Powell’s Cautiousness Could Be Dovish To The Dollar

With no rate hike expected tonight and existing US data showing a slowdown in growth, short USD/JPY?

FOMC will be scheduled later at 3am (SGT) and investors expect Federal Reserved to rule out a near term rate hike due to the data released earlier to be softer. It is widely expected that Fed would let rates remain unchanged.

Although the US government shutdown has ended, it was only temporarily until 15th February. Instead of rising, dollar pulled back as investors can finally expect an onslaught of US data releases which should confirm the slowdown in the economy.

Economic data that were released have confirmed our beliefs that the economy is indeed slowing. Yesterday, the consumer confidence released dropped to its lowest level since September of 2017 at 120.2 from 126.6. Furthermore, inflation fell from 2.2% in November to 1.9% in December. ISM manufacturing and services both fell from 59.3 to 54.1 and 60.7 to 57.6 respectively from November to December. The only saving grace was the labor market which was still growing strongly.

More importantly, the press conference followed by the policy decision should hold more weight to rock the financial market. During Powell’s previously speech, he made some unfortunate missteps by expressing flexibility on the balance-sheet unwind if necessary and then said Fed will remain patient and not rush to raise rates. This created a whiplash in dollar which he will try his best to prevent it.

We believe that Powell will tiptoe through the press conference by reiterating his previous views on being “patient” and that Fed “judges” rather than “expects” more rate hike, which means moves in rates will be largely data dependent. There are 3 things to look out for during his press conference:

- Powell’s “patient” language – Investors will want to know if there are any changes to the assessment on the economy that could change his “patient” mantra. This would also mean investors want to know Powell’s view on the current string of softer data.

- Balance sheet unwinding – During December’s meeting, Powell described Fed’s program to wind down its balance sheet as being on “autopilot”. The comment unnerved investors as they inferred from the comment to mean that Fed could end its program sooner than it had expected. Prominent investors also blame Fed’s balance sheet runoff for the market volatility faced late last year.

- Data dependency – We could expect Powell to emphasize that they will base rate decisions on how the data performed, instead of hiking on a pre-set schedule.

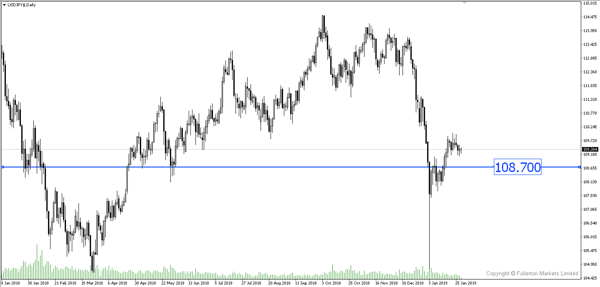

With that in mind, we believe that USD/JPY could resume its downtrend to the 108.70 price level.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more