Post-FOMC USD/JPY Weakness To Persist As Bullish Sequence Snaps

JAPANESE YEN TALKING POINTS

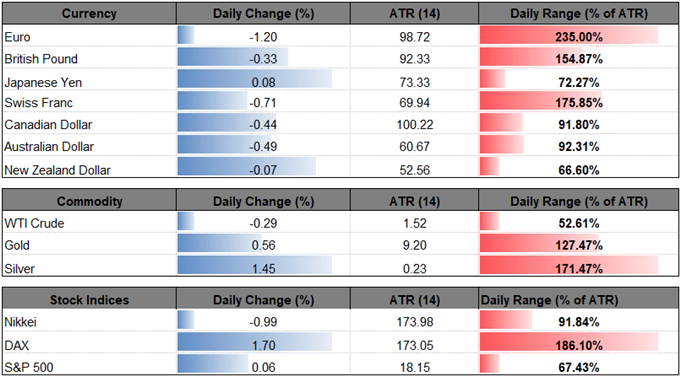

USD/JPY pares the decline following Federal Open Market Committee (FOMC) rate decision as fresh data prints coming out of the U.S. economy encourage an improved outlook for growth and inflation, but recent price action raises the risk for range-bound conditions as the dollar-yen exchange rate snaps the series of higher highs & lows from earlier this week.

(Click on image to enlarge)

POST-FOMC USD/JPY WEAKNESS TO PERSIST AS BULLISH SEQUENCE SNAPS

USD/JPY trades on a firmer footing as the U.S. Retail Sales report instills an improved outlook for the economy, with household spending increasing 0.8% in May versus forecasts for a 0.4% print.

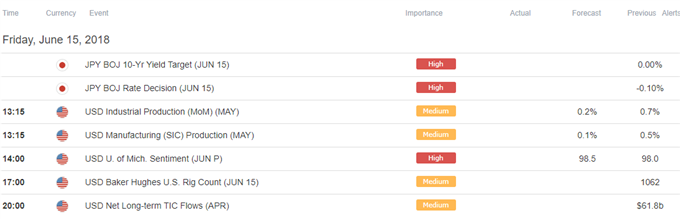

The positive development should keep the FOMC on course to deliver four rate-hikes in 2018 as ‘the Committee expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee's symmetric 2 percent objective over the medium term,’ and it seems as though the central bank will continue to strike a hawkish tone over the coming months as officials achieve their dual mandate for full-employment and price stability.

However, the reaction to the FOMC interest rate decision undermines the stickiness in the USD/JPY exchange rate as Chairman Jerome Powell & Co. continue to project a longer-run neutral Fed Funds rate of 2.75% to 3.00%, and the updates suggest the central bank will refrain from adopting a more aggressive approach as the committee pledges to ‘assess realized and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective.’ At the same time, the Bank of Japan (BoJ) meeting may keep USD/JPY under pressure as officials start to change their tune, and fresh comments from Governor Haruhiko Kuroda and Co. may heighten the appeal of the Japanese Yen if the central bank shows a greater willingness to move away from its Quantitative/Qualitative Easing (QQE) Program with Yield-Curve Control.

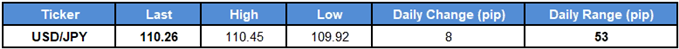

With that said, lack of momentum to test the May-high (111.40) may generate a larger pullback in USD/JPY, with the pair at risk of working its way back towards the May-low (108.11) as it fails to retain the bullish series from earlier this week.

USD/JPY DAILY CHART

(Click on image to enlarge)

- Failed attempt to test the May-high (111.40) may foster range-bound conditions in USD/JPY, with a break/close below the 109.40 (50% retracement) to 110.00 (78.6% expansion) region raising the risk for a move back towards the Fibonacci overlap around 108.30 (61.8% retracement) to 108.40 (100% expansion).

- Need a break/close below the overlap to bring the downside targets back on the radar, with the next region of interest coming in around 106.70 (38.2% retracement) to 107.20 (61.8% retracement).

(Click on image to enlarge)

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more