Pump It Up

For those investors looking for a final, quiet summer vacation period before the kids go back to school, think again—the bond market has certainly had other plans. The tumultuous events that kicked off August have served as a not-so-subtle reminder that volatility appears to be here to stay. Yield movements in the Treasury market have been on a roller coaster since the Federal Reserve’s (Fed) July rate cut, and given the various catalysts that remain out there (solid job market, good U.S. growth but recession fears, trade uncertainty, softening global economies, Middle East (Iran) flare-ups), it’s a difficult landscape for fixed income investors to traverse.

Certainly, the recent trend has been for rates to be on a descending trajectory, but what if headlines or tweets change course? Then what? Against this backdrop, I continue to advocate a solution for fixed income investors that has been time-tested, and does not require a “call” on where you think interest rates may be headed—the barbell strategy.

As the reader may recall, we began writing about this approach last summer, utilizing the Bloomberg Barclays U.S. Aggregate Yield Enhanced (AEY) Index and U.S. Treasury floating rate (UST FRN) strategy and comparing the results to the widely followed benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index (AGG). At first, the combination centered around a 70% AEY and 30% UST FRN blend, but throughout the course of 2019, this ratio has continued to be adjusted due to the decline in intermediate yields and the resulting flattening of the yield curve.

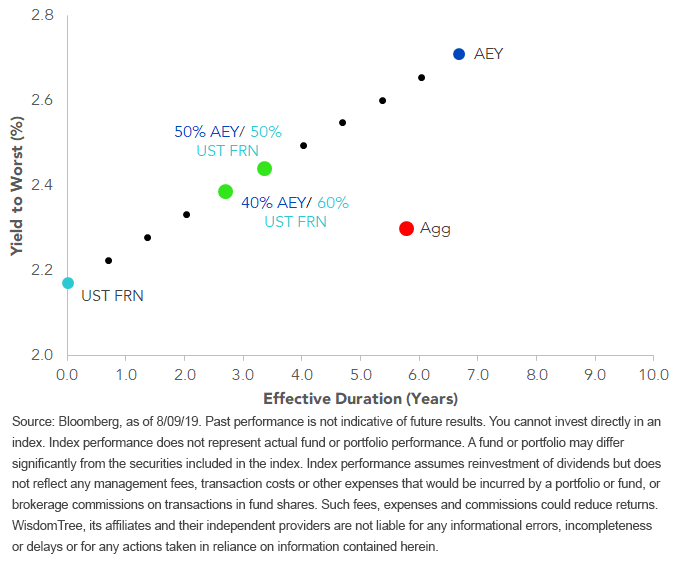

Yield to Worst and Effective Duration Comparison Enhanced Yield/UST FRN vs. Aggregate

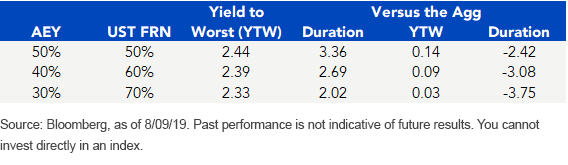

The accompanying graph now illustrates the updated combination of either 50% AEY/50% UST FRN or 40% AEY/60% UST FRN pairings. Given the latest bout of yield curve flattening, I also threw in a 30% AEY/70% UST FRN combo for consideration. Here are the respective results versus the Agg:

Conclusion

The WisdomTree Yield Enhanced U.S. Aggregate Bond Fund (AGGY), which seeks to track the Bloomberg Barclays U.S. Aggregate Enhanced Yield Index, and the WisdomTree Floating Rate Treasury Fund (USFR), which seeks to track the Bloomberg U.S. Treasury Floating Rate Bond Index, can be utilized as the two “weights” of the barbell strategy. This approach offers a strategic solution that is designed to help fixed income investors navigate the uncertain waters that loom ahead, without making a “high conviction bet” on where rates are headed in this seemingly “ever-changing” interest rate landscape.

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more