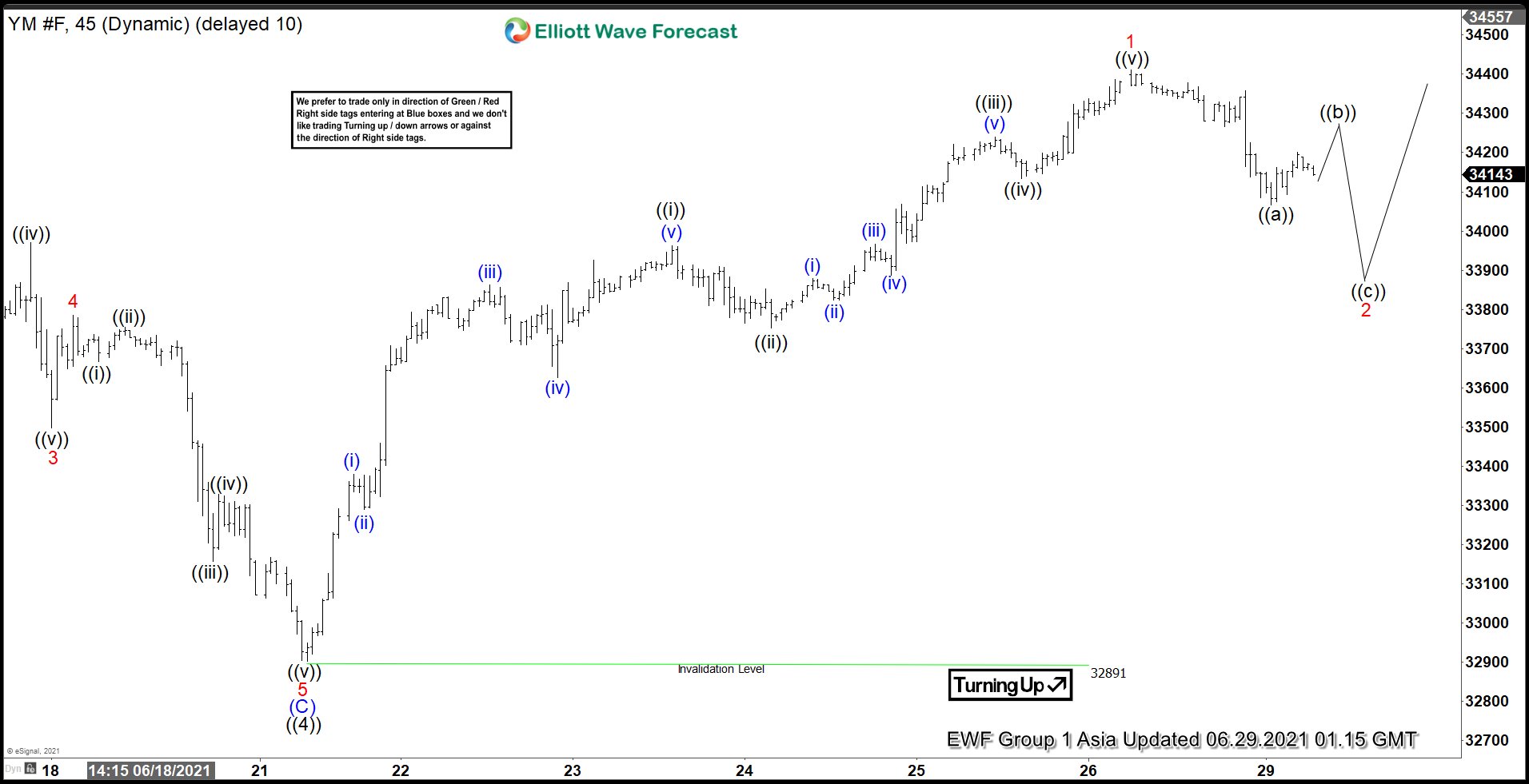

Pullback In Dow Futures (YM) To Find Support

Video Length: 00:07:25

Short-term Elliott Wave View in Dow Futures (YM) suggests cycle from March 2020 low remains intact in a 5 waves impulse Elliott Wave structure. The 45 minutes chart below shows wave ((4)) of this impulse ended at 32891. The Index has turned higher in wave ((5)) with the internal unfolding as another impulse to a lesser degree. It still needs to break above the previous wave ((3)) peak at 35000 on May 10 peak to rule out a deeper correction. Up from wave ((4)) low, wave (i)) ended at 33380, and pullback in wave (ii) ended at 33289.

Index resumes higher in wave (iii) towards 33863 and dips in wave (iv) ended at 33627. The final leg higher wave (v) ended at 33962 which also completed wave ((i)). The pullback in wave ((ii)) ended at 33752. The index then resumes rally higher in wave ((iii)) towards 34240, and a pullback in wave ((iv)) ended at 34133. The final push higher in wave ((v)) ended at 34411 which completes wave 1 to a higher degree. The index is now correcting the cycle from June 21 low in wave 2 before the rally resumes. As far as pivot at 32891 low stays intact, dips should find support in 3, 7, or 11 swing for more upside.

Dow Futures (YM) 45 Minutes Elliott Wave Chart

(Click on image to enlarge)

Disclaimer: Futures, options, and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as well as for ...

more