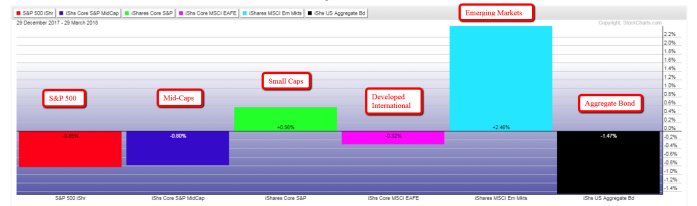

The 1st quarter saw a return of volatility,ending a 9 quarter win streak. Most asset classes finished lower for the quarter, led by the aggregate bond index. Emerging markets and small caps finished positive.

Diversification works over time, that much we do know. However, that doesn’t mean it works every day, month, quarter, or year for that matter. Long term investors shouldn’t be dismayed, or surprised, when asset classes act in unison at times. Stay diversified, and don’t chase performance.

(Click on image to enlarge)

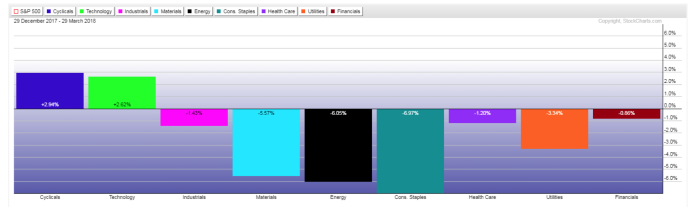

From a sector level, technology and consumer discretionary were the only two sectors to close with gains for the quarter. The weakest sectors were the rate sensitive consumer staples and utilities, along with energy and basic materials.

(Click on image to enlarge)

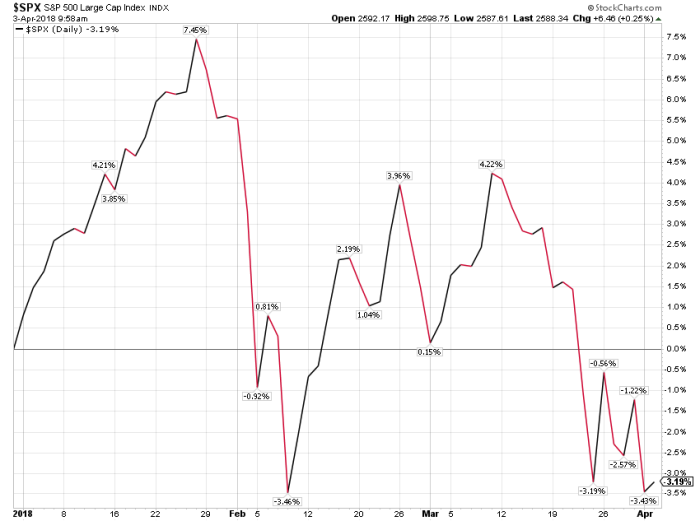

Much has been made about the recent volatility in the markets. But it’s not nearly as bad as it’s been made out to be. For example, the Dow closing down 1,000 points in one day sounded awful. But in reality, when the Dow is near an all time high above 20,000, a 1,000 point daily move is only about 4%. 4% isn’t fun, but it’s certainly far from a doomsday scenario. The 1987 crash experienced a 22% decline in one day, even though the decline in points was less, it was far more impactful than anything we’ve seen.

To clarify this point, the above chart shows the 2018 year to date performance of the S&P 500. Even with the recent volatility, the market is only down 3.19% year to date. This is perfectly normal. Stocks are risk assets, sometimes they do go down. Before $1 is invested, understand that you’ll have to put up with these periods from time to time. That is why stock investors have been compensated well over time (assuming you don’t panic and sell), because you have to deal with this periodically. It comes with the territory.

(Click on image to enlarge)

Is this a precursor to another crash? I understand how investors are still fearful of market crashes after the lost decade of 2000-2012. But the reality is that not every decline ends in a crash. Stocks can, and do, go down without it being a crisis. Why just a couple years ago, the market got off to it’s worst start ever. The above chart shows how 2016 got to negative 10.51% year to date performance level, more than twice as bad as our current situation in 2018. Yet the markets proceeded to do just fine.

Market Technicals – Trader’s Timeframe

(Click on image to enlarge)

The last time the market experienced a correction (decline of 10%+ from highs) was 2015-16. The above chart shows how the decline came in two selling “waves”. The first initial selloff came fast and sharp, producing a 12.55%. The market rebounded much of the decline, but eventually succumbed to a second round of selling that took the index down below the prior low, for a full decline of 15.21% before it was all said and done.

(Click on image to enlarge)

If we fast-forward to today, we can see a similar setup potentially playing out. The first initial selling shock wave came in February, pushing the index down 11.84% from it’s highs. We rebounded, gaining back much of the lost ground, but have once again come under selling pressure.

A similar 15% decline, matching what happened in 2015-16, would mean support on the S&P 500 would stand between 2435-2462. Should the February low fail to hold.

This seems reasonable and rather normal for stocks historically. Given the current fundamentals of strong earnings growth, reasonable valuations when compared to fixed income and inflation, and low risk of recession, this scenario would be the maximum downside I could really see us experiencing. And it’s quite possible the February low holds, and we never get that lower low at all. Even so, it’s worth having a plan in place beforehand.

Conclusion

Despite all the noise in the media, things are quite good economically. Scary headlines are not fundamental analysis. People will use this time to justify all their preconceived notions about everything from finance to politics. But the reality is that stocks are risk assets. They go down from time to time. And often there’s no rhyme or reason. Half of all years since 1950 have experienced a double digit correction in stocks. This is nothing new or out of the ordinary. Get used to it!

Eventually the dust settles and things calm down. And then there will be a whole new set of problems to worry about. If your waiting for the “all clear” sign before investing, your either going to be late to the party and/or paying an exorbitant price.

Remember, volatility is not the enemy because it causes these swift price fluctuations. It is the enemy because it drives bad decisions. Don’t let this volatility scare you out, or away, from your long term investments. You only lose if you give in.

Disclosure: None.

Nothing on this article should be misconstrued as investment advice. Trading and investing is very risky, please consult your investment advisor before making any ...

more