Pound For Pound, Retail Opportunity Investments Corp. Is One Of The Best REITs Around

This weekend I'm headed out to Las Vegas to attend The MoneyShow. I'll bespeaking on May 13th so let me know if you want to meet in person (I'll also be at my booth). Later in the week I'll head over to the annual Shopping Center conference (called ReCon) where I'll be meeting with over a dozen REIT CEOs. If that sounds like a lot of work, it is; however, for my (few) days off I'll be kicking back poolside at Trump Las Vegas (working on my upcoming book).

Leading up to ReCon I have been preparing for the big retail conference by researching the long list of Shopping Center REITs. Based on the growing number of REITs, the Shopping Center sector is the largest (sector) so it's especially challenging to filter out the best names to own.

Of course, if you have been reading any of my previous articles you already know that there are a few REITs I don't like, notably, Wheeler Real Estate (NASDAQ:WHLR) and Whitestone (NYSE:WSR), and a handful I would like to own - when the price is right.

I have written extensively on some REITs that I would like to buy: Usrtadt Biddle (NYSE:UBA), Federal Realty (NYSE:FRT), Weingarten Realty (NYSE:WRI), and Developers Diversified (NYSE:DDR). Yesterday, I examined Acadia Realty (NYSE:AKR) - another prospect that I would like to own - when the price is right.

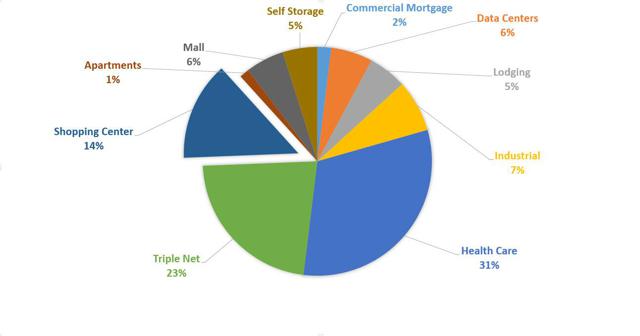

Currently I own 3 Shopping Center REITs that make up around 14% of my Durable Income Portfolio. These REITs include Brixmor Property Group (NYSE:BRX), Retail Opportunity Investment Corp. (NASDAQ:ROIC), and Kimco Realty (NYSE:KIM).

Round One: Don't Be Fooled By The Size

I hate that I missed the big fight this past weekend in Las Vegas. Of course, even if I was in Vegas there's no way that I was going to fork out thousands to watch Floyd "Money" Mayweather outlast Manny Pacquiao.

I didn't even think about watching the fight on pay-per-view at home for such a ridiculous sum of $99. Instead, I was sound asleep when the fight started - remember, I know how to "sleep well at night" (that's just how I roll - pun intended).

I'm sure "Money" Mayweather was the legitimate winner of the boxing match; and while his paycheck of $150 million is more than I can fathom, I wonder which Shopping Center REIT has the best scorecard - that will enable me to be wealthy like "Money" Mayweather.

So let's leave out the bling and get down to business…are you READY TO RUMBLE….

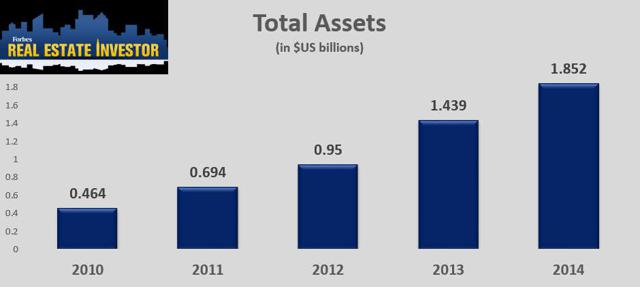

Retail Opportunity Investment Corporation got its start from cash raised through a special purpose acquisition company (or SPAC); in essence, a blind pool with $400MM of cash at the trough of the real estate market. CEO, Stuart Tanz, took advantage of the situation buying properties in familiar West Coast markets where Pan Pacific (the company Tanz previously ran) had deep experience (and strong relationships).

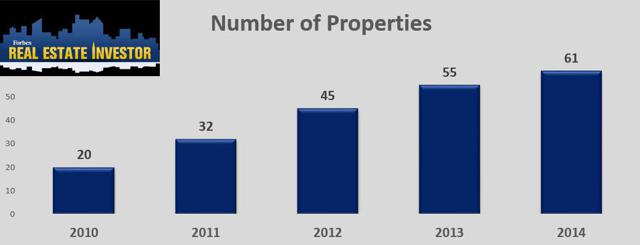

So instead of throwing a wide range of shots, ROIC has a focused weapon that consists of 61 shopping centers - all on the West Coast. Since the company's listing on NASDAQ in November 2009, ROIC has delivered sound earnings growth to its shareholders while maintaining a conservative balance sheet. Here's a snapshot that illustrates the growth in the number of properties.

Based in San Diego, ROIC acquired and operates a portfolio of shopping centers encompassing approximately 7.3 million square feet. One competitive advantage for ROIC is the fact that the company only invests in strong economic markets with exceptional demographics and growth characteristics that provide stable income and long-term growth.

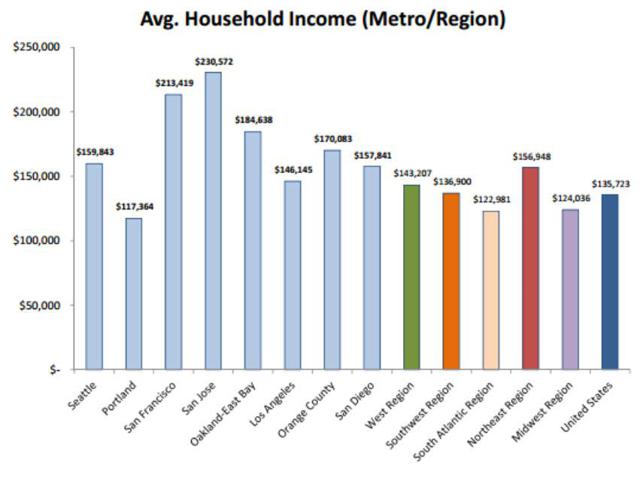

About 46% of ROIC's GLA (gross lease area) is in Southern CA and the high-growth REIT focuses exclusively on investing in densely populated metro markets with above-average household income and solid employment growth. Accordingly, these (West Coast) markets enjoy retail sales above pre-recession levels and are considered high barrier to entry trade areas.

Based on median household income, ROIC compares favorably with the peer group:

Continue reading this article here.

Brad Thomas is the Editor of the Forbes Real Estate Investor.

more