PSW Trade Review – Thank You Sir, MAY I Have Another! – Part 1

1,900 on the S&P, 16,600 on the Dow!

The month isn't quite over yet but we're up about 3% for the year now although, as Dave Fry points out, on record low volumes – which makes the whole thing sort of suspect.

[Chart by Dave Fry]

It seems contrived but those that can engineer a new record SPY close were able to get the job done Friday.

To some extent, we've sat out this "rally" as we moved to mostly cash last time the S&P tested 1,900 and we're certainly not true believers just yet. Nonetheless, our virtual portfolios are well outperforming the market despite having very little of our cash committed. Our $500,000 Long-Term Portfolio is up a whopping 12.5% for the year ($62,500) with $499,650 of cash remaining, while even the more bearish $100,000 Short-Term Portfolio is up 0.7% ($700) with $83,840 left to deploy.

[Chart by Dave Fry]

That's because we're teaching our Members this year "Don't Gamble With Your Investments - BE THE HOUSE – Not the Gambler" this year. Our key strategy where use options to sell risk to others, which gives us an excellent probability of making good money in up, down or sideways markets. Clearly, we've had a little of all of that this year!

We have the modest goal of making 20% a year, which keeps us on track to turn $250,000 into $5,000,000 in 15 years - allowing us to retire in style.

We have also been constructing a new Buy List (part 1 and part 2, so far) for our Members, our 20 favorite post-earnings bargains. Those are our "official" trades but, at Philstockworld – we're all about teaching our Members HOW to trade – using the principle of "Give a man a fish and you feed him for a day but teach a man to fish – and you feed him for a lifetime." Not only does it benefit our students but many of our students become masters themselves and enrich our trading community over time.

[Chart by Dave Fry]

The following is a list of the untracked trades we make every day in our Live Member Chat Room. We haven't done one in a while as it was getting boring, since the always up market combined with our "Be the House" strategy was giving us 85% winning trade averages (see Portfolio Reviews). The purpose of a review is to see what's going right and what's going wrong – when almost everything goes right, the reviews seem pointless.

At this moment, I don't know how we did in May, I will begin reviewing as I write the rest of this lengthy post. Keep in mind that where a trade stands 2 or 3 weeks after it was made is very arbitrary, but one of the main purposes of doing these trade reviews is to identify trade ideas that DID NOT work – as those give us even better entries than we had before (assuming the fundamentals didn't betray us).

Every single trade you see here came from either my morning post (you can sign up here) or the Live Member Chat Rooms we maintain each trading day (the comment section below those posts).

I like to include the title of that post and some of the commentary, so we can look at the trade in the perspective it was taken. I find that reviewing trades like this, periodically, makes me a smarter trader – it's something you might want to try with your own trades as well.

You will see a wide variety of trading styles here – from very aggressive short-term Options and Futures trading to the Long-Term, Conservative Strategies we prefer for the bulk of our investments. It's fine to gamble a little, as long as your investment strategy is otherwise on track to a solid retirement plan!

April 28: Monday Market Manipulation – M&A News Keeps Things Hot

The fact that one multi-Billionaire can afford to buy crap from another multi-Billionaire with money they are able to borrow at 3% doesn't tell you anything real about the economy. What is real is the Shanghai dropping 1.62% today, finishing at the low, just over 2,000 (not reflected in chart yet). What kind of moron would ignore something that significant going on in the World's 2nd-largest economy? Oh yeah, US investors, apparently…

All we know for sure is that PFE has admitted they have contacted AZN to "renew discussions" but PFE's stock has made no progress this year, so they'd have to pony up a lot more cash to satisfy the rumor mill. Nonetheless, all Healthcare stocks are rising in Europe and the US this morning and Healthcare is about 13% of the S&P, right up with Financials in significance so isn't it a very happy coincidence for those who needed the market propped up that we had such a big deal announce, or re-re-reannounced this morning?

