Q1 2018/19 Soybean Demand/Stocks

Market Analysis

This year’s record US soybean crop has found record domestic crush and disappointing overseas demand during the 1st quarter of the US crop year. The past 7 months of trade tensions between the US and China has had a heavy impact on US soybean exports after US tariffs on Chinese imports prompted Beijing to retaliate by placing duties on US bean imports. However, the current 90-day pause will hopefully lead to a trade deal as the US and China resume talking in Beijing this week.

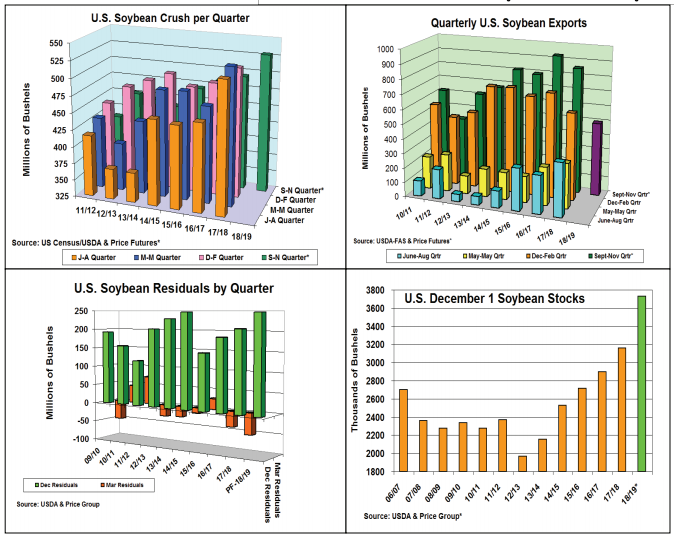

The current Federal government shutdown has added to the drama and uncertainty in the markets. Despite no USDA Fats and Oils soybean crush report, November’s NOPA crush report of 166.96 million bu. suggests our US total crush was 176.7 million. This means this year’s 1st quarter domestic soybean demand was 529 million bu., 34 million higher than last year & the 4th consecutive record fall US crush. With the current outlook already 25 million higher than last year, the USDA may leave this outlook unchanged until more monthly data is available. In exports, last fall’s 1st quarter shipments totaled 498 million bu., down 358 million from 2017 when China stayed out of the US export market because of its self-imposed 25% import tariffs on US soybeans. Without any overnight or weekly export sales data since late December, no exact amount of Chinese bean purchases is known during the current trade negotiation period. The general trade talk of 2.7 to 3.0 metric tons (100-110 million bu) seems the minimal increase of Chinese exports for a revised 2 to 2.1 billion yearly export level. US soy exports will remain fluid until the US/China trade tensions are resolved or abdicated with no resolution.

Utilizing these demand numbers & a fall residual level that will likely be on high side (246 million bu) because of the late harvest in parts of W Midwest and the SE, a 3.725 billion bu. Dec 1 quarterly stocks seems likely.

What’s Ahead

A modest 45 million smaller final bean crop because of last fall’s late harvest in parts of W Midwest & recent Chinese bean buys during current US/China trade talks may tighten the US ending stocks to 800 million. This decline is going in the right direction, but US soybean stocks remain high. Further S. American weather problems are needed for push above $9.50. Move sales to 70% on rallies into $9.25-$9.40 range.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more