Platinum Price Forecast For 2015

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Precious Metals Research View

| Platinum Price 2015 Projections |

Projected price (USD1266/ Oz) |

| Upside +0.5% |

Current Price: USD 1261 |

Platinum Price Forecast:

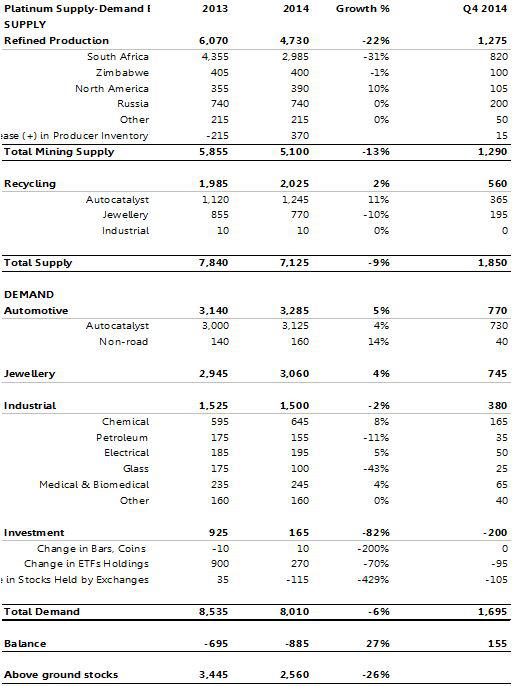

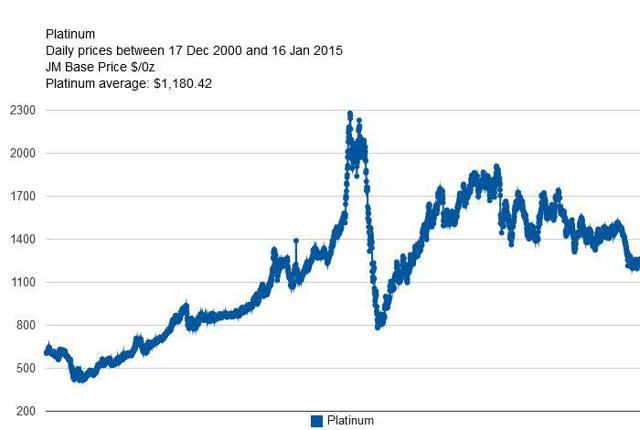

A relatively tight market for platinum is anticipated over the medium term, though not undersupplied. We expect platinum prices to improve in rand terms, but given expectations for a still-weakening rand through 2016E, platinum prices are forecast to be rather range bound in the USD. Recent short-term demand and a tentative l/t cyclical support calculated. However, there is a lot of supply above and there is an outside possibility Platinum could see $1350-1300 zone. We have forecasted platinum prices to $1270 per ounce in 2015 and $1450 per ounce in 2016.

(Click on image to enlarge)

Investment Thesis:

Ongoing limitations and potential disruptions to supply (i.e. Labor Strikes in S.A.) bodes well for platinum prices. A five-month strike that left 1moz underground in South Africa - which together with Russia control 80% of the world's palladium and 70% of its platinum supply was expected to affect the platinum and palladium prices, but in the end did little to move prices. Ample above-ground stocks, particularly in key consumer Europe, was blamed for platinum's lackluster performance, which end the year 2014 down more than 10%.

South African miners struck a three-year deal so no strike in 2015, and besides 2014 showed platinum consumers could sit out a prolonged mine supply hiatus. Russia has been thoroughly chastened by the fall in oil, so government stockpiles (if they still exist) may make it onto the market in greater ounces. While the supply side may be schizophrenic, demand is looking better than in many years. Overall, the market seems fairly balanced and only economic surprises can provide some upside surprise to platinum prices.

Since 1970, platinum has on average commanded a 30% price premium over gold. However, as the following chart demonstrates, from 2000 to 2008, platinum spent much time trading over 1.8 times gold's price. It is anticipated that due to the current crisis in the Euro currency and emerging markets, platinum might just regain its reign as the Rich Man's Gold in the 2015-2016 period.

Platinum ETF (NYSEARCA:PPLT) Holdings demonstrates an astounding Compound Annual Growth Rate of +78% in each of the years from 2007-2012. Moreover, Platinum and palladium ETF (NYSEMKT:PAL), PTM and PGM holdings jumped to new record highs in 2013/2014