- Silver (/SI) Futures long at $19.60 out at $19.67 - up $350 per contract

- Dow (/YM) Futures short at 16,400, out at 16,250 - up $750 per contract

- Russell (/TF) Futures short at 1,125, out at 1,000 - up $2,500 per contract

- Oil (/CL) Futures short at $102, out at $100.50 - up $1,500 per contract

- AAPL 2016 $500/550 bull call spread at $21, now $32.60 - up 64%

- 10 CAKE Oct $45/49 bull call spreads at $2 ($2,000) selling 8 June $47 calls for $1.90 ($1,520) for net $480, now $2,360 - up 391%

- CROX 2016 $12 puts sold for $12, still $1.60 – even

- 4 FB Jan $60/50 bear put spreads at $4.40 ($1,760), selling 5 June $60 puts for $4 ($2,000) for a net $240 credit, now $952 - up 296%

- IRBT long at $34.13, now $35.99 – up $1.86 - up 5.4%

- 10 IRBT Dec $35/45 bull call spreads at $2.90, selling 10 Dec $30 puts for $3.30 for net $400 credit, now net $50 credit - up 87%

- S&P (/ES) Futures short at 1,870, out at 1,850 - up $1,000 per contract

- SDS June $28/32 bull call spread at $1, selling F 2016 $13 puts for $1.05 for a .05 credit, now -0.60 - down 1,100%

The SDS, of course, was a hedge, which helps lock in the ridiculous gains our other trades made. Keep in mind that hedges are insurance plays we EXPECT to lose – they are only there to protect our bullish bets. Notice we make all sorts of trade during a day – that's because we have a diverse group of Members with different trading interests. By sharing the conversation – over time, everyone learns new trading strategies – as well as ways to improve on their own ideas.

April 29 – Technical Tuesday – 1,880 or Bust Again – China's Melting Away!

The only thing Small Caps really have going for them is that the Mega-Caps have been snapping them up, especially in the Energy and Biotech sectors and it's that consolidation trend, much like in 2007, that is driving us to new highs – despite the relatively poor economic performance in the background…

How long can the madness last? Until the music stops and the Fed stops giving interest-free Trillions to their Bankster buddies who, in turn, push for M&A deals with low-cost financing and find many willing partners in the Mega Caps – as they are not able to grow their business internally in a stagnant economy.

In order to protect their phony-baloney jobs (harrumph!), large-cap CEOs are buying their own stock and the stock of their competitors – whatever they can get with the oceans of cash that are sloshing around for the top 0.01% to dip into at will.

- Oil (/CL) Futures short at $102, out at $99 - up $3,000 per contract

- Dow (/YM) Futures short at 16,450 – out even

- S&P (/ES) Futures short at 1,870 – out even

- Nasdaq (/NQ) Futures short at 3,550 – out even

- Russell (/TF) Futures short at 1,120, out at 1,110 - up $1,000 per contract

- AAPL 2016 $600/750 bull call spread at $40, selling 2015 $600 puts for $37.50 for net $3.50, now $8.60- up 145%

- LUV 2016 $27 calls at $2.60, selling June $24 calls for .85 for net $1.75, now $1.15 - down 34%

- EBAY Jun $52.25/55 bull call spreead at $1.30, out at $1.40 - up 7.6%

- PNRA 2016 $150/180 bull call spread at $15, selling 2015 $150 puts for $9 and May $170 calls at $4.50 for net $1.50, now net -$3.50 - down 333%

- STX 2016 $52.50/57.50 bull call spread at $1.90, selling 2016 $30 puts for $1.60 and June $50 puts for $1.60 for net $1.30 credit, now 0.25 credit - up 80%

- TWTR 2016 $40/50 bull call spread at $5, selling $35 puts for $4.40 for net 0.60, now -$8.60 - down 1,533%

- Nikkei (/NKD) Futures short at 14,500, out at 14,300 - up $1,000 per contract

- NLY at $11.32, selling 2016 $10 calls for $1.50 and 2016 $12 puts for $2.75 for net $7.07/9.54, now $11.76 - on track

As you can see, when you live by the leverage, you die by the leverage! Of course, we adjust these trades when they miss and TWTR is one we deconstructed in our portfolio already without too much damage. My comment on the TWTR earnings trade the next day in our Live Member Chat was:

For those who are in the TWTR earnings play, I'd roll the short puts to the 2016 $30 puts for a .50 credit and buy back the $55s for $5, sell the $40s to another sucker for $10 and roll down to the 2016 $23 calls at $18. That would change the net to 0.60 – .50 + $5 – $10 + $8 = $3.10 on the 2016 $23/40 bull call spread with the short $30 puts.

