Pre-July US S&D/Wheat Updates

Market Analysis

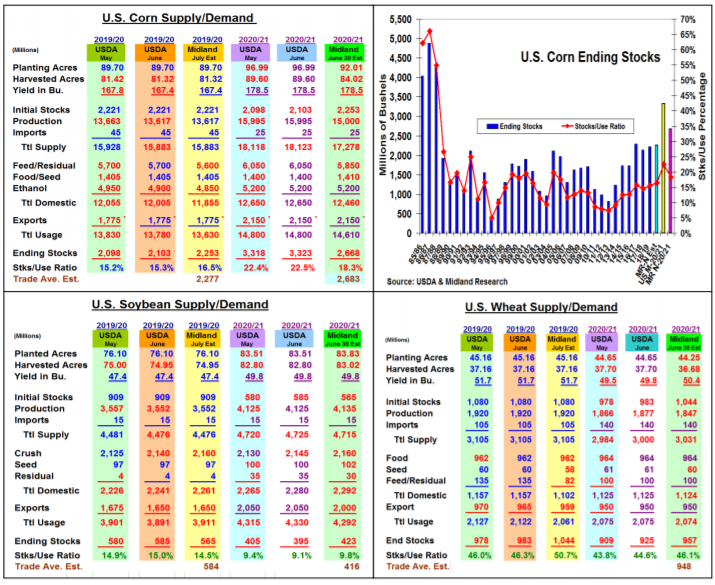

The US 2020 acreage report stunned the trade last week when the latest USDA producer survey revealed sharply lower corn plantings and only a modest rise in soybean seedings from the March intentions. The USDA will utilize these planting and harvesting ideas in their upcoming monthly 2020/21 US supply/demand updates on Friday, July 10. June’s US stocks report also found many of the missing corn bushels from the two previous quarterly updates. This information —plus our domestic processing and US export trends — will be utilized to update both corn’s and bean’s US old and new –crop balance sheets along with a 3rd look at the US winter wheat crop.

Corn’s (CORN) 5 million drop in seedings to 92 million acres were also 3.2 million below expectations as shuttered ethanol plant & slow export demand prompted a re-think of 2020 plantings. With exports & ethanol output rebounding, corn’s 5.224 billion bu. June 1 stocks was a surprise. This suggests a 100-150 million cut in old-crop feed demand despite this spring’s slaughter delays causing heavier weights. However, the USDA should slice 1 billion bu. from its 2020 crop size because of less area. Overall, a 2.67 billion bu, revised 20/21 corn ending stocks are expected.

Soybean’s (SOYB) modest rise in 2020 plantings to 83.825 million acres was 891,000 below the trade’s average. With sales already above the current export forecast & the US crush running strong a 20-30 million drop in 2019/20 stock is expected. However, a slight rise in the 20/21 crop size & strong S. Am competition could up 2020/21 ending stocks slightly to 423 million bu.

Wheat’s (WEAT) June 1 stocks found 61 million more bushels than expected which reduced last year’s final feed demand. Reduced N Plains seedings & winter wheat’s harvested area drop in the latest acreage data sliced these added bu. in half. With no likely demand changes, the US 2020/21 wheat stocks might rise to 957 million bu. this month.

What’s Ahead

The combination of weather, soil conditions & economics that prompt producers to decrease their 2020 corn plantings has changed US ag price dynamics. Without corn’s excessive new-crop supplies, weather have become a factor in pricing. Look to finish up 2019/20 corn & bean sales on Sept & August prices in the $3.60-70 & $9.20-30 ranges. Increase new-crop hedges to 25% at $3.70 & $9.25-35.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more