Predicted Acceleration In DJIA Rise To Continue

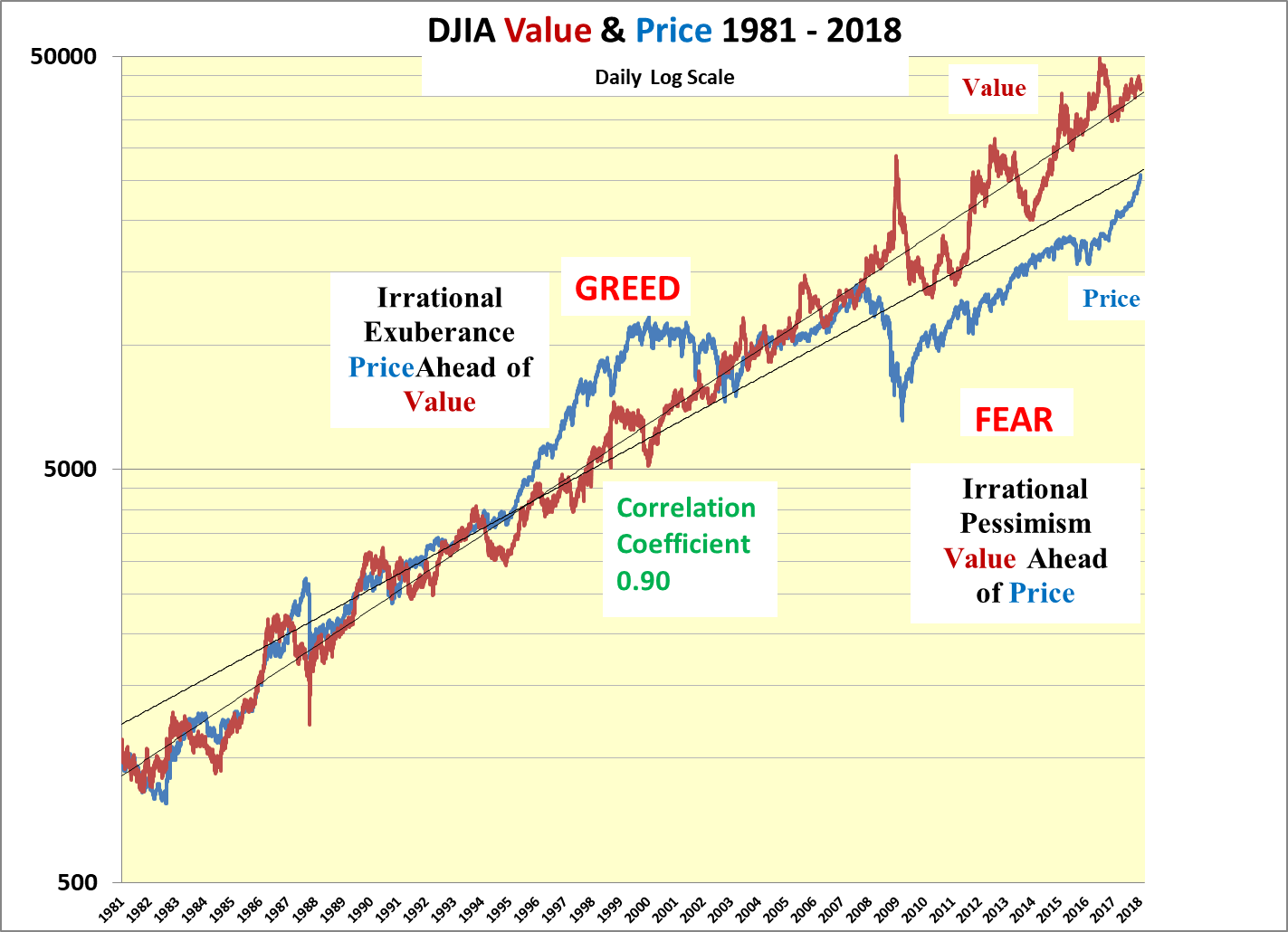

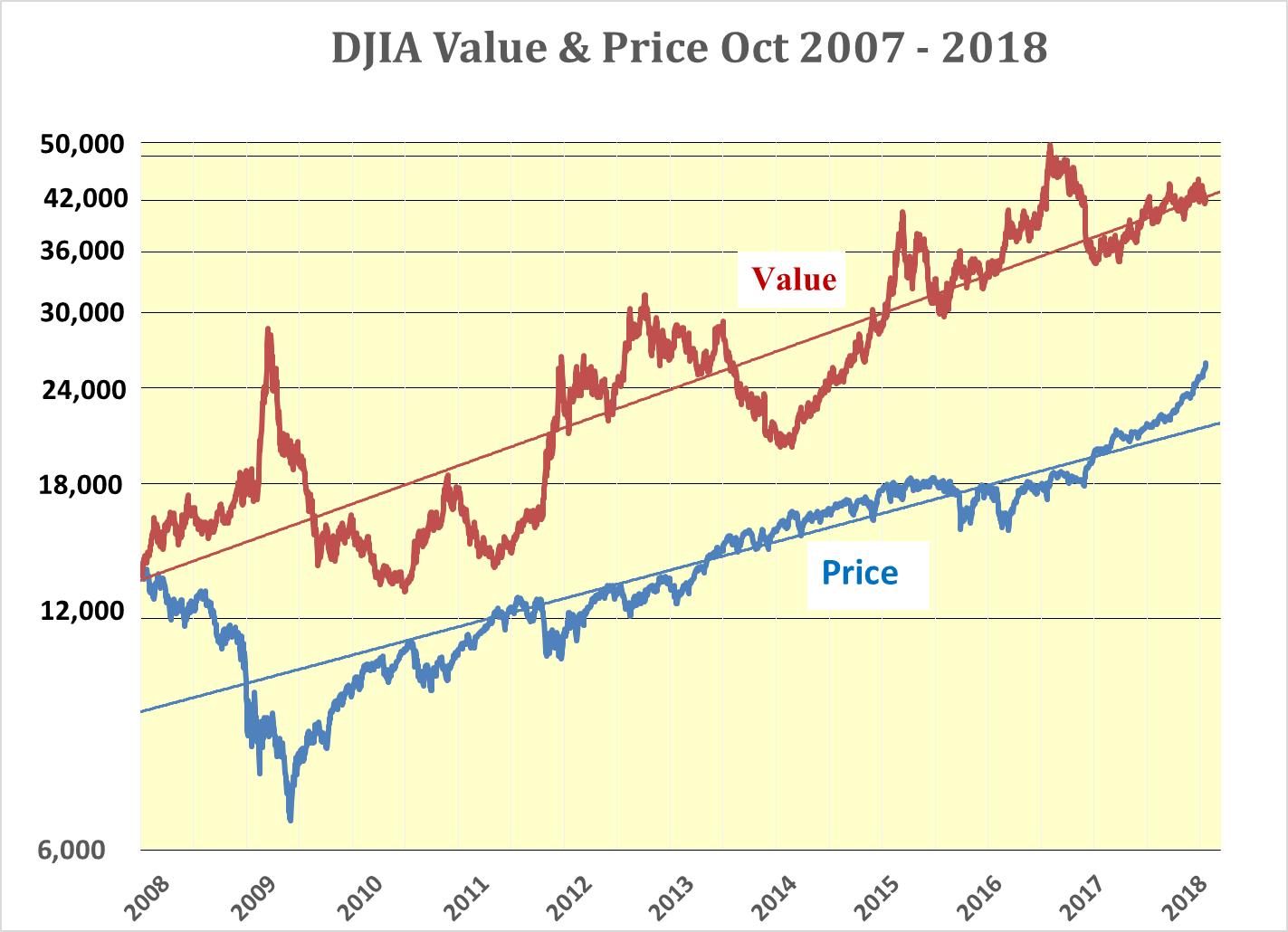

People should not get hung up on President Trump’s prediction of the DJIA going to 30,000 this year. An increase of 4,200 points is only 16%. Furthermore, the dividend discount value of the DJIA today is 42,186 which is just 63% higher than its price.

Although that might be a bit of a stretch for 2018 it is highly probable that the DJIA price will be there next year. In two years? Yes, this has just happened in the past two years. The DJIA price has risen by 65% since February 2016 and the rate of increase is accelerating. Hence, the strong belief that the DJIA will be there next year. In which case, while “The Donald” had little or nothing to do with it, he will grandstand his success to set up his re-election in 2020.