PNRA, on the other hand, is one of those gems we look for when doing these reviews. The stock is just under $155, still above our short Jan $150 puts, so the $9.50 that is currently charged against the -$3.50 position will evaporate over time and turn into a profit – it's just not the immediate profit we hoped for but, as a new trade – it's an even better entry than we had before.

April 30 – Will We Hold It Wednesday – $100 Oil Edition

If not for the continuing nonsense in the Ukraine, oil would be much lower at the moment as we print record US inventory storage today (10:30 is the official report) without near-record supply and nowhere near record demand.

- EZCH Jan $25/30 bull call spread at $1.85, selling $20 puts for $1.75 for net .10, now .70 - up 600%

- AAPL 2016 $600/700 bull call spread at $31, now $35.50 - up 14%

May 1 – Thrilling Thursday – Dow Hits Record Highs on Lower Earnings

Why should we worry?

The Dow is at 16,580 so all must be well, right? The fact that we're up here on low volume and even lower earnings is just one of those nit-picky things that won't matter a year from now, when TA people use the movement to draw new, bullish trend lines.

That's what the Fed is controlling, they are painting charts in broad strokes to keep things moving along – even when they aren't.

The Fed says it's just bad weather slowing us down and, whether or not you believe that, they also promise to continue to stimulate the economy long after it is necessary. The Fed is like Santa Claus, only they don't have to put in any effort to make their toys, so Christmas comes 365 days a year for the top 0.01%. For the bottom 99.99% – well, it's 0.1% growth on the "trickle down" effect.

- S&P (/ES) Futures short at 1,880, out at 1,870 - up $500 per contract

- Oil (/CL) Futures long at $98.50, out at $100 - up $1,500 per contract

- Nikkei (/NKD) Futures short at 14,500, out at 14,400 - up $500 per contract

- Dow (/YM) Futures short at 16,500 , out at 16,450 - up $250 per contract

- Russell (/TF) Futures short at 1,130, out at 1,115 - up $1,500 per contract

- DLTR Jan $50/55 bull call spread at $2.40, selling 2016 $45 puts for $3.60 for a net $1.20 credit, now -0.20 - up 83%

- Gasoline (/RB) Futures at $2.92, out at $2.95 - up $1,260 per contract

- LNKD June $180 calls at $4.60, out at $2.50 - down 32%

- AKAM Jan $55/65 bull call spread at $3.40, selling 2016 $45 puts for $5.40 for net $2 credit, still $2 credit – even

- XRT June $82 puts at $1.50, out at $2.50 - up 66%

May 2 – Non-Farm Friday – Our Economy Is Not Worlking

When is a job not a job?

