Protection Against A December Volatility Spike

Stock market activity has essentially slowed to a crawl, and many traders are wondering if that’s it for volatility in 2019. Some traders are jokingly wondering if they should take the rest of the year off. It certainly seems like the market isn’t interested in action these days.

There are certainly mechanical reasons for the drop in volatility. With interest rates at ultra-low levels, fixed income products are not providing reasonable yields for many investors. Big funds have resorted to selling volatility in order to generate yield.

The amount of cash flowing into the short-volatility trade is certainly keeping a lid on overall market volatility levels to some extent. Yield generation is the most important aspect of the financial markets for many investors, and funds will find yield wherever they can get it.

However, mechanics isn’t the only reason why volatility is low. Certainly, the news cycle has died down in terms of market-moving material. The rhetoric between China and the US has softened. Plus, and probably most importantly, the Fed has been accommodative with interest rates.

Keeping rates low is the Fed’s attempt to avoid a recession or at least engineer a soft landing. Whether it will be effective remains to be seen, however, it certainly is having an impact on the stock market.

Cheap money is good for businesses that use it for stock buybacks and some business investment (although not as much as hoped). This has also served to send stocks higher and volatility lower.

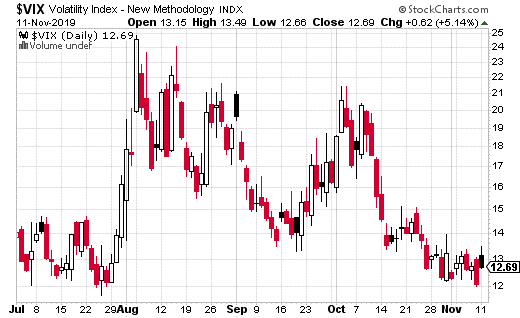

Nevertheless, given what we’ve seen in August and early October this year, it may not take much for volatility to spike. As you can see in the graph of the VIX (S&P 500 Volatility Index), we had some pretty sharp spikes in volatility over the last few months.

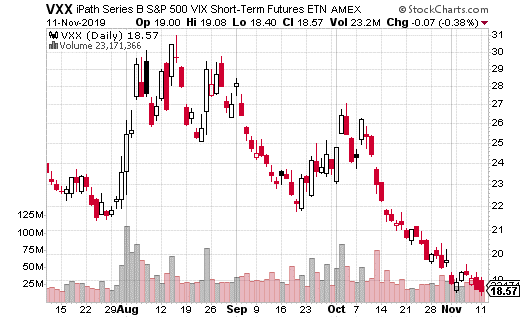

At least one trader is betting on or protecting against a substantial spike in short-term volatility through the end of the year. This trader bought a December 27th call spread in iPath S&P 500 Shor-Term Futures ETN (VXX).

VXX is a popular method for short-term trading volatility as it is based on the first two futures of the VIX. The VIX itself is not a tradable index, so ETFs based on VIX futures have grown in popularity over the years due to ease of access.

Back to the trade, the call spread involved the 20 calls (purchased) and the 30 calls (sold) for a total debit of $0.99. This trade was made 2,500 times, so the amount of premium spent was right around $250,000. That cash outlay is also the max loss if VXX remains below $20.99 at December expiration.

The trade can make money up to $30 in VXX, where max gain would be capped at $9.01. With 2,500 spreads traded, this works out to be about $2.3 million in profits. In percent terms, that’s about a 900% potential return.

Keep in mind; it would take a major shock to the market to get short-term volatility to move up that far, that fast. It could happen, but it’s not likely. If you look at the chart of VXX, you can see just how far it has fallen. (This trade was made with VXX at $18.45 for reference.)

If you want to speculate on long volatility or protect against a sharp selloff in stocks (which would lead to higher volatility), then copying this trade isn’t a bad plan. It’s relatively cheap with high upside potential. While you may not reach max gain, seeing this spread turn profitable is certainly in the realm of possibility, given how fast the market can start to worry if negative news starts rolling in.