Comparing the price of the DJIA with its dividend discount value the above chart shows that, until Lehman and subsequently, the PRICE of the DJIA has not fallen significantly when its VALUE has been at a premium to its PRICE.

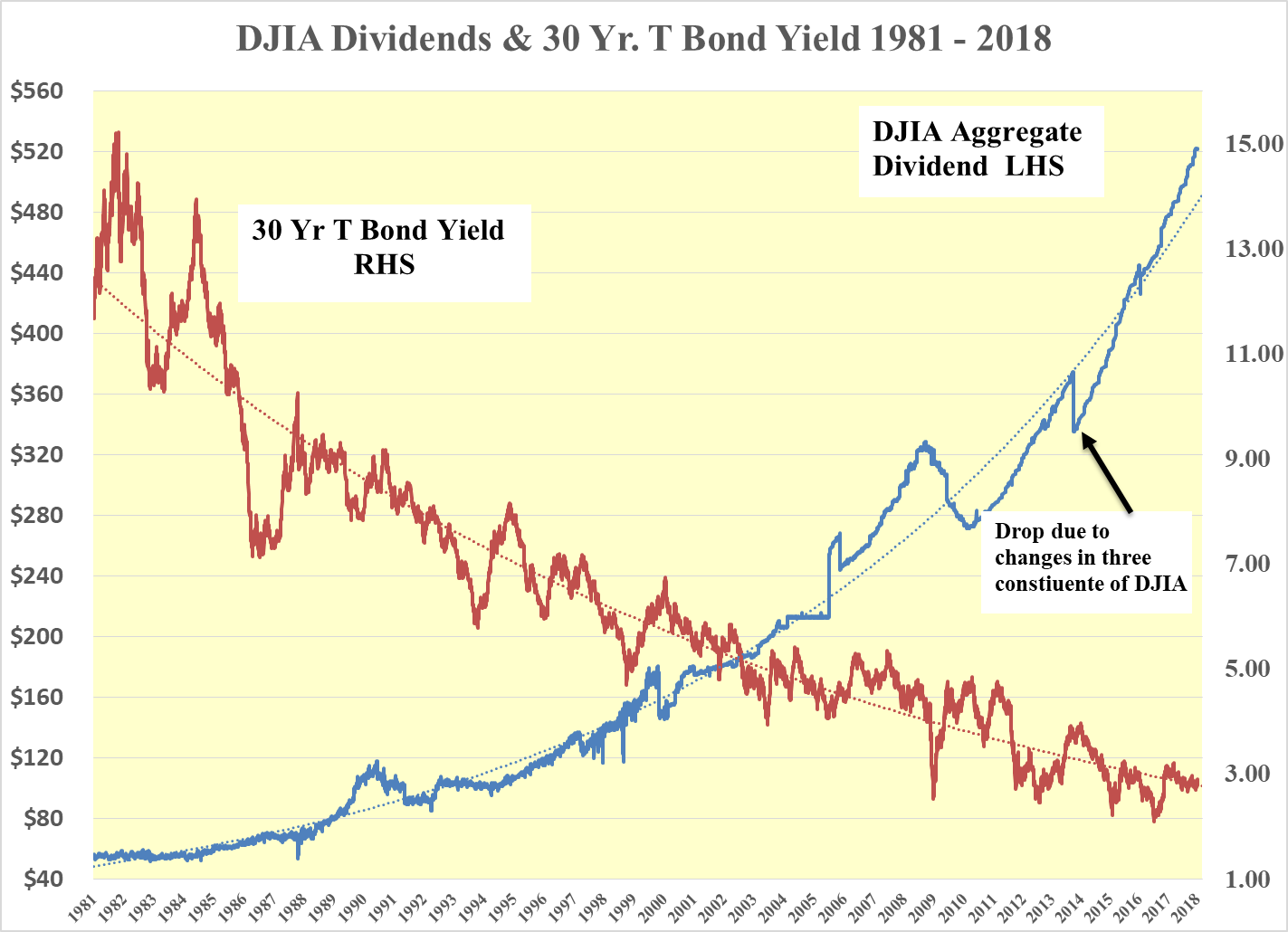

The two main vectors determining the dividend-discount value are the aggregate dividend of the DJIA and the 30 year T bond yield. The dividend is at a record level of $522.30 and should continue to rise with the outlook for earnings over the next couple of years resulting from the changed tax regime in the United States. While the yield of the 30 year T bond probably passed its nadir on July 8, 2016, it will probably take decades to climb back to the dreadful days of 1981 and the peak rate of 15.2%.

