Pre June Soybean Stock Update - Despite Record US Crush, Exports Remain A Question Mark

Market Analysis

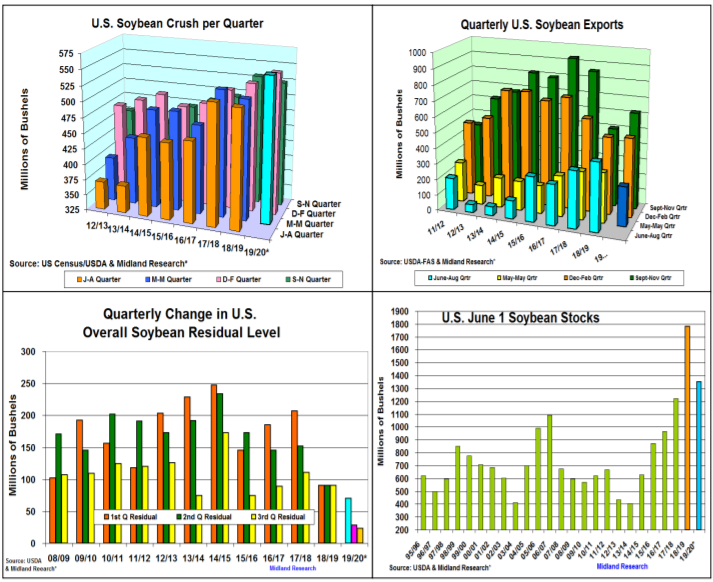

This year’s record US soybean crushing pace has continued this past quarter as Argentine processing problems & US livestock numbers and delayed slaughtering paces has kept America’s protein demand strong. Brazil’s sizable soybean output & aggressive overseas sales however have limited US shipments this past quarter. This spring’s coronavirus outbreak & China’s modest initial Phrase 1 purchases have also impacted soybean’s quarterly supplies.

May’s US NOPA processing pace posted its 6th monthly record output of 169.6 million bu. pace last week. This will likely advance this year’s 3rd quarter US soy crush to 555 million bu., a new quarterly record & the 2nd consecutive quarterly record for US processing this year. Overall, this year’s crushing pace through the first three quarters will be near 1.628 billion bu. or 51 million larger than last year. To reach the USDA’s recently increased crush forecast, this summer’s processing pace needs to be 512 million bu. vs. 2019’s 514 million level. Given current US livestock & poultry numbers and heavier weights before slaughter, this domestic forecast appears to be achievable.

After a solid 4-5 months of US export shipments, strong Brazilian competition has reduced US export shipments to just 250 million bu. this past spring quarter (68 million below last year). Current export sales are just 26 million bu. from the USDA’s 1.650 billion forecast. However, shipments will need to be 280 million to reach this forecast or a 13 week average 21.5 million bu. pace to achieve this goal. With Brazil’s exports seasonally slowing, overseas buyers could be sourcing more of their protein needs from the US. However, China’s desire to meet their Phase 1 trade commitments could be a bigger factor if the US ending stocks rise or contract from the current projection.

The reduced fall US export shipments the past 2 years because US/China trade tensions have altered the traditional large seasonal residual disappearance from exports in transit. Using a modest 23 million bu. residual this quarter, we are expecting a June 1 stocks at 1.35 billion bu.

What’s Ahead:

The upcoming June 30 soybean stocks report will be the next monitoring point for the size of the US 2019/20 soybean crop. After 2 larger stocks levels than expected, this year’s residual demand does not have excess left. 2020’s planting level & China’s commitment to its Phase 1 trade deal are the main price factors going forward.

Up old-crop to 90-92% at $8.92-98 & begin new –crop sales at 15% at $8.96-$9.02.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more