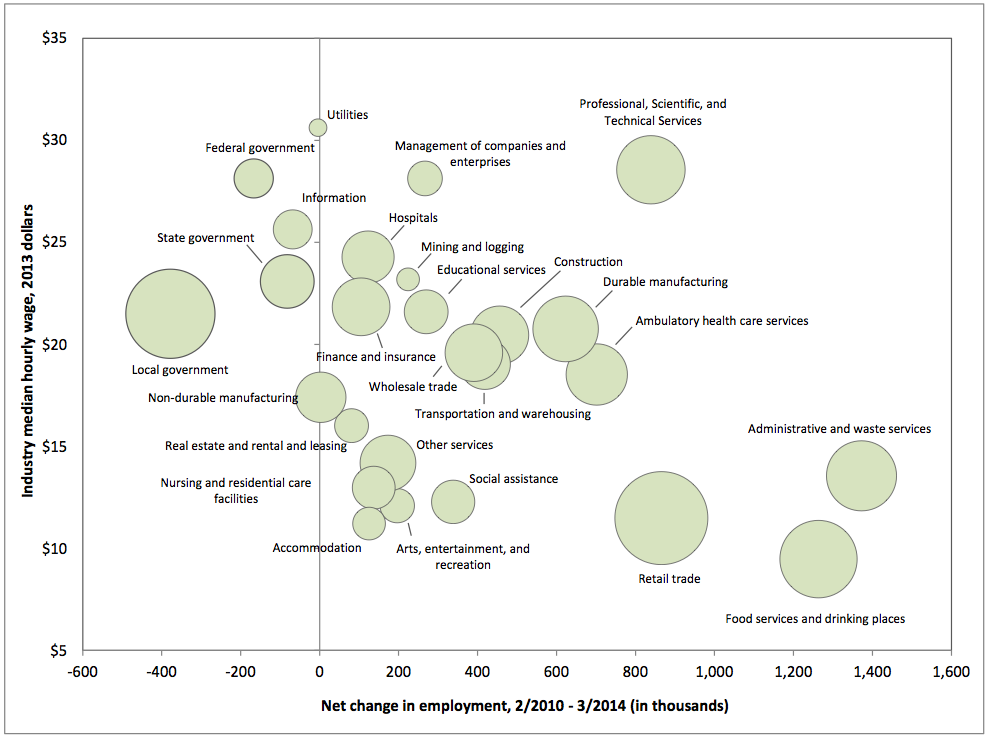

When the job sucks! We've all had crappy jobs in our lives – something we stay in to pay the bills but has no chance of being a career. As you can see from this chart, a lot of career Government jobs have disappeared over the past 4 years – the kind of jobs that held advancement and retirement and health benefits.

They have been replaced by Retail, Food Service and "Adminstrative and Waste Services" – ie., minimum wage jobs. That's why, when the GOP puts up charts with minimum wage data, they tend to have old data. The newer the data is, the worse the picture looks and the harder it is to spin into the "job creator" mythology.

- Silver (/SI) Futures long at $19, out at $19.17 - up $850 per contract

- Nasdaq (/NQ) Futures short at 3,600, out at 3,575 - up $500 per contract

- Dow (/YM) Futures short at 16,550, out at 16,450 - up $500 per contract

- S&P (/ES) Futures short at 1,885, out at 1,875 - up $500 per contract

- Russell (/TF) Futures short at 1,130, out at 1,120 - up $1,000 per contract

- Oil (/CL) Futures short at $100, out at $99.50 - up $500 per contract

- Nikkie (/NKD) Futures short at 14,600, out at 14,400 - up $1,000 per contract

- LNKD 2016 $150/175 bull call spread at $10, selling $100 puts for $9 for net $1, now $1.85 - up 85%

- SGEN 2016 $30/40 bull call spread at $4.50, selling $25 puts for $4.20 for net .30, now $0 - down 100%

- SDS June $28/32 bull call spread at 0.65, selling F 2016 $13 puts for 0.98 for net .33 credit, now .50 credit - down 51%

The other way you win on earnings is DON'T PLAY AHEAD OF EARNINGS and WAIT for an opportunity to buy good deals like LNKD or SGEN when they sell off more than you think they should have!

Well, the month is off to a great start with 47 trade ideas in the first 5 days and only 7 misses for an 85% winning percentage. As I always point out, we're not supposed to have 100% winning percentage becase that means we're not hedging properly and then, when we are wrong, things can get very ugly. The key is to BALANCE your picks and sell plenty of premium – that puts the odds very much in your favor and, over the long haul – that's what counts.

As I noted above, with earnings plays like LNKD, you are often better off simply having a watch list and waiting PATIENTLY until after earnings to pick up bargains. We lost $2.10 on our long stab, but we made back 0.85 and, evenually (hopefully) $9 by selling puts the next day as they drop. Often the smarter, less stressful play is to simply wait until you have more data – so you can make a smarter play.

On to part 2!