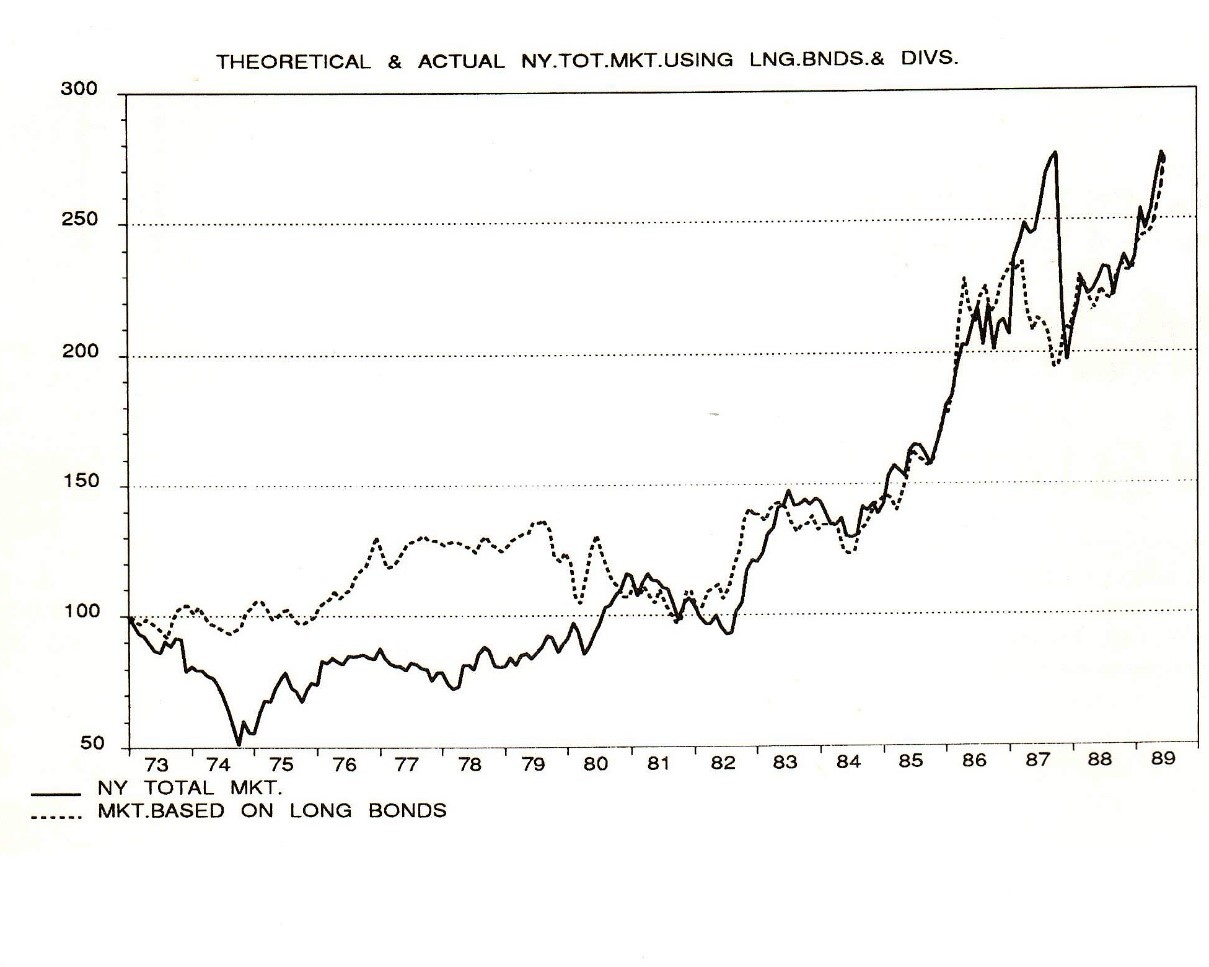

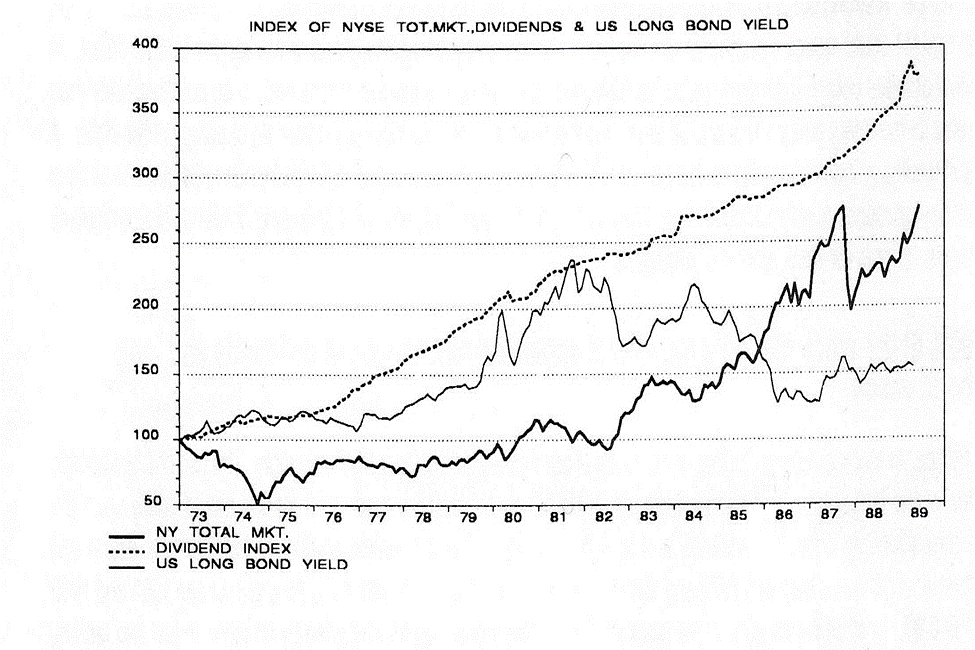

The next chart is from my article published on June 6, 1989, recommending the sale of the Nikkei at 36,000 and the purchase of the DJIA at 2,481. It shows how the price and the dividend discount value of the total New York market fared from 1973 through 1989. The price of the market fell below its value following OPEC 1 and remained there for the rest of the decade. It is surmised that the shock of the 1974 crash and the losses incurred, instilled a great deal of fear in the minds of market participants. This appears very similar what has happened to the DJIA price and value post-Lehman.

In the 1970s inflation rose considerably and Mr. Volker’s action, intended to kill inflation, resulted in a doubling of the long bond yield. This kept the price of the stock market below its value despite the doubling of dividends over the period between 1973 and 1980. Equilibrium was finally achieved at the end of 1980 and remained there until the latter part of the 1990s. The crash of 1987 came about as result of the dividend discount value falling well below its price as long rates rose. The move to equilibrium picked up steam in the latter part of the 1970s even though the 30 year T Bond yield rose rapidly towards its all-time peak of 15.2%.

The same fear that held the market back in the 1970s would appear to be present today. Back then it took 8 years for value and price to reach equilibrium. Today it has been ten years, so far, since the two have been in equilibrium. However, the gap appears to have started to close over the past two years with the 65% rise in the DJIA price since early 2016. This acceleration is clearly seen in the following logarithmic chart with the price moving up relative to the exponential trend line.

Thus while some continue calling for an immediate crash in equities along with bonds, it appears unlikely during the remainder of the decade. So the rallying cry remains:

BUY the DJIA and take no Prisoners!

Buy the DJIA and take no Prisoners! I'll echo that.

How did you get the data for the DJIA dividend? Is that info easy to come by on a regular basis?

Dear Danny,

The DJIA dividend is published every week in Barron's market Lab.

www.barrons.com/.../9_0210-indexespeyields.html

Thanks Tony!